Form 4506 Rev 1 Request for Copy of Tax Return 2024

What is the Form 4506 Request for Copy of Tax Return

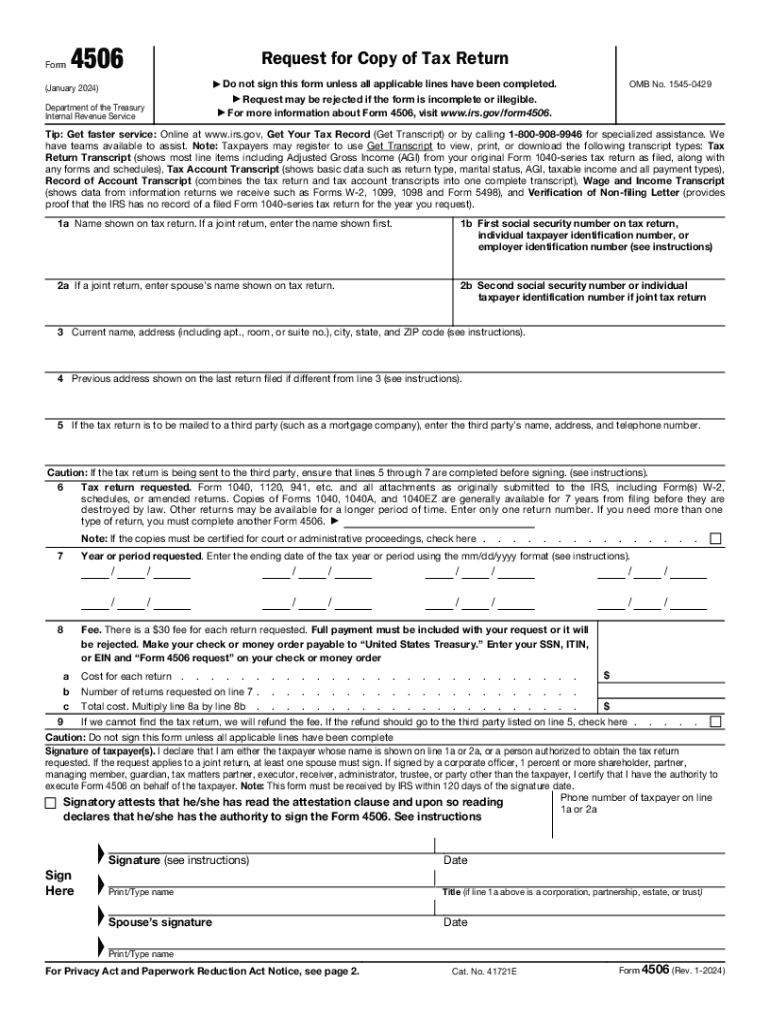

The Form 4506 is an official document issued by the Internal Revenue Service (IRS) that allows taxpayers to request a copy of their tax return. This form is essential for individuals who need a copy of their 2020 tax return for various reasons, such as applying for loans, verifying income, or addressing tax-related issues. The form can be used to obtain copies of tax returns for the current year and up to six prior years, including the 2020 tax return.

How to Use the Form 4506 Request for Copy of Tax Return

To effectively use the Form 4506, you must fill it out with accurate information. This includes your name, Social Security number, and the tax years for which you are requesting copies. You will also need to provide your mailing address and specify whether you want a full copy of the return or just a transcript. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on your preference.

Steps to Complete the Form 4506 Request for Copy of Tax Return

Completing the Form 4506 involves several straightforward steps:

- Download the Form 4506 from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax years you need copies of, such as 2020.

- Choose whether you want a complete copy of your tax return or a transcript.

- Sign and date the form to authorize the request.

- Submit the form to the appropriate IRS address listed in the instructions.

Required Documents for Form 4506 Submission

When submitting the Form 4506, you may need to include additional documentation to verify your identity. This can include a copy of your driver’s license or another form of identification. If you are requesting a copy on behalf of someone else, you will need to provide a signed authorization from that individual.

IRS Guidelines for Submitting Form 4506

The IRS has specific guidelines for submitting the Form 4506. It is important to ensure that the form is filled out completely and accurately to avoid delays. The IRS typically processes requests within 10 to 30 days, depending on their workload. If there are any issues with your request, the IRS will contact you directly.

Eligibility Criteria for Requesting Copies of Tax Returns

To be eligible to request a copy of your tax return using Form 4506, you must be the taxpayer or have written authorization from the taxpayer. You should also ensure that the tax returns you are requesting are within the allowable time frame, which includes the 2020 tax return and up to six prior years. If you are requesting a return for someone else, you must provide their information along with your authorization.

Quick guide on how to complete form 4506 rev 1 request for copy of tax return

Effortlessly Prepare Form 4506 Rev 1 Request For Copy Of Tax Return on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 4506 Rev 1 Request For Copy Of Tax Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Form 4506 Rev 1 Request For Copy Of Tax Return with Ease

- Find Form 4506 Rev 1 Request For Copy Of Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and electronically sign Form 4506 Rev 1 Request For Copy Of Tax Return and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 rev 1 request for copy of tax return

Create this form in 5 minutes!

How to create an eSignature for the form 4506 rev 1 request for copy of tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I obtain a copy of my 2020 tax return using airSlate SignNow?

To get a copy of your 2020 tax return, you can upload your tax documents to airSlate SignNow and use our eSigning features for quick access. Our platform allows you to securely store and retrieve important documents, including past tax returns. If you need a copy of your 2020 tax return, our user-friendly interface makes it easy to manage your files.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features for managing tax documents, including secure cloud storage, eSigning capabilities, and document sharing. Whether you need a copy of your 2020 tax return or other tax-related documents, our platform ensures your files are safe and easily accessible. Additionally, our integration capabilities enable you to streamline your workflow efficiently.

-

Is it cost-effective to use airSlate SignNow for retrieving tax documents?

Yes, using airSlate SignNow is a cost-effective way to manage and retrieve important documents like your 2020 tax return. Our pricing plans cater to various needs, ensuring you only pay for the features you require. Plus, the ease of use and efficiency offered by our services can save you both time and money.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your tax documents. If you need a copy of your 2020 tax return, you can easily connect your existing applications to streamline your document handling. This integration enhances your workflow and ensures that all your financial documents are organized in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including increased security, ease of access, and efficient document management. If you need a copy of your 2020 tax return, you can quickly retrieve it without hassle. Furthermore, our platform is designed to simplify the signing and sharing processes, giving you peace of mind regarding your sensitive information.

-

How secure is my data with airSlate SignNow when handling tax documents?

Security is a top priority at airSlate SignNow. When managing documents like your 2020 tax return, we utilize advanced encryption and compliance measures to protect your data. You can trust that your sensitive tax information is safe with us, allowing you to focus on getting your documents signed and shared as needed.

-

Do you offer customer support for tax document inquiries?

Yes, airSlate SignNow provides dedicated customer support to assist you with any inquiries regarding tax documents. If you need a copy of your 2020 tax return or help using our features, our support team is here to help. We strive to ensure your experience is smooth and that you can effectively utilize our platform for your needs.

Get more for Form 4506 Rev 1 Request For Copy Of Tax Return

- Short form of option to purchase real estate

- Itemized list of all deductions from the deposit form

- Landlord rights dealing with problem rentersattorney form

- Notice of commencement corporation 490218355 form

- Location notice corporation form

- Buyer shall form

- Notice of furnishing of labor or materials individual form

- County south dakota on form

Find out other Form 4506 Rev 1 Request For Copy Of Tax Return

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document