Form 4868 Application for Automatic Extension of Time to File U S Individual Income Tax Return 2022

What is the Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

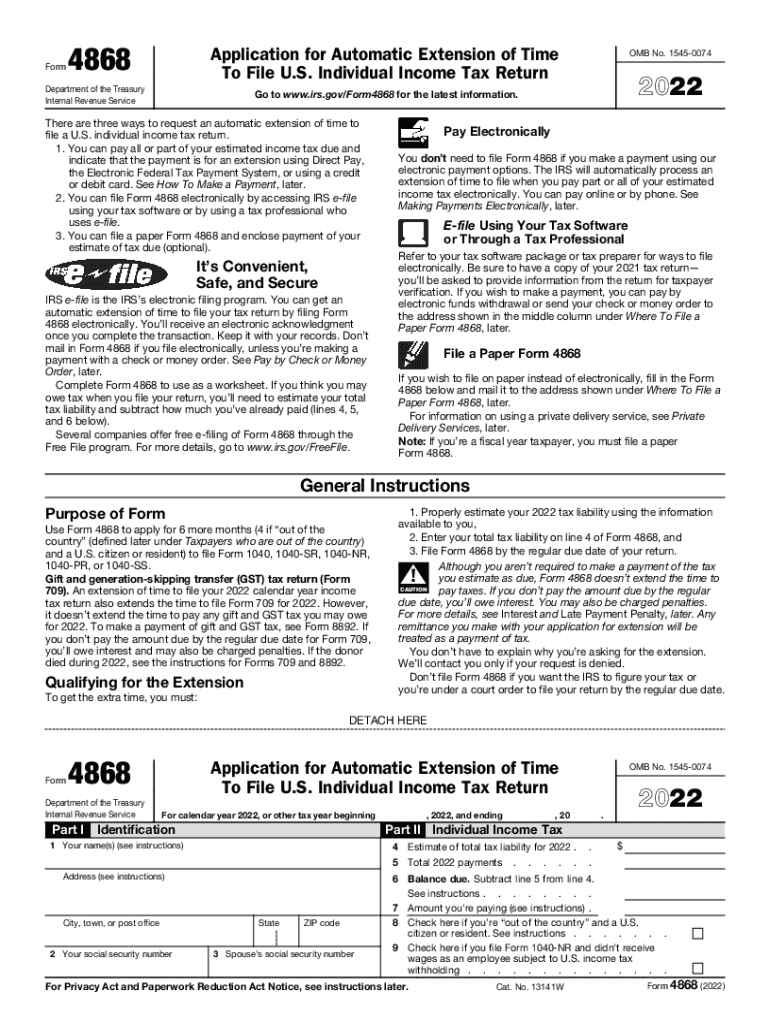

The Form 4868 is the official application for an automatic extension of time to file U.S. individual income tax returns. This form allows taxpayers to extend their filing deadline by six months, providing additional time to gather necessary documents and complete their tax returns. It is important to note that while this form extends the filing deadline, it does not extend the time to pay any taxes owed. Taxpayers must estimate and pay any owed taxes by the original deadline to avoid penalties and interest.

Steps to Complete the Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

Completing Form 4868 involves several straightforward steps. First, you need to provide your personal information, including your name, address, and Social Security number. Next, you must estimate your total tax liability for the year and any payments already made. This information helps determine if you owe additional taxes. After filling out the form, you can submit it electronically or by mail. If filing electronically, ensure you use a compatible e-filing system that supports Form 4868.

Filing Deadlines / Important Dates

The deadline for submitting Form 4868 typically aligns with the original tax filing deadline, which is usually April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Once the form is submitted, the extended deadline for filing your tax return is generally October 15. It is crucial to keep these dates in mind to ensure compliance and avoid any potential penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 4868. Taxpayers must ensure that they meet eligibility criteria, which include being an individual taxpayer and not having filed a previous extension for the same tax year. The IRS also emphasizes that the extension applies only to the filing of the tax return and not to the payment of taxes owed. Failure to adhere to these guidelines may result in penalties or interest on unpaid taxes.

Penalties for Non-Compliance

Failing to file your tax return on time, even with an extension, can lead to significant penalties. The IRS imposes a failure-to-file penalty, which is generally five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. Additionally, if you do not pay your taxes by the original due date, interest will accrue on any unpaid balance. Understanding these penalties can help motivate timely compliance with tax obligations.

Eligibility Criteria

To qualify for an extension using Form 4868, taxpayers must meet certain eligibility criteria. This form is intended for individual taxpayers, including those who are self-employed or retired. Additionally, it is important to have a valid Social Security number or Individual Taxpayer Identification Number. Taxpayers who are in bankruptcy or who have previously filed for an extension for the same year may not be eligible for this automatic extension.

Quick guide on how to complete 2022 form 4868 application for automatic extension of time to file us individual income tax return

Effortlessly Prepare Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return on Any Device

Digital document management has gained popularity among enterprises and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork since you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to Edit and Electronically Sign Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return with Ease

- Obtain Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and bears the same legal validity as a conventional hand-written signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that need the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 4868 application for automatic extension of time to file us individual income tax return

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to IRS 2018?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents seamlessly. With regards to IRS 2018, it helps ensure compliance and secure signing of essential tax documents, making your filing process efficient and hassle-free.

-

What features does airSlate SignNow offer for IRS 2018 documentation?

airSlate SignNow includes features such as customizable templates, secure document storage, and real-time tracking of document status. These features are particularly beneficial for managing IRS 2018 forms, ensuring you stay organized and compliant.

-

How does pricing work for airSlate SignNow, especially for IRS 2018 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focused on IRS 2018 forms. You can choose from monthly or annual subscriptions which provide access to features that simplify the eSigning process for tax documents.

-

Can airSlate SignNow help with IRS 2018 audit trails?

Yes, airSlate SignNow provides a comprehensive audit trail for every document signed, which is crucial for IRS 2018 documentation. This feature ensures you have verifiable records of all activities, enhancing your compliance and accountability with IRS requirements.

-

Is airSlate SignNow compliant with IRS 2018 regulations?

airSlate SignNow complies with the necessary electronic signature laws, which include regulations relevant to IRS 2018. This compliance ensures that your eSigned documents are legally binding and recognized by the IRS.

-

What benefits does airSlate SignNow provide for IRS 2018 document management?

Using airSlate SignNow for IRS 2018 document management yields benefits such as increased efficiency, reduced turnaround time for signatures, and improved organizational capabilities. This leads to faster processing and a smoother annual filing experience.

-

What integrations are available with airSlate SignNow for managing IRS 2018 forms?

airSlate SignNow integrates with various platforms like Google Drive, Dropbox, and CRM systems, enhancing your ability to access and manage IRS 2018 forms easily. These integrations streamline your workflow by connecting the tools you already use.

Get more for Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

- Notice to beneficiaries of being named in will ohio form

- Estate planning questionnaire and worksheets ohio form

- Document locator and personal information package including burial information form ohio

- Demand to produce copy of will from heir to executor or person in possession of will ohio form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497322711 form

- Bill of sale of automobile and odometer statement oklahoma form

- Bill of sale for automobile or vehicle including odometer statement and promissory note oklahoma form

- Promissory note in connection with sale of vehicle or automobile oklahoma form

Find out other Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast