1099 Div Form 2016

What is the 1099 Div Form

The 1099 Div Form is a tax document used in the United States to report dividends and distributions to taxpayers. It is typically issued by banks, mutual funds, and other financial institutions to individuals who have received dividend payments during the tax year. The form provides essential information about the type and amount of dividends received, which is necessary for accurate tax reporting. Taxpayers must include the information from this form when filing their annual income tax returns.

How to use the 1099 Div Form

Using the 1099 Div Form involves several steps. First, taxpayers should ensure they receive the form from the issuing financial institution by the end of January each year. Once obtained, individuals must review the information for accuracy, including the total dividends received and any foreign tax paid. This information is then reported on the taxpayer's income tax return, typically on Schedule B if the total dividends exceed a specific threshold. It is crucial to keep a copy of the form for personal records and future reference.

Steps to complete the 1099 Div Form

Completing the 1099 Div Form requires careful attention to detail. Here are the essential steps:

- Obtain the form from your financial institution or download it from the IRS website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report the total dividends received in the appropriate boxes on the form.

- If applicable, include any foreign tax paid in the designated section.

- Review the completed form for accuracy before submission.

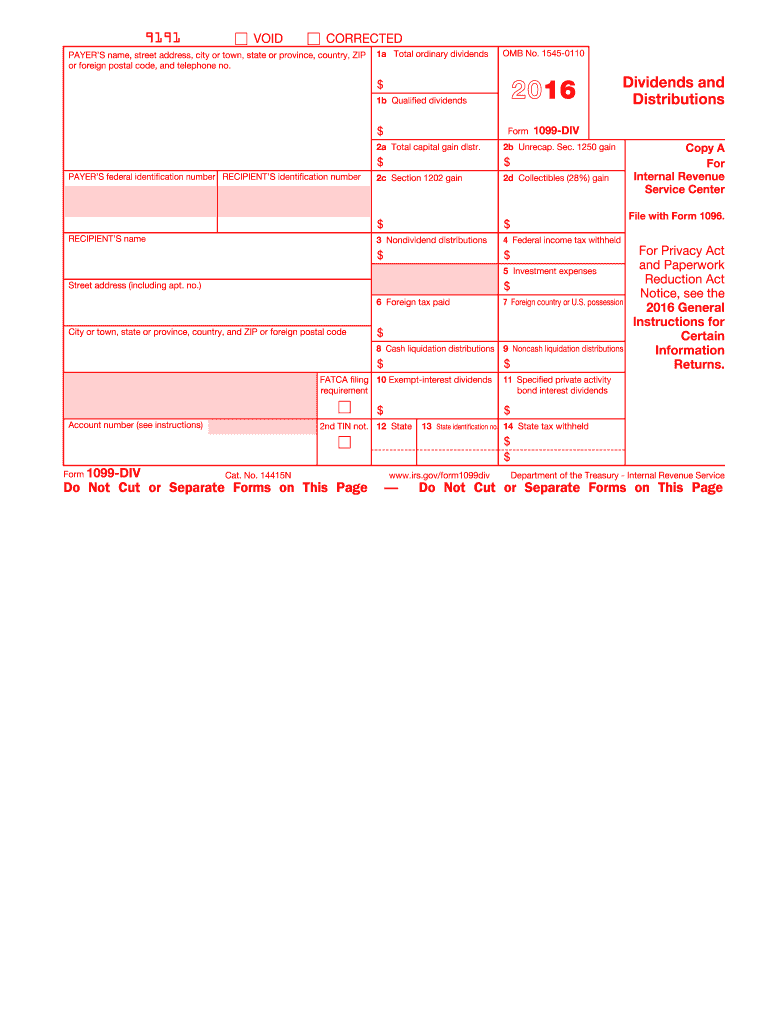

Key elements of the 1099 Div Form

The 1099 Div Form includes several key elements that are essential for accurate reporting. These elements include:

- Recipient's Information: This section contains the taxpayer's name, address, and taxpayer identification number.

- Payer's Information: This includes the name and address of the financial institution issuing the form.

- Dividend Amounts: The form lists various types of dividends received, including ordinary dividends and qualified dividends.

- Foreign Tax Paid: Any foreign tax withheld on dividends is reported here, which may be eligible for a tax credit.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Div Form are crucial for compliance with IRS regulations. The form must be sent to recipients by January 31 of the year following the tax year in which the dividends were paid. Additionally, the form must be filed with the IRS by February 28 if submitted by mail or by March 31 if filed electronically. It is essential for taxpayers to adhere to these deadlines to avoid potential penalties.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the 1099 Div Form can lead to significant penalties. If a taxpayer does not report dividend income accurately, they may face fines from the IRS. Additionally, financial institutions that fail to issue the form on time may also incur penalties. It is essential to ensure that all information is reported correctly and submitted by the deadlines to avoid these consequences.

Quick guide on how to complete 2016 1099 div form

Complete 1099 Div Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage 1099 Div Form on any platform via airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign 1099 Div Form effortlessly

- Find 1099 Div Form and click on Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors necessitating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 1099 Div Form while ensuring exceptional communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 1099 div form

Create this form in 5 minutes!

How to create an eSignature for the 2016 1099 div form

How to make an eSignature for the 2016 1099 Div Form online

How to create an electronic signature for the 2016 1099 Div Form in Chrome

How to make an eSignature for signing the 2016 1099 Div Form in Gmail

How to create an electronic signature for the 2016 1099 Div Form from your smartphone

How to make an electronic signature for the 2016 1099 Div Form on iOS

How to generate an electronic signature for the 2016 1099 Div Form on Android OS

People also ask

-

What is the 1099 Div Form and why do I need it?

The 1099 Div Form is a tax document used to report dividends and distributions to shareholders. If you receive dividends from investments, you will need this form for your tax returns. Using airSlate SignNow, you can easily manage and eSign your 1099 Div Form, ensuring compliance and accuracy.

-

How does airSlate SignNow simplify the process of completing a 1099 Div Form?

airSlate SignNow streamlines the completion of the 1099 Div Form by providing an intuitive interface for filling out and signing documents electronically. With features like customizable templates and real-time collaboration, users can efficiently complete their forms online, reducing the hassle of paperwork.

-

Is airSlate SignNow cost-effective for managing multiple 1099 Div Forms?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it a cost-effective solution for managing multiple 1099 Div Forms. By choosing our platform, you can save on printing and mailing costs while benefiting from secure electronic signing and storage options.

-

Can I integrate airSlate SignNow with other accounting software for 1099 Div Forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, allowing you to sync your 1099 Div Form data with platforms like QuickBooks or Xero. This integration simplifies your workflow and helps maintain accurate financial records.

-

What security measures does airSlate SignNow have for my 1099 Div Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your 1099 Div Form and any sensitive information. Additionally, our platform complies with industry standards to ensure that your documents are safe and secure.

-

Can I track the status of my 1099 Div Form once sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your 1099 Div Form after it has been sent for signature. You can see when the document is viewed, signed, and completed, giving you peace of mind and keeping you informed throughout the process.

-

What types of documents can I send with airSlate SignNow besides the 1099 Div Form?

In addition to the 1099 Div Form, airSlate SignNow supports a wide range of document types, including contracts, agreements, and tax forms. This versatility makes our platform an all-in-one solution for managing various business documents efficiently.

Get more for 1099 Div Form

Find out other 1099 Div Form

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online

- Sign Colorado Affidavit of Service Secure

- Sign Connecticut Affidavit of Service Free

- Sign Michigan Affidavit of Service Online

- How To Sign New Hampshire Affidavit of Service

- How Can I Sign Wyoming Affidavit of Service

- Help Me With Sign Colorado Affidavit of Title

- How Do I Sign Massachusetts Affidavit of Title

- How Do I Sign Oklahoma Affidavit of Title