Form 4506 C 9 IRS Tax FormsForm 4506 Request for Copy of Tax ReturnDisaster 4506 T Request for Transcript of Tax ReturnDisaster 2021

Understanding the IRS Form 4506

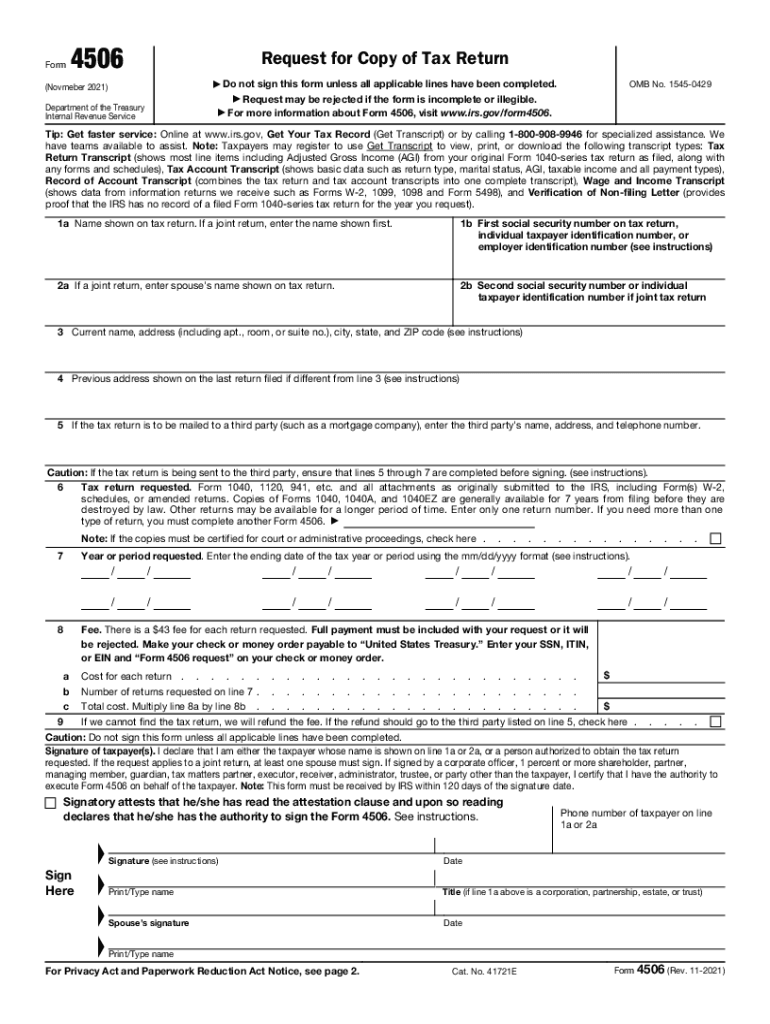

The IRS Form 4506 is a request form that allows individuals to obtain copies of their tax returns from the Internal Revenue Service. This form is essential for taxpayers who need to retrieve past tax documents for various reasons, such as applying for loans, verifying income, or resolving tax issues. The form can be used to request copies of tax returns for the past three years, providing a reliable way to access important financial information.

How to Complete the IRS Form 4506

Completing the IRS Form 4506 requires careful attention to detail. Begin by filling out your personal information, including your name, Social Security number, and address. Next, specify the tax years for which you are requesting copies. Be sure to include the appropriate box indicating whether you want a complete copy of your tax return or just a transcript. After completing the form, sign and date it before submission. This ensures that your request is processed efficiently.

Submitting the IRS Form 4506

The IRS Form 4506 can be submitted via mail or fax, depending on your preference. If you choose to mail the form, send it to the address specified in the instructions, which varies based on your location. Alternatively, you can fax the completed form to the appropriate number provided by the IRS. Ensure that you keep a copy of the submitted form for your records, as this will help you track your request.

Legal Considerations for Using the IRS Form 4506

The IRS Form 4506 is legally binding, and it is crucial to understand the implications of submitting this request. By signing the form, you authorize the IRS to release your tax information to the designated recipient. This means that you should only submit the form if you are certain of the recipient's identity and purpose for accessing your tax records. Misuse of this form can lead to legal consequences, so it is important to handle it responsibly.

Key Information Required for the IRS Form 4506

When filling out the IRS Form 4506, certain key pieces of information are required to ensure your request is processed correctly. This includes your full name, Social Security number, address, and the specific tax years you are requesting. Additionally, you must provide the name and address of the third party to whom the tax information will be sent, if applicable. Providing accurate and complete information is essential for a smooth processing experience.

Common Uses for the IRS Form 4506

The IRS Form 4506 is commonly used for various purposes, including loan applications, mortgage approvals, and financial aid requests. Individuals may also need this form when resolving discrepancies with the IRS or when preparing for tax audits. Understanding the common scenarios in which this form is utilized can help taxpayers recognize its importance in managing their financial affairs.

Quick guide on how to complete form 4506 c 9 2020 irs tax formsform 4506 request for copy of tax returndisaster 4506 t request for transcript of tax

Effortlessly Prepare Form 4506 C 9 IRS Tax FormsForm 4506 Request For Copy Of Tax ReturnDisaster 4506 T Request For Transcript Of Tax ReturnDisaster on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 4506 C 9 IRS Tax FormsForm 4506 Request For Copy Of Tax ReturnDisaster 4506 T Request For Transcript Of Tax ReturnDisaster on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Adjust and Electronically Sign Form 4506 C 9 IRS Tax FormsForm 4506 Request For Copy Of Tax ReturnDisaster 4506 T Request For Transcript Of Tax ReturnDisaster with Ease

- Locate Form 4506 C 9 IRS Tax FormsForm 4506 Request For Copy Of Tax ReturnDisaster 4506 T Request For Transcript Of Tax ReturnDisaster and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about missing or lost files, tedious document searches, or errors that require reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and electronically sign Form 4506 C 9 IRS Tax FormsForm 4506 Request For Copy Of Tax ReturnDisaster 4506 T Request For Transcript Of Tax ReturnDisaster and facilitate excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 c 9 2020 irs tax formsform 4506 request for copy of tax returndisaster 4506 t request for transcript of tax

Create this form in 5 minutes!

How to create an eSignature for the form 4506 c 9 2020 irs tax formsform 4506 request for copy of tax returndisaster 4506 t request for transcript of tax

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an e-signature for a PDF document on Android

People also ask

-

What is the process for submitting an IRS form request using airSlate SignNow?

To submit an IRS form request with airSlate SignNow, simply create a document or form that requires signatures. Then, upload it to our platform, add the necessary recipients, and send it out for eSignature. Once completed, you can download or save the signed document for your records.

-

How does airSlate SignNow ensure the security of my IRS form requests?

airSlate SignNow prioritizes your data security by utilizing advanced encryption technology for all IRS form requests. We comply with legal standards, including eSigning laws, to ensure that your documents are protected. Additionally, our platform offers audit trails to track all actions taken on your documents.

-

Are there any costs associated with using airSlate SignNow for IRS form requests?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focusing on IRS form requests. You can choose from basic to advanced plans, depending on the features required. Check our pricing page for detailed information on what's included in each plan.

-

Can I integrate airSlate SignNow with other tools for managing IRS form requests?

Absolutely! airSlate SignNow allows seamless integrations with various applications such as Google Drive, Dropbox, and more. This compatibility makes it easy to manage IRS form requests and streamline your document workflow by connecting with your existing systems.

-

What features does airSlate SignNow offer for optimizing IRS form requests?

airSlate SignNow includes features like customizable templates, real-time tracking, and reminders for IRS form requests. These tools help you streamline your document processes and ensure that deadlines are met without hassle. You can also automate repetitive tasks to improve efficiency.

-

Is airSlate SignNow suitable for small businesses needing to process IRS form requests?

Yes, airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses. Our platform enables you to handle IRS form requests with ease, allowing for efficient eSigning workflows that cater to your budget. Plus, our support team is available to assist you as needed.

-

Can airSlate SignNow help me keep track of multiple IRS form requests?

Certainly! airSlate SignNow provides features such as a dashboard for monitoring the status of all your IRS form requests in one place. You can see which documents are signed, pending, or active, which enhances organization and celebrates completed tasks efficiently.

Get more for Form 4506 C 9 IRS Tax FormsForm 4506 Request For Copy Of Tax ReturnDisaster 4506 T Request For Transcript Of Tax ReturnDisaster

- Quitclaim deed from corporation to two individuals hawaii form

- Warranty deed from corporation to two individuals hawaii form

- Hawaii warranty 497304294 form

- Warranty deed from husband and wife to a trust hawaii form

- Warranty deed from husband to himself and wife hawaii form

- Quitclaim deed from husband to himself and wife hawaii form

- Quitclaim deed from husband and wife to husband and wife hawaii form

- Warranty deed from husband and wife to husband and wife hawaii form

Find out other Form 4506 C 9 IRS Tax FormsForm 4506 Request For Copy Of Tax ReturnDisaster 4506 T Request For Transcript Of Tax ReturnDisaster

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation