Schedule C Form 990 Political Campaign and Lobbying Activities 2021

What is the Schedule C Form 990 Political Campaign And Lobbying Activities

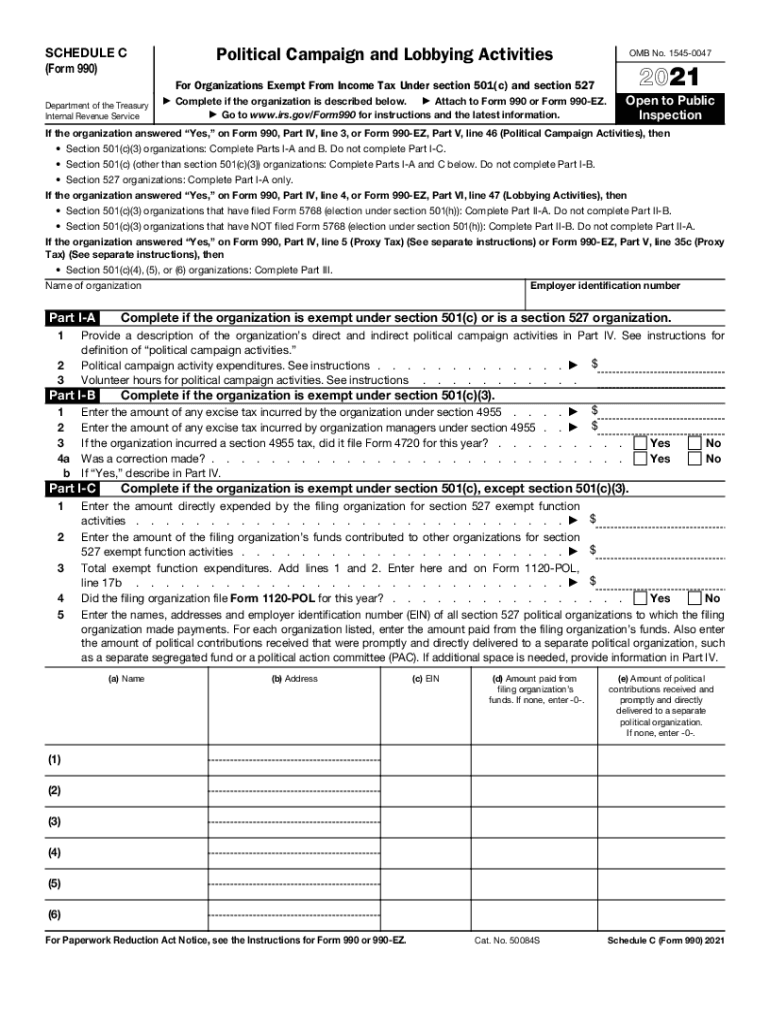

The Schedule C Form 990 is a crucial document for tax-exempt organizations that engage in political campaign activities or lobbying efforts. This form provides detailed information about the organization's political expenditures and lobbying activities during the tax year. It is essential for ensuring compliance with IRS regulations and maintaining transparency regarding political involvement. Organizations must accurately report these activities to avoid potential penalties and ensure that their tax-exempt status is not jeopardized.

Steps to complete the Schedule C Form 990 Political Campaign And Lobbying Activities

Completing the Schedule C Form 990 involves several steps to ensure accuracy and compliance. First, gather all relevant financial records related to political activities and lobbying expenditures. This includes receipts, invoices, and any documentation supporting the reported amounts. Next, fill out the form by providing details about the organization, the nature of the political activities, and the total expenditures incurred. It is crucial to review the form for completeness and accuracy before submission. Finally, ensure that the form is filed along with the main Form 990 by the designated deadline.

Legal use of the Schedule C Form 990 Political Campaign And Lobbying Activities

The legal use of the Schedule C Form 990 is governed by IRS regulations that dictate how tax-exempt organizations must report their political and lobbying activities. Organizations must adhere to specific guidelines to maintain their tax-exempt status. This includes ensuring that political activities do not constitute a substantial part of their overall operations. By accurately completing and submitting the Schedule C, organizations demonstrate compliance with federal laws and regulations surrounding political engagement.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Form 990 are aligned with the main Form 990 submission dates. Typically, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. It is important to note that extensions may be available, but organizations must file for an extension before the original deadline to avoid penalties.

Examples of using the Schedule C Form 990 Political Campaign And Lobbying Activities

Examples of when to use the Schedule C Form 990 include instances where an organization engages in direct lobbying efforts, such as advocating for specific legislation, or when it contributes to political campaigns. For example, a nonprofit organization that spends funds to support a candidate's campaign must report these expenditures on the Schedule C. Similarly, if the organization conducts grassroots lobbying, encouraging members to contact legislators about specific issues, these activities also need to be documented and reported accurately.

Key elements of the Schedule C Form 990 Political Campaign And Lobbying Activities

Key elements of the Schedule C Form 990 include sections that require detailed information about the organization’s political activities and expenditures. This includes reporting the total amount spent on lobbying activities, a breakdown of expenditures by type, and information on any contributions made to political campaigns. Additionally, organizations must disclose the names of candidates or political committees supported and provide a summary of the lobbying issues addressed during the year. Accurate reporting of these elements is essential for compliance and transparency.

Quick guide on how to complete 2021 schedule c form 990 political campaign and lobbying activities

Effortlessly Finalize Schedule C Form 990 Political Campaign And Lobbying Activities on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, enabling you to access the required form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Handle Schedule C Form 990 Political Campaign And Lobbying Activities on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and Electronically Sign Schedule C Form 990 Political Campaign And Lobbying Activities Easily

- Find Schedule C Form 990 Political Campaign And Lobbying Activities and click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule C Form 990 Political Campaign And Lobbying Activities and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule c form 990 political campaign and lobbying activities

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule c form 990 political campaign and lobbying activities

How to generate an e-signature for a PDF document in the online mode

How to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is the 990 c form and why is it important?

The 990 c form is a tax document that non-profit organizations must file to report their income, expenses, and activities. It provides essential information to the IRS and the public about your organization's finances and governance. Understanding and properly managing this form is crucial for maintaining compliance and transparency.

-

How can airSlate SignNow help with the 990 c form process?

airSlate SignNow streamlines the signing and submission process of the 990 c form, allowing organizations to easily collect eSignatures from necessary parties. Our platform ensures that all documents are securely stored and easily accessible, transforming your form-filing experience to be more efficient. With airSlate SignNow, you'll save time and reduce the administrative burden associated with paper-based processes.

-

What features does airSlate SignNow offer for signing the 990 c form?

airSlate SignNow offers a range of features such as customizable templates, real-time tracking, and automated reminders, making it easy to manage the signing process for the 990 c form. Our platform also provides advanced security measures, ensuring that sensitive information is protected. Additionally, you can invite multiple signers and coordinate workflows with ease.

-

Is airSlate SignNow cost-effective for non-profits needing to file the 990 c form?

Yes, airSlate SignNow is a cost-effective solution for non-profits looking to file the 990 c form. Our pricing plans are designed to fit the budgets of organizations with varying needs. By using our platform, you can lower costs associated with printing, mailing, and managing paper documents.

-

Can airSlate SignNow integrate with other software I use for the 990 c form?

Certainly! airSlate SignNow integrates seamlessly with various software applications that organizations commonly use, such as accounting and document management systems. These integrations simplify the process of gathering necessary data for the 990 c form and help maintain consistency across all your financial reporting tools.

-

How secure is the information when signing the 990 c form with airSlate SignNow?

airSlate SignNow prioritizes the security of your information while you sign the 990 c form. Our platform utilizes advanced encryption and complies with industry standards to protect sensitive data during transmission and storage. You can rest assured that your organization's information is safe with us.

-

What are the benefits of using airSlate SignNow for the 990 c form compared to traditional methods?

Using airSlate SignNow for the 990 c form offers signNow benefits over traditional methods, including faster processing times, reduced paper usage, and enhanced convenience. Our eSigning solution eliminates the need for physical signatures and mailing documents, which can be time-consuming. Instead, you can complete your filing electronically and track its status in real-time.

Get more for Schedule C Form 990 Political Campaign And Lobbying Activities

- Sample cover letter for filing of llc articles or certificate with secretary of state hawaii form

- Supplemental residential lease forms package hawaii

- Hawaii tenant 497304600 form

- Name change instructions and forms package for an adult hawaii

- Hawaii name change instructions and forms package for a minor hawaii

- Name change instructions and forms package for a family father mother and minor children hawaii

- Name change instructions and forms package for a family one parent and children hawaii

- Hawaii unsecured installment payment promissory note for fixed rate hawaii form

Find out other Schedule C Form 990 Political Campaign And Lobbying Activities

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template