Www Irs Govpubirs Pdf2020 Form 1099 MISC IRS Tax Forms 2021

Understanding the 2 DIV Form

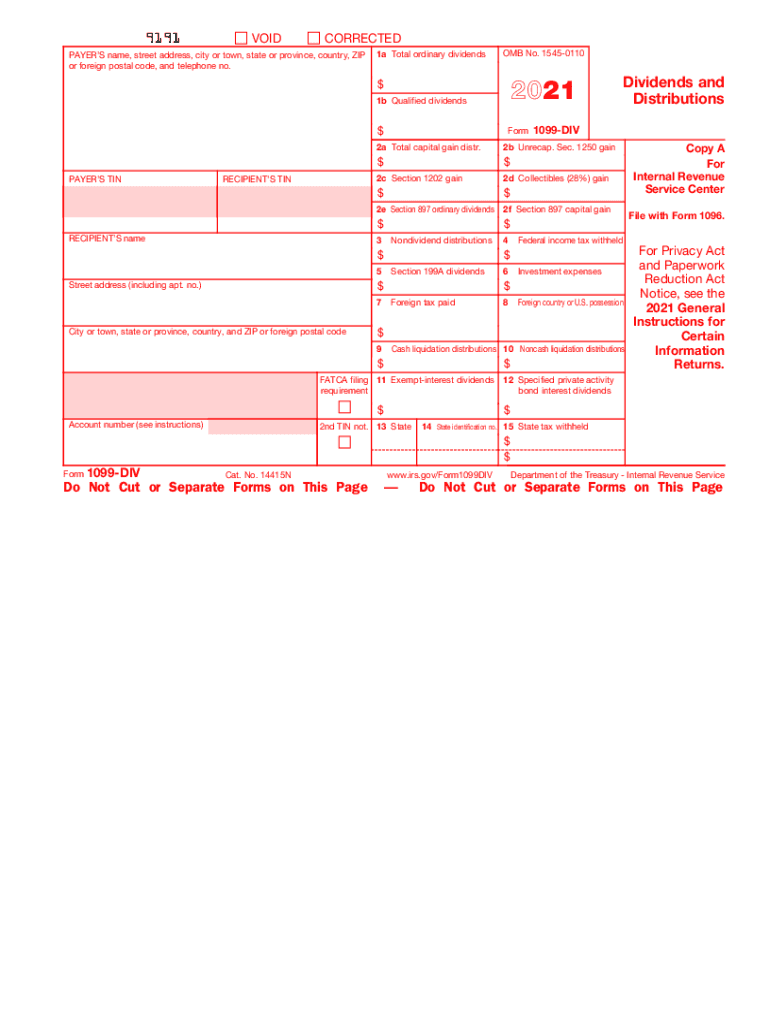

The 2 DIV form is a tax document used to report dividends and distributions received by a taxpayer during the tax year. This form is essential for individuals and businesses that have received dividends from stocks, mutual funds, or other investments. It helps the IRS track income and ensures that taxpayers report their earnings accurately. The information on the 1099 DIV includes details such as the payer's name, the amount of dividends paid, and any taxes withheld. Understanding this form is crucial for proper tax filing and compliance.

Steps to Complete the 2 DIV Form

Completing the 2 DIV form involves several key steps:

- Gather Information: Collect all necessary documents, including brokerage statements and any other records of dividend payments received during the year.

- Fill Out the Form: Enter your personal information, including your name, address, and taxpayer identification number. Then, input the details of the dividends received.

- Report Additional Information: If applicable, include any amounts for foreign taxes paid or any qualified dividends.

- Review for Accuracy: Double-check all entries to ensure that the information is correct and complete.

- Submit the Form: File the completed 1099 DIV form with the IRS and provide a copy to the recipient.

Legal Use of the 2 DIV Form

The 2 DIV form is legally recognized as a valid document for reporting income to the IRS. It must be issued by any entity that pays dividends totaling $10 or more in a tax year. Failure to issue or accurately report this form can result in penalties for both the issuer and the recipient. It is important for taxpayers to retain copies of their 1099 DIV forms for their records, as they may be required to substantiate income during an audit.

Filing Deadlines for the 2 DIV Form

Filing deadlines for the 2 DIV form are critical to ensure compliance with IRS regulations. Generally, the form must be sent to recipients by January 31 of the year following the tax year. Additionally, the form must be filed with the IRS by February 28 if submitted by mail, or by March 31 if filed electronically. Meeting these deadlines helps avoid penalties and ensures that income is reported accurately.

Required Documents for Completing the 2 DIV Form

To complete the 2 DIV form accurately, several documents may be required:

- Brokerage statements detailing dividend payments.

- Taxpayer identification number (Social Security Number or Employer Identification Number).

- Any previous year’s 1099 DIV forms for reference.

- Documentation of any foreign taxes paid related to dividends.

Penalties for Non-Compliance with the 2 DIV Form

Non-compliance with the 2 DIV form requirements can lead to significant penalties. If a payer fails to issue a 1099 DIV when required, they may face fines ranging from $50 to $270 per form, depending on how late the form is filed. Additionally, recipients who do not report the income shown on the 1099 DIV may be subject to penalties for underreporting income, which can include interest and additional fines. It is essential to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete wwwirsgovpubirs pdf2020 form 1099 misc irs tax forms

Complete Www irs govpubirs pdf2020 Form 1099 MISC IRS Tax Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it in the cloud. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without any obstacles. Manage Www irs govpubirs pdf2020 Form 1099 MISC IRS Tax Forms on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Www irs govpubirs pdf2020 Form 1099 MISC IRS Tax Forms seamlessly

- Locate Www irs govpubirs pdf2020 Form 1099 MISC IRS Tax Forms and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Www irs govpubirs pdf2020 Form 1099 MISC IRS Tax Forms to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2020 form 1099 misc irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2020 form 1099 misc irs tax forms

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 'div 2017 convert' feature in airSlate SignNow?

The 'div 2017 convert' feature in airSlate SignNow allows users to effortlessly convert documents into a signer-friendly format. This feature ensures that all essential elements of your documents are preserved during the conversion process, making it ideal for businesses aiming to streamline their eSigning workflows.

-

How does airSlate SignNow simplify document signing with 'div 2017 convert'?

With 'div 2017 convert,' airSlate SignNow simplifies document signing by enabling users to transform complex documents into easy-to-sign formats. This not only enhances user experience but also speeds up the signing process, helping businesses close deals faster and more efficiently.

-

Is 'div 2017 convert' an affordable solution for small businesses?

Yes, 'div 2017 convert' is part of airSlate SignNow's cost-effective pricing plans tailored for small businesses. Our plans ensure that companies can leverage powerful signing capabilities without breaking the bank, providing great value for essential document management tools.

-

What are the benefits of using the 'div 2017 convert' feature?

The 'div 2017 convert' feature is designed to enhance accessibility and efficiency in the document signing process. Users benefit from improved document integrity, quicker turnaround times, and a more streamlined experience, which can signNowly boost productivity.

-

What document types can be converted using 'div 2017 convert'?

Using the 'div 2017 convert' feature, you can convert various document types including PDFs, Word documents, and other formats into a streamlined version suitable for eSigning. This versatility makes it easy for users to work with a wide range of documents seamlessly.

-

Can 'div 2017 convert' be integrated with other applications?

Absolutely! The 'div 2017 convert' functionality in airSlate SignNow integrates smoothly with various applications, including CRM and project management tools. This integration enhances workflow efficiency, allowing teams to manage documents across platforms effortlessly.

-

Is there a trial period available for 'div 2017 convert'?

Yes, airSlate SignNow offers a free trial period that allows users to experience the 'div 2017 convert' feature without any commitment. This trial enables prospective customers to explore the full potential of our platform and make informed decisions.

Get more for Www irs govpubirs pdf2020 Form 1099 MISC IRS Tax Forms

- Legallife multistate guide and handbook for selling or buying real estate arizona form

- Subcontractors agreement arizona form

- Option to purchase addendum to residential lease lease or rent to own arizona form

- Arizona prenuptial premarital agreement with financial statements arizona form

- Arizona prenuptial premarital agreement without financial statements arizona form

- Az prenuptial form

- Financial statements only in connection with prenuptial premarital agreement arizona form

- Revocation of premarital or prenuptial agreement arizona form

Find out other Www irs govpubirs pdf2020 Form 1099 MISC IRS Tax Forms

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile