Instructions for Form 990 Return of Organization Exempt from Income Tax Instructions for Form 990 Return of Organization Exempt 2019

Understanding Form 990 Instructions

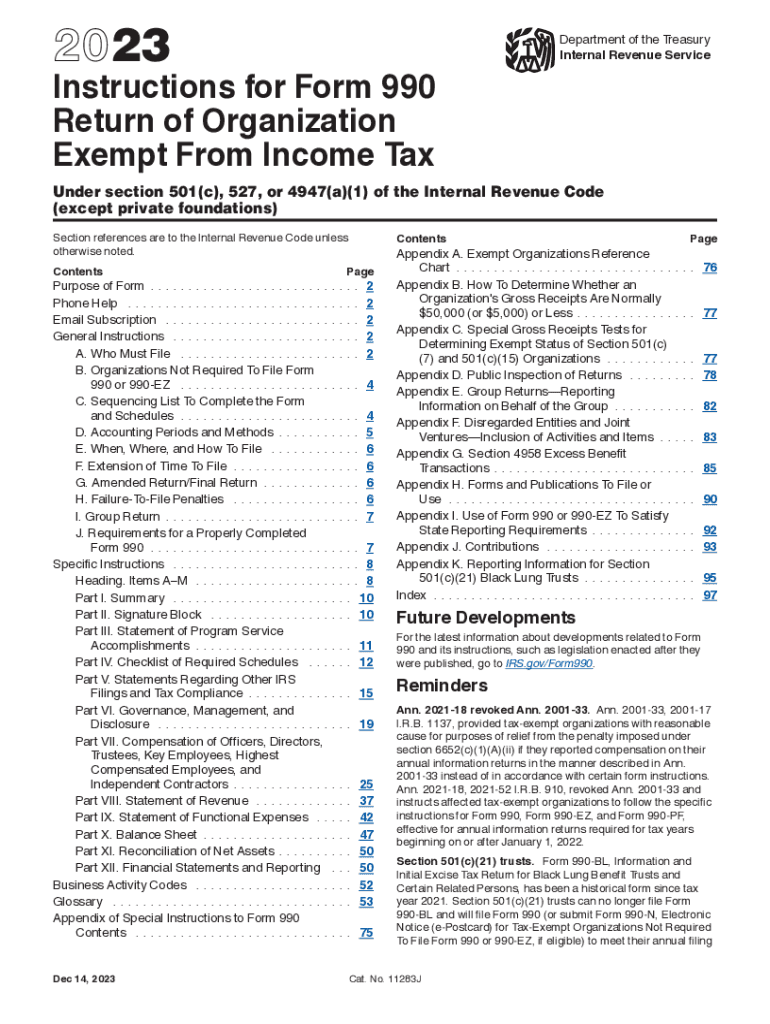

The Instructions for Form 990 are essential for organizations exempt from income tax under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code, excluding private foundations. This form serves as an annual information return that provides the IRS with financial data about the organization’s activities, governance, and compliance with tax regulations. It is crucial for maintaining tax-exempt status and ensuring transparency to the public and stakeholders.

Steps to Complete Form 990 Instructions

Completing the Instructions for Form 990 involves several key steps:

- Gather necessary financial records, including income statements, balance sheets, and details of program activities.

- Review the specific sections of the form to determine what information is required for your organization.

- Fill out the form accurately, ensuring that all figures are correct and correspond to your financial records.

- Provide any additional schedules that may be required based on your organization’s activities and financial structure.

- Review the completed form for accuracy and completeness before submission.

Key Elements of Form 990 Instructions

The key elements of the Instructions for Form 990 include:

- Organizational Information: Details about the organization’s mission, structure, and governance.

- Financial Data: Comprehensive reporting of income, expenses, and assets.

- Program Service Accomplishments: Information on the organization’s programs and their impact.

- Compliance Information: Questions related to governance practices and compliance with IRS regulations.

Filing Deadlines and Important Dates

Organizations must be aware of the filing deadlines for Form 990 to avoid penalties. Generally, Form 990 is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. Extensions may be available, but it is important to file the necessary forms to avoid late fees.

IRS Guidelines for Form 990

The IRS provides specific guidelines for completing Form 990, which include:

- Clear instructions on how to report income and expenses.

- Requirements for disclosing certain information about board members and key employees.

- Guidance on how to report unrelated business income.

Legal Use of Form 990 Instructions

Form 990 serves a legal purpose by ensuring that organizations comply with federal tax laws. Accurate completion of the form is necessary to maintain tax-exempt status and avoid potential legal issues. Organizations must ensure that all reported information is truthful and reflects their operations accurately to uphold their legal obligations.

Quick guide on how to complete instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization exempt

Complete Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt on any device using the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt easily

- Find Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization exempt

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization exempt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 990 instructions for filing taxes?

The 990 instructions provide detailed guidance on how to complete Form 990, which is required for tax-exempt organizations in the U.S. These instructions help organizations report their financial activities, governance policies, and operational details. Understanding these instructions ensures compliance and helps avoid potential penalties.

-

How can airSlate SignNow assist with the 990 instructions?

airSlate SignNow simplifies the process of signing documents required for 990 instructions. With our platform, you can easily collect eSignatures from board members or executives, ensuring that all necessary approvals are in place. This streamlines your filing process, making it much more efficient.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit different business needs. Our plans are designed to provide cost-effective solutions for organizations of all sizes, allowing you to manage eSigning and document workflows efficiently. Check our website for detailed pricing tailored to your specific needs.

-

What features does airSlate SignNow offer to help with documentation?

airSlate SignNow includes features such as eSigning, document templates, and real-time collaboration, all of which can help you manage the documents related to 990 instructions. Additionally, you can track the status of your documents to ensure timely submission. This enhances the overall productivity of your organization.

-

How do I ensure compliance with 990 instructions when using airSlate SignNow?

Using airSlate SignNow helps maintain compliance with 990 instructions by providing a secure platform for document management. Our platform keeps a detailed audit trail of all actions taken on your documents, ensuring you have the necessary records for compliance audits. This helps in maintaining transparency and accountability.

-

Can airSlate SignNow integrate with other software for better workflow management?

Yes, airSlate SignNow easily integrates with various software applications commonly used in organizations, enhancing your workflow management. For instance, you can connect it with accounting or management systems to streamline how you handle 990 instructions documentation. This integration supports a more holistic approach to your operational needs.

-

What are the benefits of using airSlate SignNow for non-profits concerning 990 instructions?

Using airSlate SignNow offers signNow benefits for non-profits managing 990 instructions, such as reduced administrative burden and enhanced compliance. Our platform's automation features streamline the signing process, which can save time and resources. This allows organizations to focus more on their mission rather than paperwork.

Get more for Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt

- Name change minor 497310995 form

- Maine promissory note form

- Maine unsecured installment payment promissory note for fixed rate maine form

- Notice of option for recording maine form

- Maine documents form

- General durable power of attorney for property and finances or financial effective upon disability maine form

- Essential legal life documents for baby boomers maine form

- Maine general form

Find out other Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization Exempt

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer