Counselormax 2018

IRS Guidelines

The IRS provides specific guidelines for completing the 2015 Form 990-T, which is used by exempt organizations to report unrelated business income. Understanding these guidelines is crucial to ensure compliance and accurate reporting. The form must be filed by organizations that have earned income from activities unrelated to their exempt purposes. This includes income from advertising, rental income, and other business activities. It is important to review the IRS instructions thoroughly to identify which income must be reported and what deductions can be claimed.

Filing Deadlines / Important Dates

For the 2015 Form 990-T, the filing deadline is typically the 15th day of the fifth month after the end of the organization’s tax year. For organizations with a calendar year ending December 31, the due date would be May 15 of the following year. If additional time is needed, organizations can file for an extension using Form 8868, which grants an automatic six-month extension. However, it is essential to note that any taxes owed must still be paid by the original due date to avoid penalties and interest.

Required Documents

When preparing to file the 2015 Form 990-T, organizations must gather several key documents to ensure accurate reporting. This includes financial statements detailing income and expenses related to unrelated business activities. Additionally, organizations should have documentation for any deductions claimed, such as expenses directly connected to the unrelated business income. It is also advisable to keep records of any prior year filings for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The 2015 Form 990-T can be submitted through various methods, offering flexibility to organizations. The form can be filed electronically using the IRS e-file system, which is often the preferred method due to its speed and efficiency. Alternatively, organizations may choose to mail the completed form to the appropriate IRS address, which can vary based on the organization's location and whether payment is included. In-person submissions are generally not accepted for this form, making electronic and mail submissions the primary options.

Penalties for Non-Compliance

Failing to file the 2015 Form 990-T or filing it late can result in significant penalties for organizations. The IRS imposes a penalty for each month the return is late, up to a maximum amount. Additionally, if the organization owes taxes and fails to pay them by the due date, interest will accrue on the unpaid balance. Organizations should take compliance seriously to avoid these financial repercussions and maintain their tax-exempt status.

Key Elements of the Counselormax

The Counselormax is a tool designed to assist organizations in navigating the complexities of tax compliance, particularly concerning Form 990-T. Key elements include user-friendly interfaces that guide users through the form-filling process, ensuring that all necessary information is included. The Counselormax also provides access to up-to-date IRS guidelines and resources, helping users stay informed about changes in tax law that may affect their filings. By utilizing this tool, organizations can streamline their filing process and reduce the risk of errors.

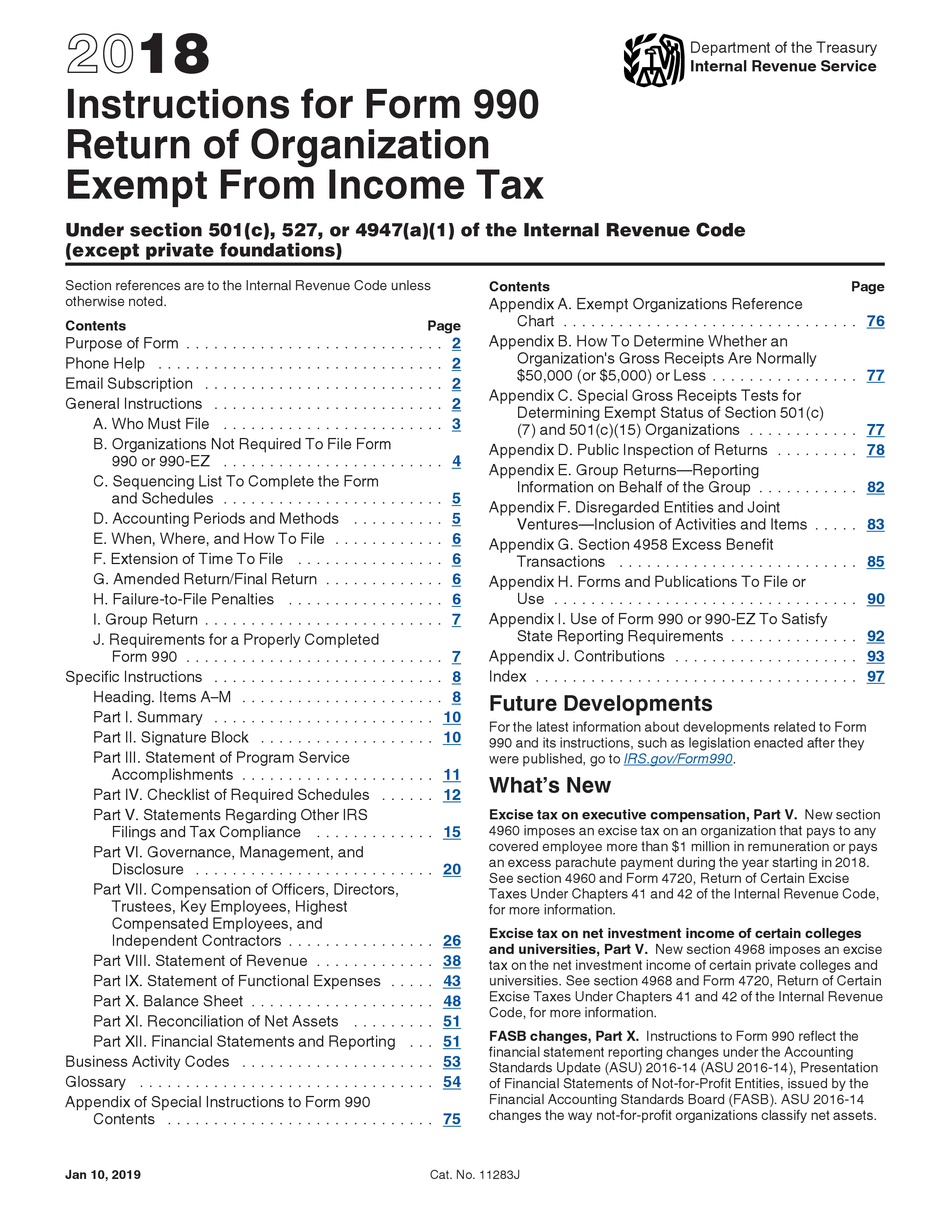

Quick guide on how to complete 2018 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

Discover the most efficient method to complete and endorse your Counselormax

Do you still spend time preparing your official documents on paper instead of doing it online? airSlate SignNow provides a superior way to complete and endorse your Counselormax and similar forms for public services. Our intelligent eSignature platform equips you with all the tools required to handle documents swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing functionalities all available within an intuitive interface.

Only a few steps are needed to complete and endorse your Counselormax:

- Insert the fillable template into the editor using the Get Form button.

- Verify what details you are required to provide in your Counselormax.

- Move between fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the spaces with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Select Sign to generate a legally valid eSignature through any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finalized Counselormax in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our platform also offers versatile form sharing. There's no need to print your forms when you can file them with the appropriate public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2018 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

Create this form in 5 minutes!

How to create an eSignature for the 2018 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

How to make an eSignature for your 2018 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization online

How to create an eSignature for the 2018 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization in Chrome

How to generate an electronic signature for putting it on the 2018 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization in Gmail

How to create an electronic signature for the 2018 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization right from your smart phone

How to generate an eSignature for the 2018 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization on iOS

How to generate an eSignature for the 2018 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization on Android devices

People also ask

-

What are the 2015 Form 990 T instructions?

The 2015 Form 990 T instructions provide detailed guidance on how to fill out the Form 990 T, which is used by tax-exempt organizations to report unrelated business income. These instructions include information on the specific lines of the form, how to calculate tax owed, and filing deadlines. Understanding these instructions is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow assist with the 2015 Form 990 T process?

airSlate SignNow simplifies the process of managing and signing documents related to the 2015 Form 990 T. With its easy-to-use platform, you can prepare, send, and eSign any required documents efficiently. This streamlines compliance and ensures that all submissions meet IRS requirements.

-

Are there any costs associated with using airSlate SignNow for 2015 Form 990 T submissions?

airSlate SignNow is a cost-effective solution, providing transparent pricing plans that cater to different business needs. Whether you are a small nonprofit or a larger organization, airSlate SignNow offers affordable plans that include features to assist with the 2015 Form 990 T process. Pricing details can be found on our website.

-

What features does airSlate SignNow offer for document management related to the 2015 Form 990 T?

AirSlate SignNow offers a variety of powerful features for document management, including customizable templates, eSignature capabilities, and secure storage. These features are invaluable when dealing with documents like the 2015 Form 990 T, ensuring that all paperwork is organized, secure, and easily accessible. Additionally, document tracking ensures you know when your forms are signed.

-

Can I integrate airSlate SignNow with other software for handling the 2015 Form 990 T?

Yes, airSlate SignNow offers integrations with various software platforms, making it easy to manage your 2015 Form 990 T seamlessly. Whether you use accounting software or other document management systems, you can configure integrations that fit your workflow. This enhances productivity by keeping all your essential tools connected.

-

Is training available for using airSlate SignNow to manage the 2015 Form 990 T?

Absolutely! airSlate SignNow provides comprehensive training resources to help users navigate the platform for handling the 2015 Form 990 T. This includes webinars, tutorials, and dedicated customer support to assist you in understanding and utilizing the tools effectively. Our goal is to ensure you feel confident in managing your documents.

-

What benefits does airSlate SignNow offer for filing the 2015 Form 990 T?

Using airSlate SignNow for filing the 2015 Form 990 T comes with several benefits, including improved accuracy, faster processing times, and enhanced compliance. The user-friendly interface allows for hassle-free document preparation and signing, reducing the risk of errors. Additionally, the secure environment protects sensitive information, aligning with IRS expectations.

Get more for Counselormax

Find out other Counselormax

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document