Form 4506 2013

What is the Form 4506

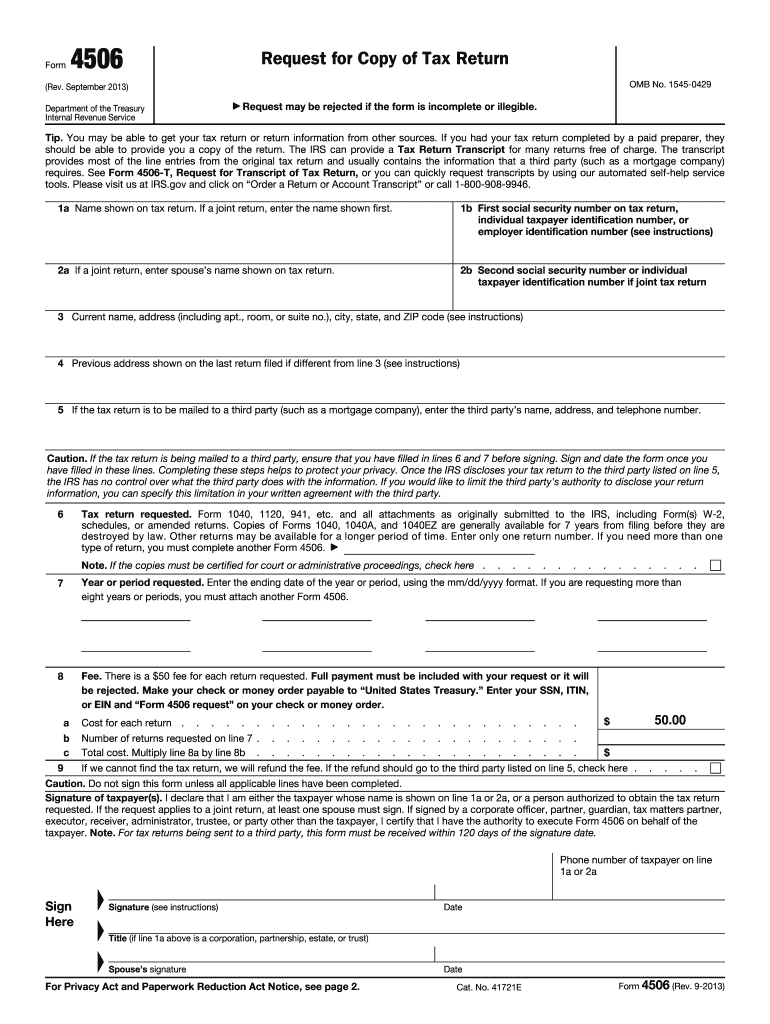

The Form 4506 is a document used by taxpayers in the United States to request a copy of their tax return from the Internal Revenue Service (IRS). This form is essential for individuals who need to obtain past tax documents for various purposes, including loan applications, mortgage approvals, or verifying income. It allows taxpayers to access their tax information for the previous years, typically up to seven years back. Understanding the purpose and function of the Form 4506 is crucial for ensuring compliance and accuracy in financial matters.

How to use the Form 4506

Using the Form 4506 involves several straightforward steps. First, you need to complete the form by providing your personal information, including your name, Social Security number, and address. Next, specify the tax years for which you are requesting copies of your returns. After filling out the required sections, you must sign and date the form. Finally, submit the completed Form 4506 to the IRS by mail or electronically, depending on your preference and the options available. It is important to ensure that all information is accurate to avoid delays in processing your request.

Steps to complete the Form 4506

Completing the Form 4506 requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by downloading the Form 4506 from the IRS website or obtaining a physical copy.

- Fill in your personal details, including your full name, Social Security number, and current address.

- Indicate the specific tax years for which you are requesting copies of your returns.

- Sign and date the form to validate your request.

- Submit the form to the IRS using the appropriate mailing address provided in the instructions.

Double-check all entries for accuracy before submission to prevent any processing issues.

Legal use of the Form 4506

The legal use of the Form 4506 is governed by IRS regulations. It is important to ensure that the form is used solely for legitimate purposes, such as verifying income for loans or other financial transactions. The IRS requires that the individual requesting the tax return must be the taxpayer or have the taxpayer's consent. Misuse of the Form 4506 can lead to penalties, including fines or legal action. Therefore, understanding the legal implications and ensuring compliance with IRS guidelines is essential when using this form.

Required Documents

When submitting the Form 4506, certain documents may be necessary to facilitate the request. Typically, you will need to provide a valid form of identification, such as a driver's license or Social Security card, to verify your identity. If you are requesting tax returns for someone else, you must include a signed authorization from that individual. Additionally, any relevant information that can help the IRS locate your records, such as previous addresses or tax identification numbers, should be included to expedite processing.

Form Submission Methods (Online / Mail / In-Person)

The Form 4506 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Mail: Print the completed form and send it to the designated IRS address based on your state of residence.

- Online: Some taxpayers may have the option to submit the form electronically through the IRS website, depending on their situation.

- In-Person: While not commonly used, individuals may also visit local IRS offices to submit their requests directly.

Choosing the appropriate submission method can impact processing times, so it is advisable to consider the urgency of your request when deciding how to submit the Form 4506.

Quick guide on how to complete 2013 form 4506

Complete Form 4506 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 4506 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 4506 with ease

- Locate Form 4506 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 4506 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 4506

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 4506

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 4506 and why do I need it?

Form 4506 is a request for a copy of your tax return from the IRS. Businesses often need this form to verify income information for loans or other financial purposes. Using airSlate SignNow, you can easily eSign and send Form 4506, streamlining the process of obtaining crucial tax documentation.

-

How does airSlate SignNow simplify the process of submitting Form 4506?

airSlate SignNow provides an intuitive platform that allows users to fill out and eSign Form 4506 quickly and securely. With our easy-to-use interface, you can manage your documents without hassle, ensuring that your tax return requests are submitted efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 4506?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, our subscription plans provide cost-effective solutions for managing and eSigning documents like Form 4506.

-

Can I integrate airSlate SignNow with other applications for Form 4506 processing?

Absolutely! airSlate SignNow can be integrated with various applications, including CRM and document management systems, to enhance your workflow. This integration allows for seamless processing of Form 4506, making it easier to manage your tax documentation alongside other business processes.

-

What are the benefits of using airSlate SignNow for Form 4506?

Using airSlate SignNow for Form 4506 offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our platform ensures that your documents are encrypted and securely stored, giving you peace of mind while you manage your tax requests.

-

How do I get started with airSlate SignNow for Form 4506?

Getting started with airSlate SignNow is simple. You can sign up for an account, choose a pricing plan that fits your needs, and begin creating and eSigning Form 4506 documents in just a few minutes. Our user-friendly platform guides you through the entire process.

-

What support does airSlate SignNow offer for users completing Form 4506?

airSlate SignNow provides comprehensive customer support to assist users with any questions or issues related to Form 4506. Our support team is available via chat, email, or phone to ensure that you have the resources you need for a smooth document signing experience.

Get more for Form 4506

Find out other Form 4506

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement