Form 4506 Rev 11 Request for Copy of Tax Return 2020

What is the Form 4506 Rev 11 Request For Copy Of Tax Return

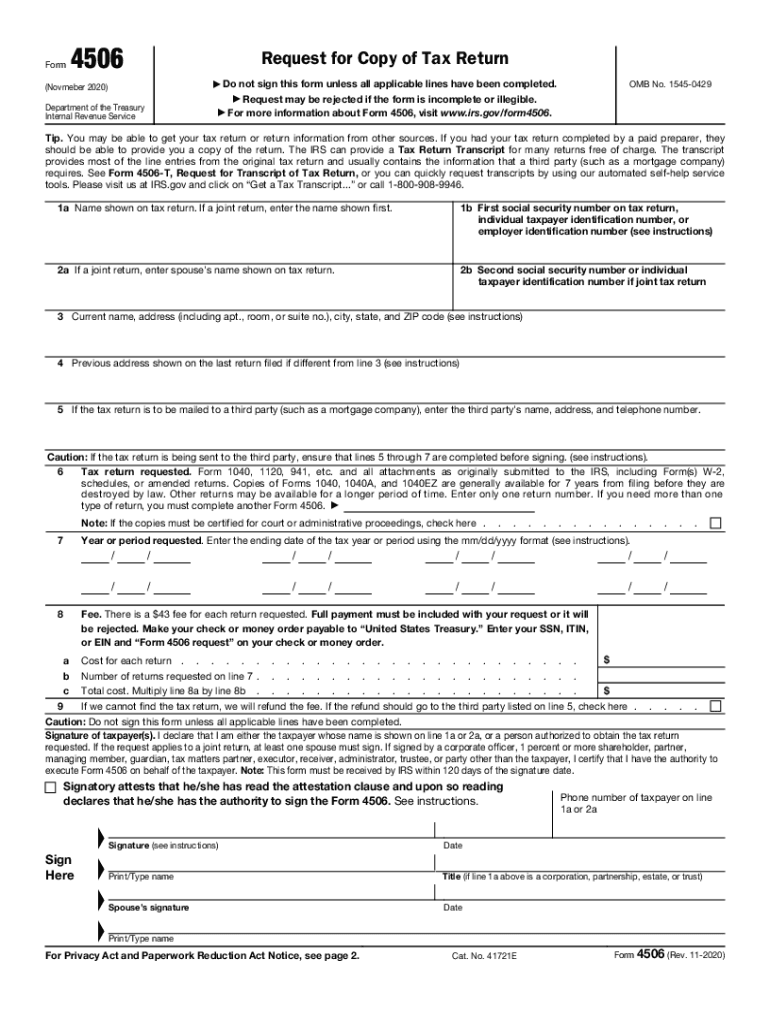

The Form 4506, officially known as the Request for Copy of Tax Return, is a document provided by the IRS that allows taxpayers to request a copy of their federal tax return. This form is essential for individuals or businesses needing to obtain copies of their past tax filings for various reasons, including loan applications, audits, or personal record-keeping. The form can be used to request copies of tax returns, including the federal tax return 2020 copy, and is applicable for returns filed in prior years as well.

How to use the Form 4506 Rev 11 Request For Copy Of Tax Return

Using the Form 4506 is straightforward. Taxpayers must fill out the form with their personal information, including name, address, and Social Security number. It is important to specify the tax years for which copies are requested, such as the federal tax return 2020 copy. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the options available. Understanding the purpose of the request is crucial, as the IRS may require additional documentation or information to process the request efficiently.

Steps to complete the Form 4506 Rev 11 Request For Copy Of Tax Return

Completing the Form 4506 involves several key steps:

- Provide your name and Social Security number, or Employer Identification Number (EIN) if applicable.

- Include your current address and any previous addresses if they differ from the address on the tax return.

- Indicate the specific tax years for which you are requesting copies, such as the federal tax return 2020 copy.

- Sign and date the form to authorize the IRS to release your tax information.

- Submit the completed form to the IRS address specified in the instructions, or use an electronic submission method if available.

