Form 990 Instructions 2016

What is the Form 990 Instructions

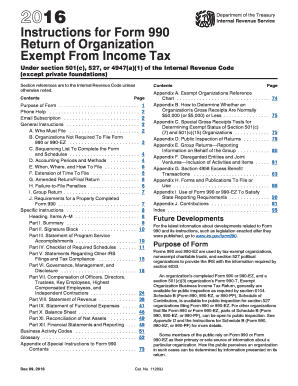

The Form 990 Instructions provide detailed guidance for organizations required to file Form 990, which is an annual information return that tax-exempt organizations must submit to the IRS. This form is essential for maintaining tax-exempt status and ensuring transparency in financial reporting. The instructions outline the necessary information to be reported, including revenue, expenses, and governance practices. Understanding these instructions is crucial for compliance and for providing stakeholders with a clear picture of the organization's financial health.

Steps to complete the Form 990 Instructions

Completing the Form 990 requires careful attention to detail. Here are the key steps involved:

- Gather financial records, including income statements, balance sheets, and expense reports.

- Review the specific sections of the Form 990 that apply to your organization, such as Part I for summary information and Part III for program service accomplishments.

- Fill out each section accurately, ensuring that all numbers match your financial records.

- Provide detailed explanations where required, particularly in areas concerning governance and financial practices.

- Review the completed form for accuracy and completeness before submission.

How to obtain the Form 990 Instructions

The Form 990 Instructions can be obtained directly from the IRS website. They are available as a downloadable PDF, which can be printed for easy reference. Organizations may also consult tax professionals or legal advisors for assistance in interpreting the instructions. Additionally, many nonprofit organizations provide resources and training on how to complete the form effectively.

Legal use of the Form 990 Instructions

Understanding the legal implications of the Form 990 Instructions is vital for compliance. The instructions are designed to ensure that organizations adhere to IRS regulations regarding transparency and accountability. Filing the form accurately helps avoid penalties and maintains the organization’s tax-exempt status. It is important to keep in mind that any misrepresentation or failure to file can lead to serious legal consequences, including loss of tax-exempt status.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with Form 990. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form would be due on May 15 of the following year. Extensions may be available, but they must be requested in advance. It is crucial to track these dates to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting Form 990. The form can be filed electronically through the IRS e-file system, which is often the preferred method due to its efficiency and immediate confirmation of receipt. Alternatively, organizations may choose to mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not accepted for Form 990. It is important to choose the method that best suits the organization’s needs while ensuring compliance with IRS requirements.

Quick guide on how to complete 2016 form 990 instructions

Effortlessly Prepare Form 990 Instructions on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage Form 990 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Method to Modify and eSign Form 990 Instructions with Ease

- Find Form 990 Instructions and click on Get Form to initiate.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature utilizing the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate the reprinting of new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 990 Instructions and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 990 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 990 instructions

How to create an electronic signature for your 2016 Form 990 Instructions online

How to create an electronic signature for the 2016 Form 990 Instructions in Google Chrome

How to generate an eSignature for putting it on the 2016 Form 990 Instructions in Gmail

How to create an electronic signature for the 2016 Form 990 Instructions from your mobile device

How to generate an eSignature for the 2016 Form 990 Instructions on iOS

How to create an eSignature for the 2016 Form 990 Instructions on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing Form 990 Instructions?

airSlate SignNow offers a range of features to streamline the process of managing Form 990 Instructions. With customizable templates, you can easily create and send documents for eSignature. The platform also allows for secure document storage and real-time tracking, ensuring that you never miss a deadline.

-

How does airSlate SignNow simplify the filing of Form 990 Instructions?

Using airSlate SignNow simplifies the filing of Form 990 Instructions by providing a user-friendly interface that guides you through each step. You can collaborate with your team in real-time, ensuring that all necessary information is accurate before submission. Additionally, the platform allows for easy integration with other tools you may be using for financial management.

-

Is there a cost associated with using airSlate SignNow for Form 990 Instructions?

Yes, there is a cost associated with using airSlate SignNow for managing Form 990 Instructions, but it is designed to be cost-effective. Various pricing plans are available to fit different organizational needs, ensuring you only pay for what you use. Consider exploring our subscription options to find the best fit for your budget.

-

Can I integrate airSlate SignNow with other software for Form 990 Instructions?

Absolutely! airSlate SignNow offers seamless integrations with a variety of software solutions that can assist in managing Form 990 Instructions. Whether you use accounting software or project management tools, our platform can connect to enhance your workflow and increase efficiency.

-

What benefits does airSlate SignNow provide for organizations handling Form 990 Instructions?

airSlate SignNow provides numerous benefits for organizations handling Form 990 Instructions, including improved efficiency and accuracy. By digitizing the signing process, you can reduce paperwork and eliminate delays caused by the traditional signing method. This not only saves time but also ensures compliance with filing deadlines.

-

How secure is airSlate SignNow when handling sensitive Form 990 Instructions?

Security is a top priority for airSlate SignNow when handling sensitive Form 990 Instructions. The platform employs advanced encryption protocols and complies with industry standards to protect your data. You can rest assured that your documents are safe and secure during the entire signing process.

-

Can I access airSlate SignNow on mobile devices for Form 990 Instructions?

Yes, airSlate SignNow is accessible on mobile devices, making it easy to manage Form 990 Instructions on the go. Whether you are using a smartphone or tablet, you can create, send, and sign documents from anywhere, ensuring you remain productive even outside the office.

Get more for Form 990 Instructions

- New york commercial building or space lease form

- Personal representative deed new mexico form

- 4 wheeler bill form

- New jersey legal last will and testament form for married person with minor children

- Cohabitation agreement form

- Power of attorney for bank account form

- Ohio request for notice of commencement corporation form

- Expungement forms

Find out other Form 990 Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors