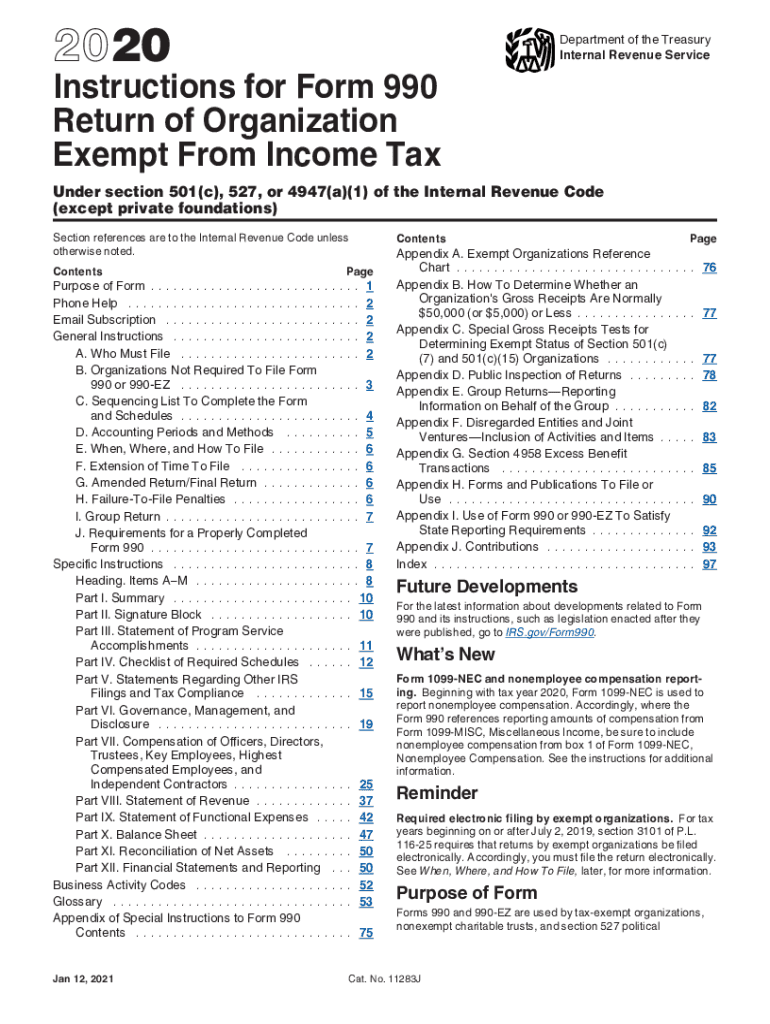

Instructions for Form 990 Return of Organization Exempt from Income Tax Instructions for Form 990 Return of Organization Exempt 2020

Understanding the Instructions for Form 990

The Instructions for Form 990 provide detailed guidance for organizations exempt from income tax under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code, excluding private foundations. This form is crucial for maintaining compliance with IRS regulations and ensuring transparency in financial reporting. Organizations must accurately complete this form to report their income, expenses, and activities, which helps the IRS assess their tax-exempt status.

Steps to Complete the Instructions for Form 990

Completing the Instructions for Form 990 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and details of expenditures.

- Review the specific sections of the form that apply to your organization’s activities and structure.

- Fill out the form accurately, ensuring that all required information is provided, including mission statements and program descriptions.

- Double-check calculations and ensure compliance with IRS guidelines to avoid errors.

- Submit the completed form by the designated deadline to maintain your organization's tax-exempt status.

Obtaining the Instructions for Form 990

The Instructions for Form 990 can be obtained directly from the IRS website. They are available in PDF format, allowing for easy access and printing. Organizations may also find these instructions in tax preparation software that supports Form 990 filing. It is important to use the most current version to ensure compliance with any updates in tax law.

Legal Use of the Instructions for Form 990

The Instructions for Form 990 serve as a legal document that outlines the requirements for tax-exempt organizations. Proper adherence to these instructions is essential for maintaining compliance with federal tax laws. Failure to follow the guidelines may result in penalties, including loss of tax-exempt status or fines. Organizations should ensure that their filings are accurate and timely to uphold their legal obligations.

Filing Deadlines for Form 990

Organizations must be aware of the filing deadlines for Form 990 to avoid penalties. Generally, Form 990 is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. Extensions may be available, but it is crucial to file for an extension before the original deadline. Staying informed about these dates helps organizations maintain compliance and avoid unnecessary complications.

Examples of Using the Instructions for Form 990

Organizations can reference the Instructions for Form 990 for various scenarios, such as reporting income from fundraising events or detailing program-related expenses. These examples illustrate how to categorize different types of income and expenses accurately. Utilizing real-world examples can help organizations better understand how to apply the instructions in their specific contexts.

Quick guide on how to complete 2020 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

Complete Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt smoothly on any device

Online document administration has gained popularity among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt effortlessly

- Obtain Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt and ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What are the primary benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow offers a seamless eSigning experience that allows you to quickly and securely sign documents online. With airSlate SignNow, you can streamline your workflow and increase efficiency, enabling you to focus on your core business activities. The platform also ensures compliance with legal standards, making it a reliable choice for obtaining 990 instructions get.

-

How does airSlate SignNow ensure the security of my documents?

AirSlate SignNow employs advanced encryption and security protocols to protect your documents during transit and at rest. Your eSigned documents are stored securely, so you can be confident that sensitive information will remain private. This aligns perfectly with your need to manage how you 990 instructions get.

-

Can I integrate airSlate SignNow with other software solutions?

Yes, airSlate SignNow offers smooth integrations with various third-party applications, including CRM and document management systems. This means you can easily incorporate the solution into your existing workflow and enhance productivity. Simplifying how you 990 instructions get is effortless when integrated with your favorite tools.

-

What pricing plans are available for airSlate SignNow?

AirSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from various tiers depending on your requirements, making it affordable to optimize your document signing process. Finding a plan that fits your budget while assisting in how you 990 instructions get is simple.

-

How can airSlate SignNow help with compliance requirements?

AirSlate SignNow is designed to help businesses meet compliance regulations efficiently, ensuring your signed documents are legally binding. The platform also provides audit trails and secure storage solutions, making it easier for you to manage compliance when you need to 990 instructions get. This reduces the risk of errors and keeps your documentation secure.

-

Does airSlate SignNow offer mobile capabilities?

Yes, airSlate SignNow offers mobile capabilities that allow you to send and sign documents on any device, anywhere. This flexibility ensures that you can complete your signing tasks on-the-go, making it easier to get things done regardless of your location. You can conveniently 990 instructions get anytime, ensuring you're always productive.

-

Is there a free trial available for airSlate SignNow?

AirSlate SignNow does offer a free trial that gives you the opportunity to test its features without any financial commitment. This allows you to explore how the platform can enhance your document signing process and help you efficiently 990 instructions get. The trial period is a great way to assess its benefits before making a purchase decision.

Get more for Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt

Find out other Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile