Form File Tax 2016

What is the Form File Tax

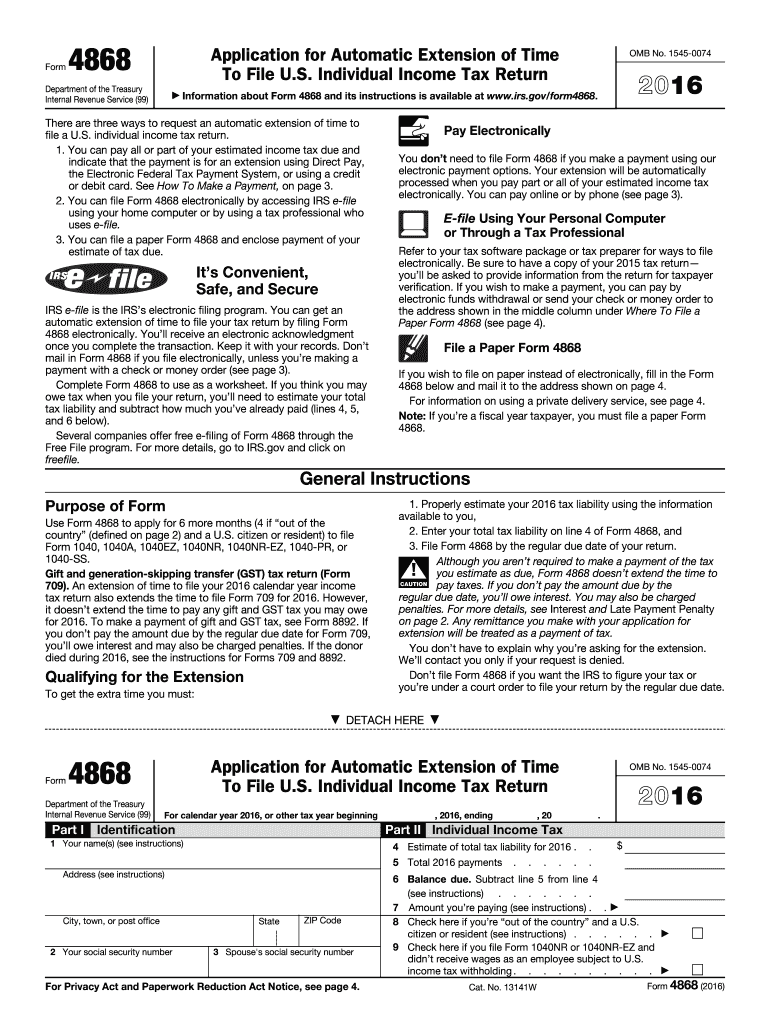

The Form File Tax is a crucial document used by individuals and businesses to report their income and calculate their tax obligations to the Internal Revenue Service (IRS). This form captures essential financial information, including earnings, deductions, and credits, ensuring compliance with federal tax laws. Understanding the purpose and requirements of this form is vital for accurate tax reporting and avoiding potential penalties.

How to use the Form File Tax

Using the Form File Tax involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Next, fill out the form by entering your income details, deductions, and credits. Once completed, review the form for accuracy before submitting it to the IRS. It's important to keep a copy for your records and to confirm the submission method, whether online or by mail.

Steps to complete the Form File Tax

Completing the Form File Tax requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim any eligible deductions and credits.

- Double-check all entries for accuracy.

- Sign and date the form.

- Submit the form by the appropriate deadline.

Legal use of the Form File Tax

The legal use of the Form File Tax is governed by IRS regulations. It is essential to complete this form accurately and truthfully to comply with federal tax laws. Misrepresentation or errors can lead to penalties, including fines or audits. Utilizing electronic filing options can enhance security and ensure that submissions meet legal standards. Understanding the legal implications of the information provided is critical for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Form File Tax are crucial for compliance. Typically, individual taxpayers must submit their forms by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines based on their entity type. It's important to stay informed about any changes to these dates to avoid late filing penalties.

Required Documents

To successfully complete the Form File Tax, several documents are required. These include:

- W-2 forms from employers for reported wages.

- 1099 forms for other income sources, such as freelance work.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any relevant receipts for business expenses if applicable.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form File Tax can result in significant penalties. Common penalties include fines for late filing, interest on unpaid taxes, and potential legal action for fraudulent reporting. Understanding these consequences can motivate timely and accurate submissions, ensuring that taxpayers remain in good standing with the IRS.

Quick guide on how to complete form 2016 file tax

Effortlessly Complete Form File Tax on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly and efficiently. Manage Form File Tax on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to Edit and eSign Form File Tax with Ease

- Obtain Form File Tax and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form File Tax while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2016 file tax

Create this form in 5 minutes!

How to create an eSignature for the form 2016 file tax

How to make an electronic signature for your Form 2016 File Tax online

How to create an eSignature for the Form 2016 File Tax in Chrome

How to create an eSignature for signing the Form 2016 File Tax in Gmail

How to create an eSignature for the Form 2016 File Tax right from your mobile device

How to make an electronic signature for the Form 2016 File Tax on iOS

How to make an electronic signature for the Form 2016 File Tax on Android OS

People also ask

-

What is the best way to Form File Tax using airSlate SignNow?

To Form File Tax effectively with airSlate SignNow, simply upload your tax forms to the platform and send them for electronic signatures. Our user-friendly interface ensures a smooth process, allowing you to complete filings quickly and securely.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as customizable templates, secure eSignatures, and seamless document sharing that simplify the process to Form File Tax. Additionally, you can track document status and automate workflows, ensuring a streamlined experience for all users.

-

Is airSlate SignNow cost-effective for small businesses needing to Form File Tax?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate small businesses looking to Form File Tax without breaking the bank. Our flexible subscription options can cater to varying needs, ensuring accessibility and affordability.

-

Can I integrate airSlate SignNow with accounting software for easier tax filing?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to Form File Tax by connecting your documents directly to your financial records. This integration enhances workflow efficiency and reduces the chances of errors.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow. When you Form File Tax with us, your documents are protected with robust encryption and secure storage, ensuring that your sensitive tax information remains confidential and safe from unauthorized access.

-

What support does airSlate SignNow offer for users preparing to Form File Tax?

Users of airSlate SignNow can access comprehensive support resources, including tutorials and customer service representatives, to assist with any inquiries while Form File Tax. We aim to provide all the necessary tools and expertise for a smooth document signing experience.

-

Can I customize tax forms within airSlate SignNow?

Yes, you can easily customize tax forms within airSlate SignNow to fit your specific needs. This flexibility ensures that when you Form File Tax, the documents are tailored to reflect your branding and meet compliance requirements.

Get more for Form File Tax

- Dcra building permit form

- How much is the electrical permit for detroit form

- Leesburg fl building department form

- Wisconsin building permit formpdffillercom

- Instructions on city of miami building permit application form

- Building permit requirements watsonville form

- Instructions for handwritten forms guidelines printing before you

- Do not include this page instructions for handwrit form

Find out other Form File Tax

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe