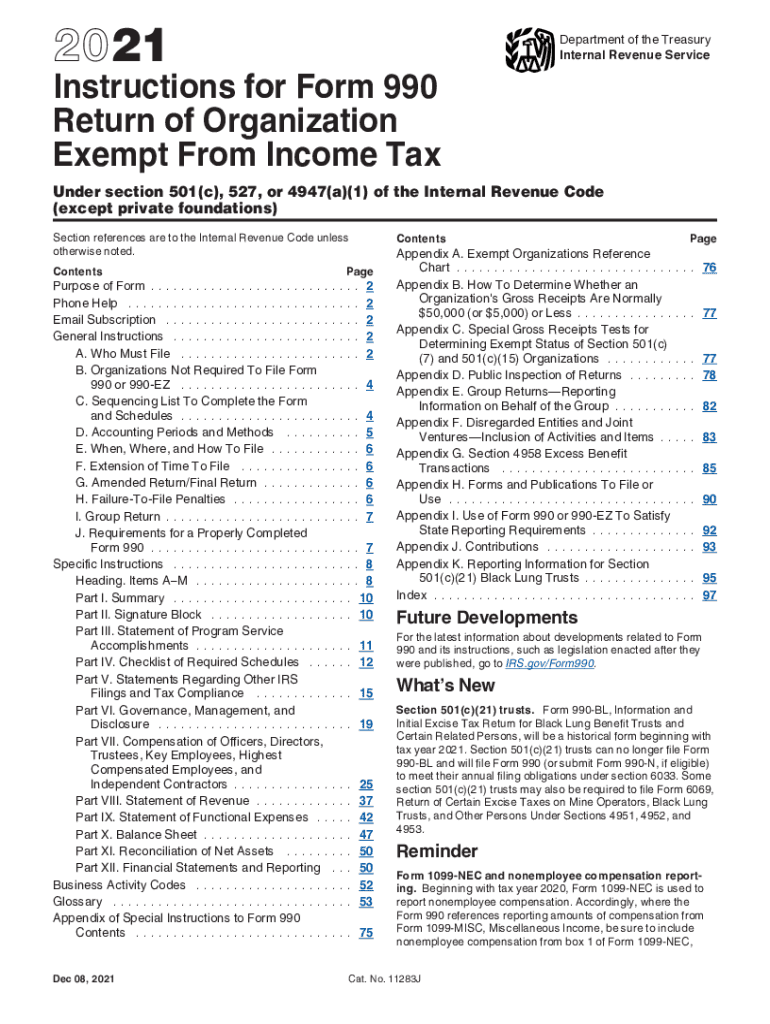

Instructions for Form 990 Return of Organization Exempt from Income Tax Instructions for Form 990 Return of Organization Exempt 2021

Understanding the Instructions for Form 990

The Instructions for Form 990 provide essential guidance for organizations exempt from income tax under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code, excluding private foundations. This form is crucial for ensuring compliance with IRS regulations, allowing organizations to report their financial activities and maintain their tax-exempt status. The instructions detail the necessary information required, including revenue, expenses, and program service accomplishments, which help the IRS assess the organization’s adherence to tax laws.

Steps to Complete the Instructions for Form 990

Completing the Instructions for Form 990 involves several key steps to ensure accuracy and compliance. First, organizations should gather all relevant financial documents, including income statements and balance sheets. Next, they should carefully review the instructions to understand the specific sections that apply to their organization. Each section must be filled out with precise information, including details about governance, financial performance, and program activities. After completing the form, organizations should review their entries for accuracy and completeness before submission.

Legal Use of the Instructions for Form 990

Using the Instructions for Form 990 legally requires adherence to IRS guidelines. Organizations must ensure that all information reported is truthful and complete, as inaccuracies can lead to penalties or loss of tax-exempt status. It is also important to maintain proper documentation to support the information provided on the form. By following the legal requirements outlined in the instructions, organizations can protect themselves from potential legal issues and ensure compliance with federal tax laws.

Filing Deadlines for Form 990

Organizations must be aware of the filing deadlines associated with Form 990 to avoid penalties. Generally, Form 990 is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form is due on May 15 of the following year. Organizations can apply for an automatic extension, but it is crucial to file the extension request before the original due date to avoid late penalties.

Required Documents for Form 990

When preparing to file Form 990, organizations must gather several required documents to ensure a complete submission. These documents typically include financial statements, a list of board members, and any relevant schedules that provide additional detail about revenues and expenses. Additionally, organizations should have records of their program activities and accomplishments, as this information is essential for demonstrating compliance with IRS requirements.

Penalties for Non-Compliance with Form 990

Failure to comply with the filing requirements for Form 990 can result in significant penalties. Organizations that do not file on time may face monetary fines, which can accumulate over time. Additionally, repeated failures to file can lead to the automatic revocation of tax-exempt status. It is vital for organizations to prioritize timely and accurate submissions to avoid these consequences and maintain their compliance with IRS regulations.

Digital vs. Paper Version of Form 990

Organizations have the option to file Form 990 either digitally or via paper submission. Filing electronically is often recommended as it can streamline the process, reduce errors, and provide immediate confirmation of receipt. However, some organizations may prefer to use a paper version for various reasons, such as lack of access to electronic filing systems. Regardless of the method chosen, it is important to ensure that all information is complete and accurate to comply with IRS requirements.

Quick guide on how to complete 2021 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

Complete Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt effortlessly on any device

Online document management has gained signNow traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly and without obstacles. Manage Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to alter and electronically sign Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt with ease

- Obtain Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or cover sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether through email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

Create this form in 5 minutes!

How to create an eSignature for the 2021 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the process to file form 990 using airSlate SignNow?

To file form 990 using airSlate SignNow, simply upload your completed document, add the necessary eSignatures, and send it for signing. Our platform allows you to securely manage and submit your IRS forms online, ensuring compliance and efficiency.

-

How much does it cost to file form 990 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs, you can select a plan that enables you to efficiently file form 990 while benefiting from features like unlimited access and advanced integrations.

-

What are the benefits of using airSlate SignNow to file form 990?

Using airSlate SignNow to file form 990 simplifies the eSignature process and enhances document workflow. With features like template creation and audit trails, you can efficiently track your document status while ensuring compliance with IRS requirements.

-

Does airSlate SignNow integrate with accounting software to file form 990?

Yes, airSlate SignNow seamlessly integrates with various accounting software, allowing you to streamline your process to file form 990. This integration helps in automating data entry and ensuring that all necessary information is available for submission.

-

Is it safe to use airSlate SignNow to file form 990?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your data. When you file form 990 with us, you can trust that your documents are encrypted and stored securely.

-

Can I track the status of my form 990 after filing with airSlate SignNow?

Yes, airSlate SignNow allows you to easily track the status of your filed form 990. You will receive notifications for each step of the signing process, ensuring you are updated when the document is viewed, signed, or completed.

-

Are there any customer support options available for filing form 990?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any questions regarding how to file form 990. Our support team is available via chat, email, or phone to ensure a smooth experience.

Get more for Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt

Find out other Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word