Form 4506 2012

What is the Form 4506

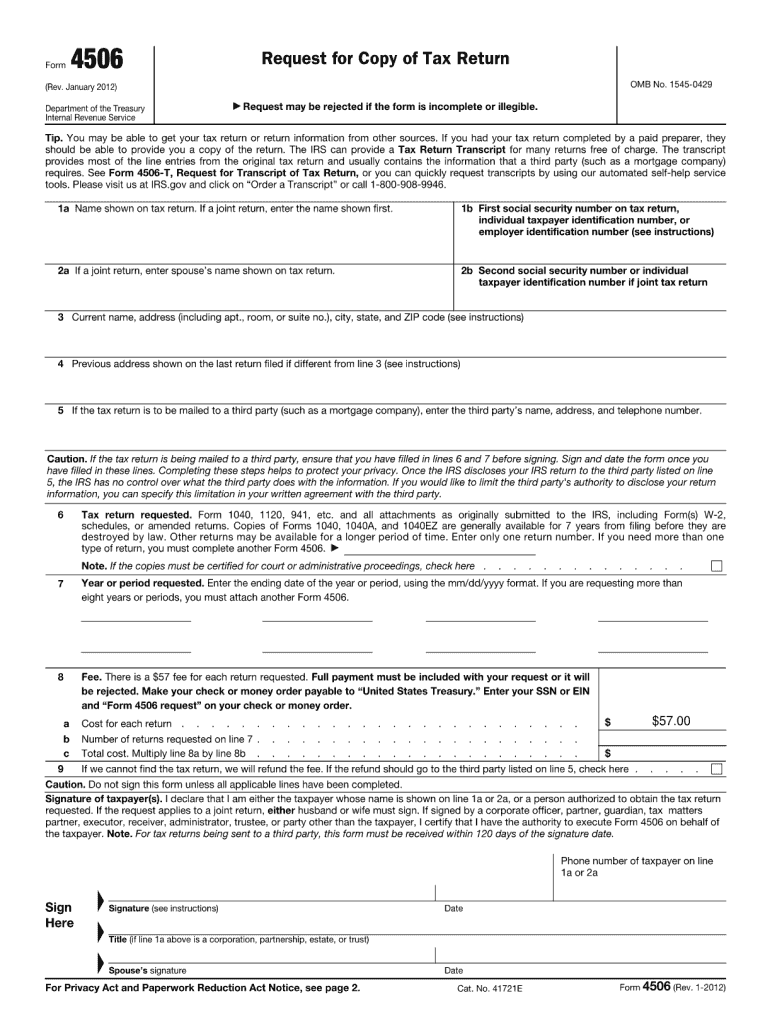

The Form 4506 is an official document issued by the Internal Revenue Service (IRS) that allows taxpayers to request a copy of their tax return. This form is essential for individuals and businesses needing to verify their income or tax filing history, particularly when applying for loans, mortgages, or other financial assistance. By completing this form, taxpayers can obtain copies of their previously filed federal tax returns, including any accompanying schedules and forms.

How to use the Form 4506

Using the Form 4506 involves a straightforward process. Taxpayers must fill out the form with their personal information, including their name, address, and Social Security number. Additionally, they need to specify the tax years for which they are requesting copies. Once completed, the form should be submitted to the IRS, either by mail or electronically, depending on the chosen method. It's important to ensure that all information is accurate to avoid delays in processing the request.

Steps to complete the Form 4506

Completing the Form 4506 requires careful attention to detail. Here are the steps to follow:

- Download the Form 4506 from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the specific tax years for which you are requesting copies.

- Sign and date the form to certify the request.

- Submit the completed form to the IRS by mail or electronically, based on your preference.

Legal use of the Form 4506

The Form 4506 is legally recognized as a valid request for tax return copies. It is crucial for maintaining compliance with IRS regulations. When used correctly, it provides a legitimate means for taxpayers to obtain their tax records, which can be essential for various legal and financial processes. Ensuring the accuracy of the information provided is vital, as any discrepancies may lead to complications or delays in processing.

Required Documents

When submitting the Form 4506, certain documents may be required to support your request. Typically, you will need to provide:

- A valid form of identification, such as a driver's license or passport.

- Proof of your Social Security number, if not included in the form.

- Any additional documentation that may be relevant to your request, such as a loan application.

Form Submission Methods

There are several methods for submitting the Form 4506 to the IRS. Taxpayers can choose to send the completed form by mail or submit it electronically. The electronic submission process may be faster, but it requires access to specific IRS online services. When mailing the form, it is advisable to use certified mail to ensure it is received by the IRS. Be mindful of the processing times, which can vary based on the submission method chosen.

Quick guide on how to complete 2012 form 4506

Prepare Form 4506 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It presents an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form 4506 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 4506 effortlessly

- Find Form 4506 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it directly to your computer.

No more worrying about lost or misplaced files, tedious form searches, or errors requiring new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Adjust and eSign Form 4506 to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 4506

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 4506

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is Form 4506 and how can airSlate SignNow help?

Form 4506 is a request for a copy of your tax return from the IRS. With airSlate SignNow, you can easily fill out and eSign Form 4506, streamlining the process of obtaining your tax documents without the hassle of printing and mailing.

-

Is airSlate SignNow suitable for completing Form 4506?

Yes, airSlate SignNow is designed to handle various document types, including Form 4506. Our platform allows users to quickly complete and eSign the form, ensuring compliance and accuracy while saving time.

-

What are the pricing options for using airSlate SignNow with Form 4506?

airSlate SignNow offers flexible pricing plans to accommodate different needs. Whether you are a small business or a large enterprise, you can choose a plan that allows you to eSign Form 4506 and other documents at an affordable rate.

-

Can I integrate airSlate SignNow with other applications for Form 4506 processing?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage your Form 4506 alongside other documents. This integration enhances your workflow by allowing you to access and send forms directly from your preferred tools.

-

What features does airSlate SignNow offer for managing Form 4506?

airSlate SignNow provides a range of features for managing Form 4506, including customizable templates, real-time tracking, and secure cloud storage. These features enhance efficiency and ensure that your documents are always accessible and securely stored.

-

How does airSlate SignNow ensure the security of my Form 4506?

Security is a top priority at airSlate SignNow. When you eSign Form 4506 with our platform, your data is protected with cutting-edge encryption and compliance with industry standards, ensuring that your sensitive information remains safe.

-

Can I use airSlate SignNow for multiple Form 4506 requests?

Yes, airSlate SignNow allows you to handle multiple Form 4506 requests efficiently. You can create and manage several requests simultaneously, making it an ideal solution for businesses that frequently need to obtain tax return copies.

Get more for Form 4506

Find out other Form 4506

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online