Form 990 Instructions 2014

What is the Form 990 Instructions

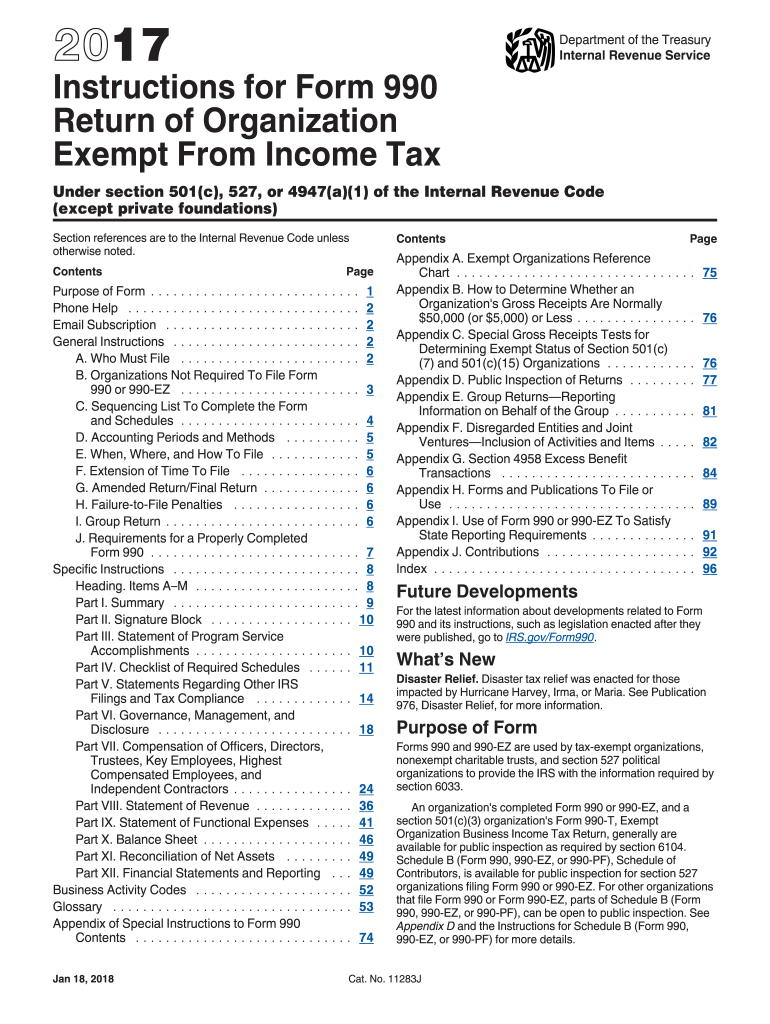

The Form 990 Instructions provide detailed guidance on how nonprofit organizations in the United States should complete their annual tax return, known as Form 990. This form is crucial for transparency and accountability, as it requires organizations to disclose financial information, governance practices, and program accomplishments. The instructions outline the specific requirements for various sections of the form, ensuring that nonprofits comply with IRS regulations while providing essential information to the public.

Steps to complete the Form 990 Instructions

Completing the Form 990 requires a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Gather financial records, including income statements, balance sheets, and expense reports.

- Review the specific requirements for your organization type, as different rules may apply.

- Fill out each section of the form according to the provided instructions, ensuring all information is accurate and complete.

- Double-check calculations and verify that all necessary schedules are included.

- Sign and date the form before submission, ensuring that the person signing has the authority to do so.

How to obtain the Form 990 Instructions

The Form 990 Instructions can be easily accessed through the IRS website. Organizations can download the instructions directly in PDF format, allowing for easy reference while completing the form. Additionally, many tax preparation software programs include the Form 990 Instructions as part of their resources, providing built-in guidance during the filing process.

Legal use of the Form 990 Instructions

The Form 990 Instructions are legally binding in the sense that they outline the requirements set forth by the IRS for nonprofit organizations. Adhering to these instructions is essential for compliance with federal tax laws. Organizations must ensure that they accurately report their financial activities and governance practices as per the instructions to avoid penalties and maintain their tax-exempt status.

Filing Deadlines / Important Dates

Nonprofit organizations must be aware of the filing deadlines for Form 990 to maintain compliance with IRS regulations. Generally, Form 990 is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically means May 15. Extensions may be available, but organizations must file Form 8868 to request additional time.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting Form 990. The form can be filed electronically through the IRS e-file system, which is the preferred method for many nonprofits due to its efficiency and confirmation of receipt. Alternatively, organizations may choose to mail their completed forms to the appropriate IRS address based on their location. In-person submissions are generally not available, as the IRS encourages electronic filing for speed and accuracy.

Penalties for Non-Compliance

Failure to comply with the Form 990 filing requirements can result in significant penalties for nonprofit organizations. The IRS imposes fines for late filings, which can accumulate over time. Additionally, organizations that consistently fail to file may risk losing their tax-exempt status. It is crucial for nonprofits to prioritize timely and accurate submissions to avoid these consequences.

Quick guide on how to complete 2014 form 990 instructions

Complete Form 990 Instructions easily on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without any hindrances. Handle Form 990 Instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Form 990 Instructions effortlessly

- Find Form 990 Instructions and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 990 Instructions and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 990 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 990 instructions

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What are the key features of airSlate SignNow for handling Form 990 Instructions?

airSlate SignNow offers a user-friendly platform for managing Form 990 Instructions with features like customizable templates, electronic signatures, and document tracking. These tools streamline the filing process, ensuring compliance and efficiency. With easy access to your documents, you can focus on your nonprofit's mission rather than paperwork.

-

How does airSlate SignNow simplify the process of completing Form 990 Instructions?

By utilizing airSlate SignNow, organizations can signNowly simplify completing Form 990 Instructions. The platform allows users to fill out forms electronically, ensuring accuracy and reducing the time spent on manual entry. Additionally, built-in reminders help keep track of deadlines, making compliance easier.

-

Are there any pricing plans available for airSlate SignNow that cater to nonprofits needing Form 990 Instructions?

Yes, airSlate SignNow offers flexible pricing plans that are particularly beneficial for nonprofits requiring assistance with Form 990 Instructions. Our pricing is designed to be cost-effective, ensuring that even smaller organizations can access essential features without breaking the bank. Explore our plans to find one that fits your budget and needs.

-

Can I integrate airSlate SignNow with other software for managing Form 990 Instructions?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easier for users to manage Form 990 Instructions alongside their existing systems. Whether you use accounting software or CRM tools, our integrations enhance your workflow and data management.

-

What benefits does airSlate SignNow provide for nonprofit organizations completing Form 990 Instructions?

airSlate SignNow provides numerous benefits for nonprofits completing Form 990 Instructions, including improved efficiency, enhanced security, and reduced paperwork. By digitizing the process, organizations can quickly collect signatures and share documents securely, which helps in maintaining compliance with IRS regulations.

-

Is it easy to use airSlate SignNow for someone new to Form 990 Instructions?

Yes! airSlate SignNow is designed to be intuitive and user-friendly, making it accessible for anyone new to Form 990 Instructions. With step-by-step guides and customer support, users can easily navigate the platform and complete forms without prior experience.

-

What security measures are in place for documents related to Form 990 Instructions on airSlate SignNow?

airSlate SignNow takes the security of your documents seriously, especially for sensitive information related to Form 990 Instructions. We implement advanced encryption, secure data storage, and access controls to protect your information. You can confidently eSign and manage documents knowing they are secure.

Get more for Form 990 Instructions

Find out other Form 990 Instructions

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement