1099 Div Form 2015

What is the 1099 Div Form

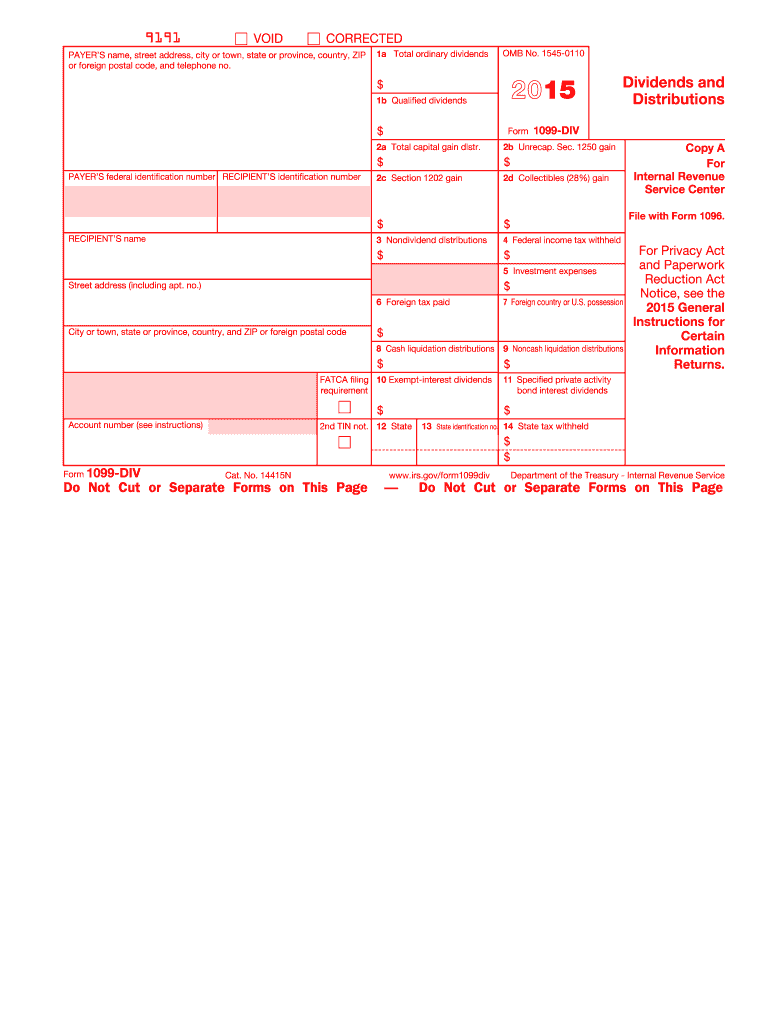

The 1099 Div Form is a tax document used in the United States to report dividends and distributions to taxpayers. This form is essential for individuals and entities that receive dividend income from stocks, mutual funds, or other investments. The Internal Revenue Service (IRS) requires this form to ensure accurate reporting of income for tax purposes. It provides a summary of the dividends received, including qualified dividends, ordinary dividends, and any capital gain distributions. Understanding this form is crucial for taxpayers to correctly report their income and avoid potential penalties.

How to use the 1099 Div Form

Using the 1099 Div Form involves a few key steps. First, individuals should receive the form from their financial institutions or brokers by the end of January each year. Once received, taxpayers need to carefully review the information presented, ensuring that all amounts are accurate. The next step is to report the dividend income on the appropriate line of their tax return, typically on Form 1040. Taxpayers must also keep a copy of the 1099 Div Form for their records, as it may be needed for future reference or in case of an audit.

Steps to complete the 1099 Div Form

Completing the 1099 Div Form requires attention to detail. Here are the steps to follow:

- Gather all necessary information, including your Social Security number or Employer Identification Number.

- Fill in the payer's information, which is the entity issuing the dividends.

- Report the total amount of ordinary dividends received in the designated box.

- Include any qualified dividends, which may be taxed at a lower rate.

- Document any capital gain distributions, if applicable.

- Double-check all entries for accuracy before submission.

Key elements of the 1099 Div Form

The 1099 Div Form contains several key elements that are vital for accurate reporting. These include:

- Payer's Information: Name, address, and taxpayer identification number of the entity issuing the dividends.

- Recipient's Information: Name, address, and taxpayer identification number of the individual receiving the dividends.

- Ordinary Dividends: Total amount of dividends that are subject to regular income tax.

- Qualified Dividends: A subset of ordinary dividends that meet specific criteria for lower tax rates.

- Capital Gain Distributions: Any distributions that are considered capital gains.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 1099 Div Form. Taxpayers must ensure that they receive the form by the end of January each year and report the information accurately on their tax returns. The IRS requires that the form be filed by the payer with the IRS and sent to the recipient. Any discrepancies or errors in reporting can lead to penalties or further scrutiny from the IRS. It is important for taxpayers to familiarize themselves with these guidelines to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Div Form are crucial for compliance. The form must be sent to recipients by January thirty-first of the year following the tax year. Additionally, the form must be filed with the IRS by the end of February if submitted on paper, or by the end of March if filed electronically. Missing these deadlines can result in penalties, so it is essential to stay organized and adhere to these important dates.

Quick guide on how to complete 1099 div form 2015

Prepare 1099 Div Form effortlessly on any device

Digital document management has become popular among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the functionalities needed to create, modify, and eSign your documents quickly without delays. Manage 1099 Div Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 1099 Div Form without any hassle

- Locate 1099 Div Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Update and eSign 1099 Div Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 div form 2015

Create this form in 5 minutes!

How to create an eSignature for the 1099 div form 2015

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is a 1099 Div Form and why do I need it?

The 1099 Div Form is a tax document used to report dividends and distributions from investments. It is essential for reporting income to the IRS and ensures compliance with tax regulations. Understanding the 1099 Div Form helps individuals accurately report their investment earnings.

-

How can airSlate SignNow help with my 1099 Div Form?

airSlate SignNow allows you to easily send, sign, and store your 1099 Div Form electronically. You can streamline the process, making it quicker and more efficient than traditional methods. This digital solution enhances accuracy and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for my 1099 Div Form?

Yes, airSlate SignNow offers various pricing plans to suit your needs, starting from a free trial for testing the service. The pricing plans are cost-effective and designed to provide excellent value for individuals and businesses dealing with 1099 Div Forms regularly.

-

What features does airSlate SignNow offer for handling 1099 Div Forms?

airSlate SignNow provides features like electronic signatures, document storage, and customizable templates to streamline your 1099 Div Form processing. Additionally, it offers automated workflows and reminders to enhance efficiency and ensure timely submissions. These features simplify your documentation process signNowly.

-

Can I integrate airSlate SignNow with other software for my 1099 Div Form needs?

Yes, airSlate SignNow seamlessly integrates with various accounting and financial software solutions. This integration allows for smoother data transfer and tracking of your 1099 Div Form along with other financial documents. Such connectivity improves the overall workflow for managing your records.

-

What benefits can I expect by using airSlate SignNow for my 1099 Div Forms?

Using airSlate SignNow for your 1099 Div Forms offers numerous benefits, including time savings, reduced paper usage, and enhanced security. The electronic signing process is quick and user-friendly, ensuring that your forms are processed promptly. Additionally, you can easily access your documents from any device.

-

Is airSlate SignNow secure for sending my 1099 Div Form?

Absolutely, airSlate SignNow employs advanced security measures to protect your documents, including encryption and secure cloud storage. Your 1099 Div Form is stored safely, ensuring confidentiality and compliance with data protection laws. You can trust that your information is well-protected.

Get more for 1099 Div Form

- Paycheck protection program loan application mid penn bank form

- Form sra addendum to business organization and justia

- Certificate of formation mississippi

- Professional solicitors in kentucky kentucky attorney general form

- Form 9 nevada resale certificatedoc

- New jersey motor vehicle dealer surety bond ioa bonds form

- Nscb industry bulletin nevada state contractors board form

- Nys dos corporations biennial e filing form

Find out other 1099 Div Form

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later