Form 4868 Online 2020

What is the Form 4868 Online

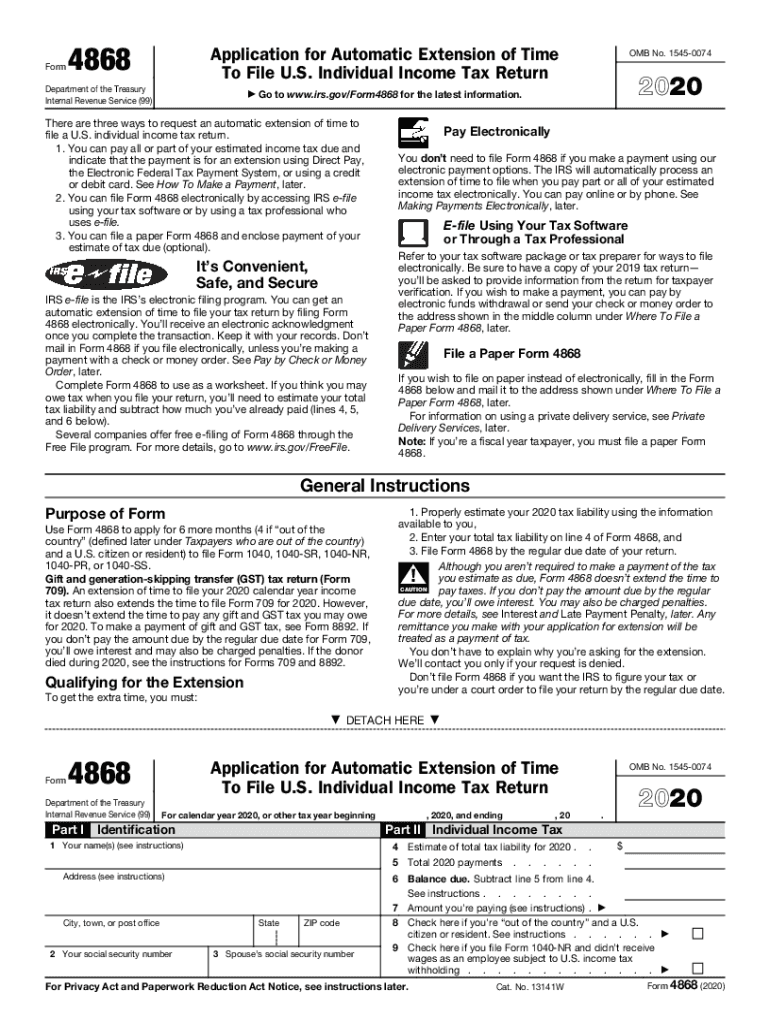

The Form 4868 is an official IRS document that allows taxpayers to request an automatic extension of time to file their income tax return. This form is particularly useful for individuals who need additional time to prepare their tax documents. By filing Form 4868, taxpayers can extend their filing deadline by six months, moving it from the typical April deadline to October. This extension does not, however, extend the time to pay any taxes owed. It is essential to understand that the Form 4868 is not an extension to pay taxes but rather an extension to file the return.

Steps to Complete the Form 4868 Online

Completing the Form 4868 online is a straightforward process. Here are the essential steps:

- Access the Form: Navigate to the IRS website or a trusted eSignature platform to find the fillable Form 4868.

- Provide Personal Information: Enter your name, address, and Social Security number. Ensure that all information is accurate to avoid delays.

- Estimate Your Tax Liability: Include an estimate of your total tax liability for the year. This estimate helps the IRS understand your financial situation.

- Choose Your Filing Method: Decide whether you will file electronically or by mail. Online filing is often faster and more efficient.

- Review and Submit: Carefully review all entries for accuracy before submitting the form electronically or mailing it to the IRS.

Legal Use of the Form 4868 Online

Using the Form 4868 online is legally valid as long as it complies with IRS regulations. The eSignature option available through platforms like signNow ensures that your submission is secure and meets legal standards. The form must be submitted by the original filing deadline to avoid penalties. It is crucial to keep a copy of the submitted form for your records, as this serves as proof of your extension request.

Filing Deadlines / Important Dates

Understanding the deadlines associated with Form 4868 is vital for compliance. The original deadline for filing your income tax return is typically April 15. By submitting Form 4868 by this date, you can extend your filing deadline to October 15. If October 15 falls on a weekend or holiday, the deadline is adjusted to the next business day. It is important to remember that while this form extends the filing deadline, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents

When preparing to file Form 4868, certain documents may be needed to ensure accurate completion. These documents include:

- Your previous year’s tax return for reference.

- W-2 forms from your employer.

- 1099 forms for any additional income received.

- Records of any deductions or credits you plan to claim.

Gathering these documents beforehand can streamline the process and help you provide accurate estimates of your tax liability.

Penalties for Non-Compliance

Failing to file Form 4868 by the deadline can result in penalties and interest on any unpaid taxes. The IRS charges a penalty of five percent of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid tax from the original due date until it is paid in full. To avoid these penalties, it is essential to file Form 4868 on time and pay any owed taxes by the original deadline.

Quick guide on how to complete form 4868 online

Easily Prepare Form 4868 Online on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary template and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 4868 Online on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form 4868 Online Effortlessly

- Locate Form 4868 Online and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Choose your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you select. Modify and eSign Form 4868 Online to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4868 online

Create this form in 5 minutes!

How to create an eSignature for the form 4868 online

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to an IRS file?

airSlate SignNow is a cost-effective solution that allows businesses to send, eSign, and manage documents securely. When it comes to IRS files, our platform simplifies the process of electronically signing and storing tax-related documents, ensuring compliance and easy access.

-

How can I securely send my IRS file using airSlate SignNow?

You can securely send your IRS file by uploading the document directly to airSlate SignNow. Our platform uses advanced encryption methods to protect your sensitive data during transmission, ensuring only authorized users can access the IRS file.

-

What features does airSlate SignNow offer for IRS file management?

airSlate SignNow provides features such as document templates, real-time tracking, and customizable workflows specifically for IRS files. With these tools, businesses can streamline their document processes and improve efficiency when dealing with tax forms and submissions.

-

Is airSlate SignNow suitable for small businesses handling IRS files?

Yes, airSlate SignNow is designed to meet the needs of small businesses, offering an affordable solution for managing IRS files. Our user-friendly interface and subscription plans cater to varying budgets, ensuring that even smaller entities can handle their tax documents professionally.

-

Are there integrations available for my IRS file handling with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with a variety of other software, including tax preparation and accounting tools. This allows for smooth handling of your IRS files, enabling you to manage your documents across different platforms without any hassle.

-

How does airSlate SignNow ensure compliance for IRS file submissions?

airSlate SignNow takes compliance seriously by adhering to regulations relevant to IRS file submissions. Our platform ensures that signatures are legally binding and that documents are securely stored, making it easier for businesses to maintain compliance with tax laws.

-

What are the pricing options for using airSlate SignNow for IRS files?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. You can select a plan that suits your requirements for managing IRS files effectively, allowing you to choose based on the volume of documents you manage each year.

Get more for Form 4868 Online

Find out other Form 4868 Online

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online