Form 4506 F Request for Copy of Fraudulent Tax Return 2024

Understanding the Form 4506 F Request For Copy Of Fraudulent Tax Return

The Form 4506 F is a crucial document used by taxpayers who suspect that their tax return has been filed fraudulently. This form allows individuals to request a copy of the fraudulent return from the IRS, which can be essential for resolving issues related to identity theft and tax fraud. By obtaining a copy of the fraudulent return, taxpayers can better understand the discrepancies and take appropriate action to protect their financial interests.

Steps to Complete the Form 4506 F Request For Copy Of Fraudulent Tax Return

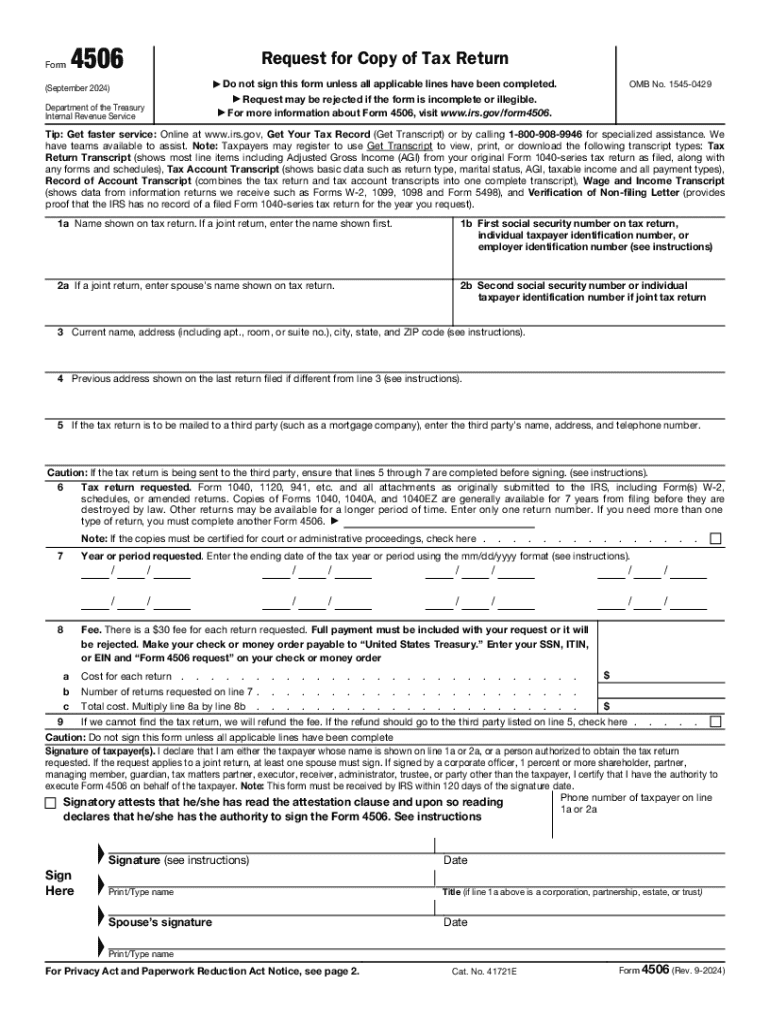

Completing the Form 4506 F involves several important steps:

- Gather necessary information: Collect your personal details, including your name, Social Security number, and address, as well as the details of the fraudulent return.

- Fill out the form: Complete the form accurately, ensuring that all required fields are filled. This includes specifying the tax year for which you are requesting a copy.

- Sign and date the form: Your signature is necessary to authorize the IRS to release the information.

- Submit the form: Send the completed form to the appropriate IRS address, which can be found in the form instructions.

How to Obtain the Form 4506 F Request For Copy Of Fraudulent Tax Return

The Form 4506 F can be obtained directly from the IRS website or through various tax assistance offices. It is available as a downloadable PDF, which can be printed and filled out. Additionally, taxpayers can request a physical copy by contacting the IRS directly or visiting a local IRS office. Ensuring you have the most current version of the form is important, as outdated forms may not be accepted.

Legal Use of the Form 4506 F Request For Copy Of Fraudulent Tax Return

The legal use of the Form 4506 F is strictly for individuals who believe they have been victims of tax-related fraud. This form serves as a formal request to the IRS for documentation that can help in addressing fraudulent activities. It is important to use this form responsibly and only for legitimate cases of identity theft or fraud, as misuse can lead to legal consequences.

Required Documents for Form 4506 F Submission

When submitting the Form 4506 F, you may need to provide additional documentation to support your request. This may include:

- A copy of your government-issued ID to verify your identity.

- Any correspondence from the IRS regarding the fraudulent return.

- Proof of your address, such as a utility bill or bank statement.

Having these documents ready can help expedite the processing of your request.

IRS Guidelines for Form 4506 F

The IRS provides specific guidelines for completing and submitting the Form 4506 F. It is essential to follow these guidelines to ensure your request is processed efficiently. Key points include:

- Submitting the form to the correct IRS address based on your state of residence.

- Understanding the processing times, which may vary depending on the volume of requests.

- Keeping a copy of the submitted form for your records.

Following these guidelines can help minimize delays and ensure that your request is handled appropriately.

Handy tips for filling out Form 4506 F Request For Copy Of Fraudulent Tax Return online

Quick steps to complete and e-sign Form 4506 F Request For Copy Of Fraudulent Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for maximum efficiency. Use signNow to e-sign and share Form 4506 F Request For Copy Of Fraudulent Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 f request for copy of fraudulent tax return

Create this form in 5 minutes!

How to create an eSignature for the form 4506 f request for copy of fraudulent tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does airSlate SignNow help with managing tax information?

airSlate SignNow streamlines the process of collecting and managing tax information by allowing users to send and eSign documents securely. This ensures that all tax-related documents are organized and easily accessible, reducing the risk of errors. With our platform, businesses can efficiently handle tax information without the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for handling tax information?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to simplify the management of tax information. Users can create templates for common tax documents, ensuring consistency and compliance. Additionally, the ability to track document status helps users stay on top of their tax information needs.

-

Is airSlate SignNow cost-effective for managing tax information?

Yes, airSlate SignNow offers a cost-effective solution for managing tax information, with various pricing plans to suit different business needs. By reducing the time spent on paperwork and improving efficiency, businesses can save money while ensuring compliance with tax regulations. Our pricing structure is transparent, with no hidden fees.

-

Can I integrate airSlate SignNow with other tools for tax information management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing for efficient management of tax information. This integration ensures that all your tax-related documents and data are synchronized across platforms, enhancing productivity and reducing manual entry errors.

-

How secure is my tax information with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your tax information from unauthorized access. Our compliance with industry standards ensures that your sensitive tax documents are handled with the utmost care and confidentiality.

-

What benefits does airSlate SignNow provide for small businesses dealing with tax information?

For small businesses, airSlate SignNow offers an easy-to-use platform that simplifies the management of tax information. By automating document workflows and reducing paperwork, small businesses can focus more on their core operations. This efficiency not only saves time but also helps ensure that tax information is accurate and up-to-date.

-

How can I get started with airSlate SignNow for my tax information needs?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore our features tailored for managing tax information. Once you're ready, choose a pricing plan that fits your business needs, and you'll be able to start sending and eSigning documents in no time.

Get more for Form 4506 F Request For Copy Of Fraudulent Tax Return

Find out other Form 4506 F Request For Copy Of Fraudulent Tax Return

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form