Legal use of the Form 4506 Rev 11 Request For Copy Of Tax Return

The Form 4506 is legally binding and must be completed accurately to ensure compliance with IRS regulations. It is used by individuals and businesses for legitimate purposes, such as verifying income for loans, applying for government assistance, or resolving tax disputes. Providing false information on the form can lead to penalties or legal repercussions. Therefore, it is essential to understand the legal implications of using this form and to ensure all information provided is truthful and accurate.

Required Documents

When submitting the Form 4506, it is important to include any required documentation that supports your request. This may include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Proof of address if your current address differs from the one on your tax return.

- Any additional forms or documentation requested by the IRS to process your request.

Ensuring that all necessary documents are included can expedite the processing of your request for a federal tax return 2020 copy.

Form Submission Methods (Online / Mail / In-Person)

The Form 4506 can be submitted in several ways, depending on the taxpayer's preference and the IRS guidelines. The options include:

- Mail: Print the completed form and send it to the IRS address indicated in the instructions.

- Online: If eligible, taxpayers may submit the form electronically through the IRS website or authorized e-filing services.

- In-Person: Some taxpayers may choose to visit a local IRS office, although this option may require an appointment.

Each submission method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete form 4506 rev 11 2020 request for copy of tax return

Effortlessly Prepare Form 4506 Rev 11 Request For Copy Of Tax Return on Any Device

Digital document management has become increasingly favored among businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed materials, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without any holdups. Handle Form 4506 Rev 11 Request For Copy Of Tax Return on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

The simplest method to modify and eSign Form 4506 Rev 11 Request For Copy Of Tax Return effortlessly

- Obtain Form 4506 Rev 11 Request For Copy Of Tax Return and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form; via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing fresh copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 4506 Rev 11 Request For Copy Of Tax Return to guarantee outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 rev 11 2020 request for copy of tax return

Create this form in 5 minutes!

How to create an eSignature for the form 4506 rev 11 2020 request for copy of tax return

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

How can I obtain a federal tax return 2020 copy using airSlate SignNow?

To obtain a federal tax return 2020 copy, you can easily upload your document to airSlate SignNow and utilize our eSignature feature to send it securely. The platform allows you to sign and share your federal tax return efficiently while ensuring compliance. Simply follow the guided steps to complete the process.

-

Is there a cost associated with getting a federal tax return 2020 copy through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit your needs. You can easily access a federal tax return 2020 copy as part of our affordable subscription model. We provide excellent value with flexible plans that cater to both individuals and businesses.

-

What features does airSlate SignNow offer for managing my federal tax return 2020 copy?

airSlate SignNow provides features like document templates, team collaboration options, and robust eSignature tools. You can manage your federal tax return 2020 copy effectively through these features, ensuring it is well-organized and quickly accessible. Additionally, our platform enhances the workflow efficiency for all your document needs.

-

Can I track the status of my federal tax return 2020 copy once it's sent?

Absolutely! airSlate SignNow includes a tracking system that allows you to monitor the status of your federal tax return 2020 copy in real-time. You'll receive notifications when your document is viewed and signed, so you can stay informed throughout the entire process.

-

Is airSlate SignNow secure for handling sensitive documents like a federal tax return 2020 copy?

Yes, airSlate SignNow prioritizes security and compliance for all documents, including your federal tax return 2020 copy. We use encryption and other security measures to protect your data and ensure a safe signing experience. Your confidentiality is our top priority.

-

What benefits does using airSlate SignNow provide for my federal tax return 2020 copy?

Using airSlate SignNow for your federal tax return 2020 copy streamlines the signing process and minimizes delays. You can complete your documents quickly, reduce paper usage, and enhance collaboration with clients or business partners. The user-friendly interface makes it easy for anyone to adopt.

-

Does airSlate SignNow integrate with other software for managing federal tax return 2020 copies?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enhancing your ability to manage your federal tax return 2020 copy. You can connect with platforms like Google Drive, Dropbox, and more to streamline your document management process. This integration supports a smooth workflow and centralized document storage.

Get more for Form 4506 Rev 11 Request For Copy Of Tax Return

- Preferred pediatrics hipaa consent formdoc

- Empower retirement hardship withdrawal form

- Ohio health referral form

- 2016 fitness challenge registration form aims

- Handbook cambridge college form

- Transfer credit permission form permission form

- Restaurant kitchen cleaning checklist template word form

- Course completion contract blinnedu form

Find out other Form 4506 Rev 11 Request For Copy Of Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors