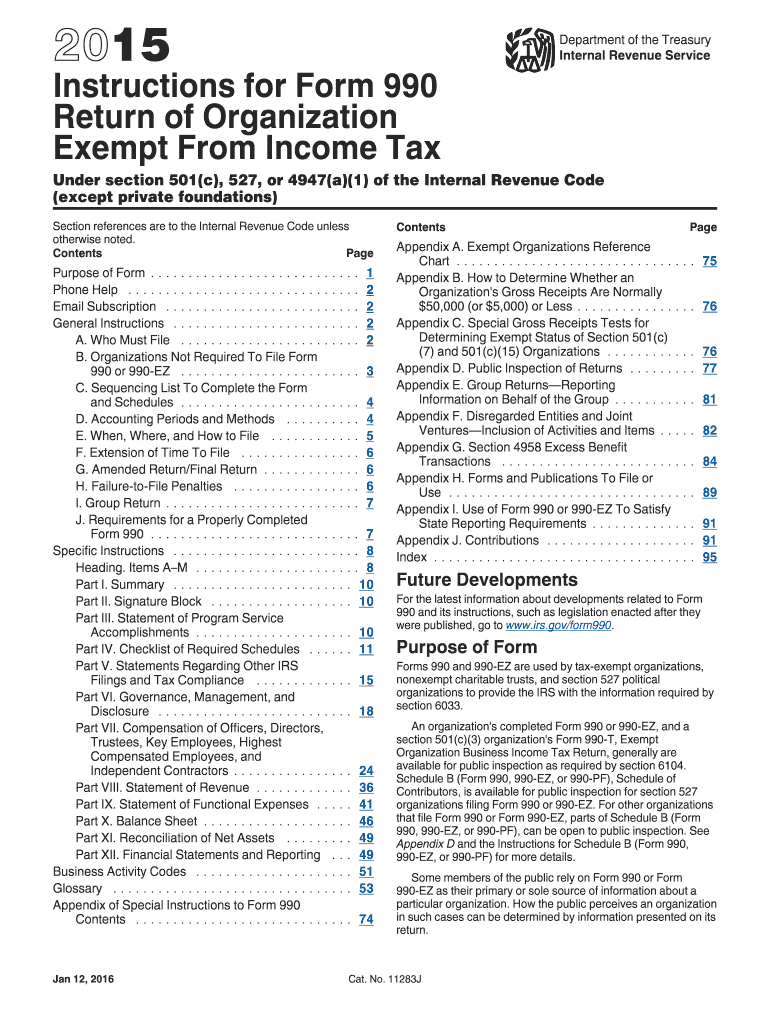

Form 990 Instructions 2015

What is the Form 990 Instructions

The Form 990 Instructions provide detailed guidance on how to complete the Form 990, which is an annual reporting return required by the Internal Revenue Service (IRS) for tax-exempt organizations. This form is essential for maintaining transparency and accountability in the nonprofit sector. It includes information about the organization’s mission, programs, and finances, allowing the IRS and the public to assess its operations and compliance with tax laws.

How to use the Form 990 Instructions

Using the Form 990 Instructions involves understanding the various sections of the form and the specific requirements for each. Organizations should carefully review the instructions to ensure they accurately report financial data, governance practices, and program accomplishments. The instructions also outline the necessary schedules and attachments that must accompany the form, ensuring a comprehensive submission. Utilizing these instructions effectively can help organizations avoid common pitfalls and ensure compliance with IRS regulations.

Steps to complete the Form 990 Instructions

Completing the Form 990 requires several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements, balance sheets, and expense reports.

- Review the instructions: Familiarize yourself with the Form 990 Instructions to understand what information is required.

- Fill out the form: Begin entering information into the form, following the instructions for each section carefully.

- Attach necessary schedules: Include any required schedules and supplementary documents as specified in the instructions.

- Review for accuracy: Double-check all entries for accuracy and completeness before submission.

- Submit the form: File the completed Form 990 by the deadline, either electronically or by mail.

Filing Deadlines / Important Dates

The filing deadline for Form 990 is typically the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May 15. However, organizations can apply for an extension to file, which can provide an additional six months. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Required Documents

To complete the Form 990, organizations must gather several key documents, including:

- Financial statements, including the balance sheet and income statement.

- Details of program accomplishments and impact.

- Governance documents, such as bylaws and board meeting minutes.

- Schedule of compensation for highest-paid employees and contractors.

- Tax-exempt status documentation, if applicable.

Penalties for Non-Compliance

Failure to file Form 990 or filing it late can result in significant penalties. The IRS may impose fines based on the organization’s gross receipts, with a minimum penalty for late filings. Additionally, repeated failures to file can lead to the loss of tax-exempt status, which can severely impact an organization’s ability to operate and receive donations. It is essential for organizations to understand these consequences and prioritize timely and accurate filing.

Quick guide on how to complete 2015 form 990 instructions

Effortlessly Manage Form 990 Instructions on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Form 990 Instructions on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Edit and eSign Form 990 Instructions Effortlessly

- Find Form 990 Instructions and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your form.

- Highlight key sections of the documents or redact confidential information using the tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 990 Instructions to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 990 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 990 instructions

How to create an electronic signature for your 2015 Form 990 Instructions online

How to create an eSignature for your 2015 Form 990 Instructions in Google Chrome

How to generate an electronic signature for putting it on the 2015 Form 990 Instructions in Gmail

How to generate an eSignature for the 2015 Form 990 Instructions straight from your smart phone

How to make an eSignature for the 2015 Form 990 Instructions on iOS

How to make an eSignature for the 2015 Form 990 Instructions on Android OS

People also ask

-

What are the key benefits of using airSlate SignNow for Form 990 Instructions?

Using airSlate SignNow for your Form 990 Instructions allows for a streamlined and efficient document signing process. The platform simplifies the preparation and submission of Form 990, ensuring compliance and accuracy while saving time and reducing administrative overhead.

-

How can airSlate SignNow help with the electronic signing of Form 990 Instructions?

airSlate SignNow offers a user-friendly interface that facilitates the electronic signing of Form 990 Instructions. With its secure eSignature capabilities, you can ensure that your documents are signed quickly and legally, helping you meet deadlines with ease.

-

Is there a trial period available for testing airSlate SignNow with Form 990 Instructions?

Yes, airSlate SignNow provides a free trial period, allowing you to explore its features and see how it can assist you with Form 990 Instructions. This trial enables you to evaluate the platform's capabilities before committing to a subscription.

-

What integrations does airSlate SignNow offer for managing Form 990 Instructions?

airSlate SignNow integrates seamlessly with various applications, enhancing its functionality for managing Form 990 Instructions. You can connect it with popular tools like Google Drive, Dropbox, and Zapier to streamline your workflow and improve document management.

-

How does airSlate SignNow ensure the security of my Form 990 Instructions?

The security of your Form 990 Instructions is a top priority for airSlate SignNow. The platform employs advanced encryption technologies and complies with industry standards to protect your sensitive data during the signing and storage processes.

-

Can I customize the templates for Form 990 Instructions in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize templates for Form 990 Instructions to fit your specific needs. This feature enables you to tailor documents, adding your branding and adjusting fields, which enhances the user experience.

-

What pricing plans are available for using airSlate SignNow with Form 990 Instructions?

airSlate SignNow offers flexible pricing plans designed to accommodate various business sizes and needs when managing Form 990 Instructions. You can choose from individual, business, or enterprise plans, depending on your requirements and budget.

Get more for Form 990 Instructions

- Form is 230 notice of absence from the u media clemson

- Ans 6 letter a e n fill this blank form

- Etradecomonlinedistribution form

- Hardship form ibew local 164

- Tsp 75 2012 2019 form

- For withdrawal from a course submit an unofficial transcript sfsu form

- Jhannuities form

- Psychotherapy intake form template pdf aable psychotherapy intake form used to streamline the intake process for clients

Find out other Form 990 Instructions

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy