Irs Extension Form 4868 2018

What is the IRS Extension Form 4868

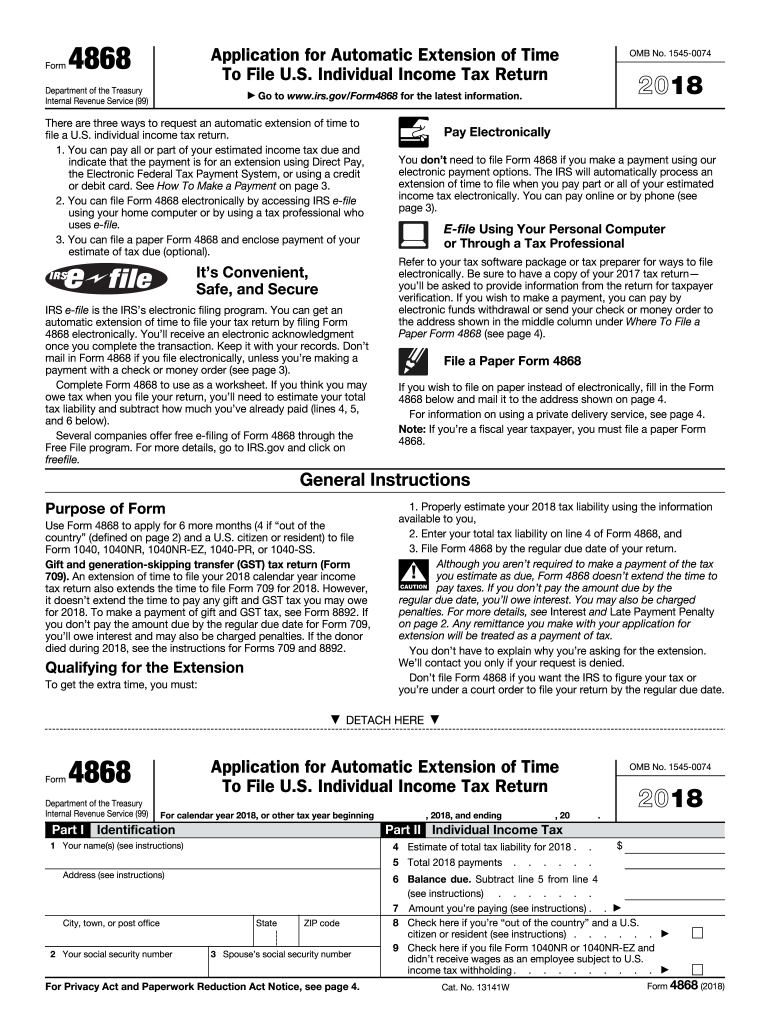

The IRS Extension Form 4868 is a document that allows taxpayers in the United States to request an automatic extension of time to file their individual income tax returns. This form is particularly useful for those who may need additional time to gather necessary documentation or complete their tax return accurately. By submitting Form 4868, taxpayers can receive an extension of up to six months, shifting their filing deadline from April 15 to October 15. It's important to note that this extension is for filing the return only, not for paying any taxes owed. Taxpayers are still required to estimate and pay any owed taxes by the original due date to avoid penalties and interest.

How to Use the IRS Extension Form 4868

Using the IRS Extension Form 4868 is a straightforward process. First, ensure you have the correct version of the form for the tax year you are filing. The form can be filled out manually or electronically. When completing the form, provide your name, address, and Social Security number. Additionally, estimate your total tax liability for the year and any payments made. After filling out the form, you can submit it electronically through the IRS e-file system or mail it to the appropriate address listed in the form instructions. Remember, submitting this form does not extend the time to pay any taxes owed.

Steps to Complete the IRS Extension Form 4868

Completing the IRS Extension Form 4868 involves several key steps:

- Obtain the latest version of Form 4868 from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Estimate your total tax liability for the year, including any payments already made.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form electronically or by mail to the IRS by the original tax deadline.

Legal Use of the IRS Extension Form 4868

The IRS Extension Form 4868 is legally recognized and provides taxpayers with a legitimate way to extend their filing deadline. To ensure compliance, it is crucial to submit the form on or before the original due date of the tax return. Failure to file the form on time may result in penalties, including interest on any unpaid taxes. Additionally, the extension granted by Form 4868 does not absolve taxpayers from their obligation to pay any taxes owed by the original deadline.

Filing Deadlines / Important Dates

The filing deadline for the IRS Extension Form 4868 typically aligns with the due date for individual income tax returns, which is April 15. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. By submitting Form 4868 by this date, taxpayers can extend their filing deadline to October 15. It is essential to keep track of these dates to avoid penalties and ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the IRS Extension Form 4868. The form can be filed electronically through the IRS e-file system, which is a quick and efficient method. Alternatively, taxpayers may choose to print the form and mail it to the appropriate IRS address specified in the instructions. In-person submission is generally not an option for this form, as it is primarily designed for electronic or mail filing. Regardless of the method chosen, ensure that the form is submitted by the original tax deadline.

Quick guide on how to complete extension form 2018 2019

Discover the most efficient method to complete and endorse your Irs Extension Form 4868

Are you still spending time preparing your official paperwork on paper rather than handling it online? airSlate SignNow provides a superior way to finalize and endorse your Irs Extension Form 4868 and associated forms for public services. Our intelligent eSignature solution equips you with all the necessary tools to manage documentation swiftly and in compliance with official standards - robust PDF editing, organizing, securing, signing, and sharing features all available within a user-friendly interface.

There are just a few steps needed to finalize and endorse your Irs Extension Form 4868:

- Upload the editable template to the editor using the Get Form button.

- Review what information you must input in your Irs Extension Form 4868.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Press Sign to create a legally binding eSignature using any method you prefer.

- Input the Date alongside your signature and complete your task with the Done button.

Store your finished Irs Extension Form 4868 in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile form sharing options. There’s no requirement to print your forms when you need to submit them at the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your profile. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct extension form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the extension form 2018 2019

How to generate an eSignature for the Extension Form 2018 2019 online

How to make an eSignature for your Extension Form 2018 2019 in Chrome

How to create an electronic signature for signing the Extension Form 2018 2019 in Gmail

How to create an eSignature for the Extension Form 2018 2019 from your smartphone

How to make an electronic signature for the Extension Form 2018 2019 on iOS

How to create an electronic signature for the Extension Form 2018 2019 on Android

People also ask

-

What is the IRS Extension Form 4868?

The IRS Extension Form 4868 is a document that allows taxpayers to request an automatic extension of time to file their federal income tax return. By filing Form 4868, individuals can gain an additional six months to submit their taxes. It’s a simple way to ensure you don’t miss the tax deadline while avoiding penalties.

-

How can airSlate SignNow help me with the IRS Extension Form 4868?

With airSlate SignNow, you can easily create, send, and eSign the IRS Extension Form 4868. Our platform streamlines the document preparation process, allowing you to complete your tax extension quickly and securely. Plus, you can track the status of your form to ensure timely submission.

-

Is there a cost associated with using airSlate SignNow for IRS Extension Form 4868?

airSlate SignNow offers a range of pricing plans to accommodate different needs, including a free trial for new users. This means you can complete the IRS Extension Form 4868 without any upfront costs. Choose a plan that fits your budget and enjoy the benefits of our eSignature solution.

-

What features does airSlate SignNow offer for eSigning the IRS Extension Form 4868?

airSlate SignNow provides a user-friendly interface for eSigning the IRS Extension Form 4868, including options for adding signatures, initials, and dates. Our platform ensures legal compliance and security, giving you peace of mind when handling sensitive tax documents. You can also integrate it with other applications for enhanced efficiency.

-

Can I track the status of my IRS Extension Form 4868 with airSlate SignNow?

Yes, airSlate SignNow features real-time tracking for your IRS Extension Form 4868. You'll receive notifications regarding the status of your document, including when it’s viewed and signed by all parties. This transparency helps you stay organized and ensures you don’t miss any deadlines.

-

What are the benefits of using airSlate SignNow for tax documents like the IRS Extension Form 4868?

Using airSlate SignNow simplifies the process of managing tax documents like the IRS Extension Form 4868. You'll save time with our easy-to-use platform, reduce paper clutter, and ensure compliance with eSignature laws. Additionally, our cost-effective solution makes it accessible for businesses of all sizes.

-

Does airSlate SignNow integrate with other tax software for filing the IRS Extension Form 4868?

Yes, airSlate SignNow can seamlessly integrate with various tax software applications. This allows you to streamline the process of filing the IRS Extension Form 4868 directly from your preferred software, enhancing efficiency and accuracy in your tax preparation. Check our integrations page for a complete list of compatible services.

Get more for Irs Extension Form 4868

- Application form no 119031

- Form hrd 315a 2013 2019

- Witness dpa cardpdffillercom form

- Ps form 3575

- Assurance of cohabitation appendices to online application 243011 f rs kran om samlevnad f r gifta och sambo migrationsverket form

- Tractor pre use form

- Ontario at form 15b response to motion to change applicants ontariocourtforms on

- Medical questionnaire for physician 2 pages form

Find out other Irs Extension Form 4868

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself