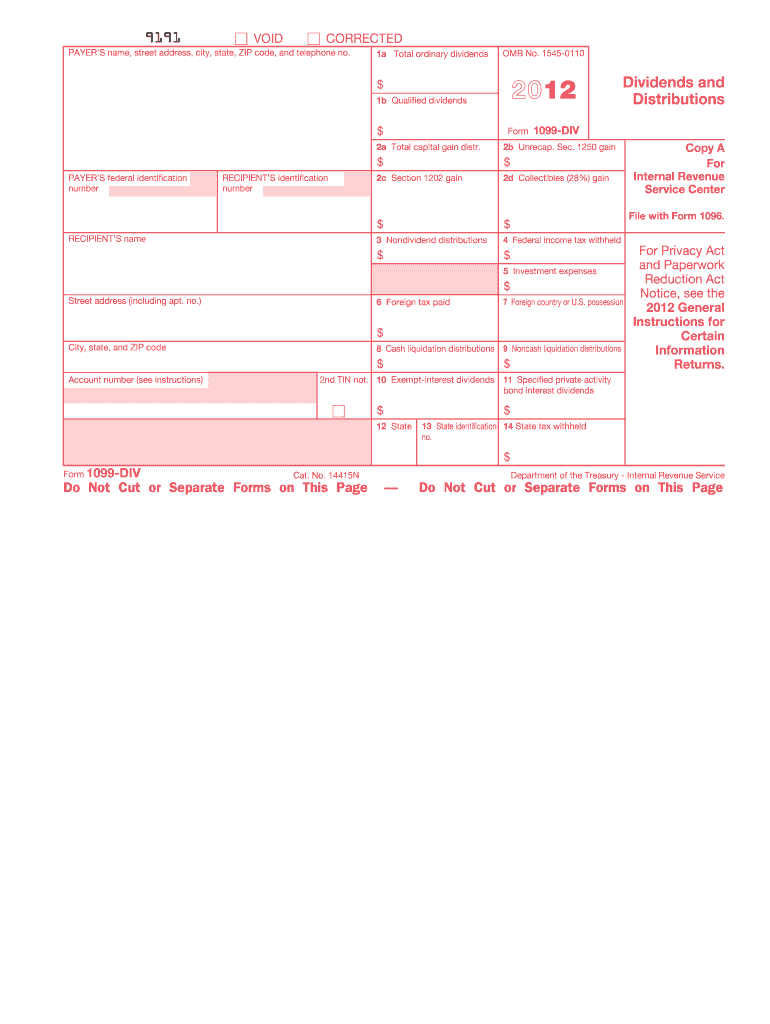

1099 Div Form 2012

What is the 1099 Div Form

The 1099 Div Form is a tax document used in the United States to report dividends and distributions to shareholders. This form is essential for taxpayers who receive dividends from stocks, mutual funds, or other investments. The Internal Revenue Service (IRS) requires this form to ensure accurate reporting of income from these sources. It is typically issued by financial institutions or corporations that pay dividends to their shareholders.

How to use the 1099 Div Form

Using the 1099 Div Form involves several steps. First, taxpayers should receive this form from their financial institutions by the end of January each year. Once received, individuals must carefully review the information provided, including total dividends received and any foreign taxes paid. This information is crucial for accurately reporting income on the individual's tax return. Taxpayers should then include the reported amounts on their Form 1040 or other applicable tax forms, ensuring compliance with IRS guidelines.

Steps to complete the 1099 Div Form

Completing the 1099 Div Form requires attention to detail. Start by entering the taxpayer's personal information, including name, address, and Social Security number. Next, input the total dividends received in Box 1a and any qualified dividends in Box 1b. If applicable, report any foreign taxes paid in Box 6. Ensure that all amounts are accurate and match the information provided by the issuing institution. Finally, retain a copy of the completed form for personal records and submit it with your tax return.

Legal use of the 1099 Div Form

The legal use of the 1099 Div Form is governed by IRS regulations. It is crucial for taxpayers to accurately report all dividend income to avoid potential penalties. The form serves as a record of income received and is used by the IRS to verify that taxpayers report their earnings correctly. Failure to report income from dividends can lead to audits and fines, making it essential to use this form accurately and responsibly.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Div Form are critical for compliance. Financial institutions must send out the form to recipients by January thirty-first. Taxpayers must report the information from the form on their tax returns, which are typically due by April fifteenth. If additional time is needed, taxpayers can file for an extension, but it's important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Who Issues the Form

The 1099 Div Form is issued by various entities, including corporations, mutual funds, and brokerage firms. These organizations are responsible for reporting the dividends they pay to shareholders. It is essential for these issuers to provide accurate information to ensure that taxpayers can correctly report their income. Taxpayers should expect to receive this form from any financial institution where they hold investments that generate dividends.

Quick guide on how to complete 2012 1099 div form

Effortlessly Prepare 1099 Div Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Handle 1099 Div Form on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Simplest Way to Edit and Electronically Sign 1099 Div Form with Ease

- Find 1099 Div Form and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, be it via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign 1099 Div Form to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1099 div form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1099 div form

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a 1099 Div Form and why is it important?

The 1099 Div Form is a tax document used to report dividends and distributions received by taxpayers. This form is essential for accurately reporting income to the IRS, ensuring that individuals comply with tax regulations. By using airSlate SignNow, you can easily create, send, and eSign your 1099 Div Form, streamlining your tax preparation process.

-

How can airSlate SignNow help me with my 1099 Div Form?

airSlate SignNow simplifies the process of managing your 1099 Div Form by providing a user-friendly platform for document creation and eSigning. With our solution, you can easily fill out the form, add signatures, and send it directly to recipients, saving you time and reducing errors. Our comprehensive features ensure that your 1099 Div Form is processed efficiently.

-

Is there a cost associated with using airSlate SignNow for 1099 Div Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features for handling 1099 Div Forms. Our plans are designed to be cost-effective, ensuring you get the best value for your money. You can choose a plan that fits your budget while still providing the essential tools for seamless document management.

-

What features does airSlate SignNow offer for 1099 Div Forms?

airSlate SignNow provides a range of features specifically for handling 1099 Div Forms, including customizable templates, secure eSigning, and document tracking. Our platform also allows for easy collaboration between team members, ensuring that all necessary parties can review and sign the form. These features help streamline the entire process and enhance accuracy.

-

Can I integrate airSlate SignNow with other software for managing 1099 Div Forms?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easier to manage your 1099 Div Forms alongside your existing tools. Whether you use accounting software or customer relationship management systems, our platform can sync with them to provide a seamless experience. This integration helps you manage your documents more efficiently.

-

How secure is airSlate SignNow when handling 1099 Div Forms?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the 1099 Div Form. We utilize advanced encryption and secure storage to protect your data, ensuring that your information remains confidential. Additionally, our platform complies with industry standards to provide you with peace of mind while managing your tax documents.

-

How can I ensure compliance when using airSlate SignNow for my 1099 Div Form?

Using airSlate SignNow for your 1099 Div Form can help ensure compliance by providing templates that adhere to IRS guidelines. Our platform also offers features that allow you to verify signatures and track document status, making it easier to maintain accurate records. By following best practices and utilizing airSlate SignNow's tools, you can ensure your forms meet all regulatory requirements.

Get more for 1099 Div Form

Find out other 1099 Div Form

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast