Instructions for Schedule C Form 990 Internal Revenue Service 2022

Understanding IRS Form 990 Schedule C

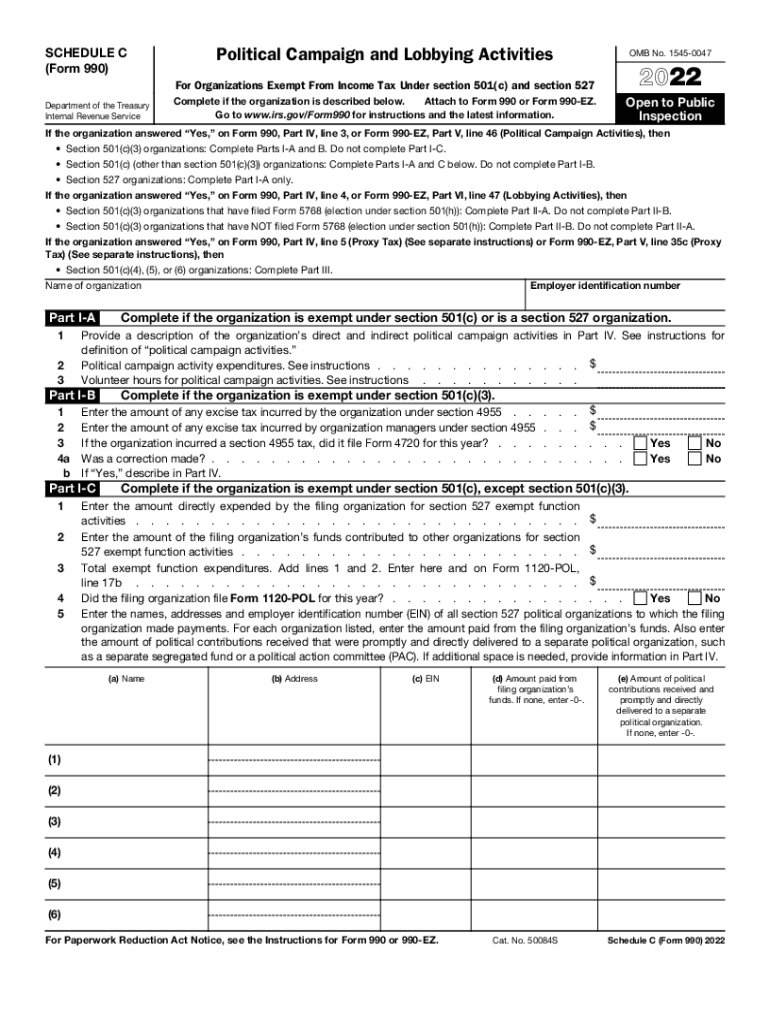

IRS Form 990 Schedule C is a crucial document for tax-exempt organizations that engage in lobbying activities. This form provides detailed information about the lobbying expenditures of the organization, ensuring compliance with federal regulations. It is part of the larger IRS Form 990, which is used to report financial information and activities of tax-exempt entities. The Schedule C specifically focuses on the lobbying efforts, detailing the nature and extent of these activities.

Steps to Complete IRS Form 990 Schedule C

Completing IRS Form 990 Schedule C requires careful attention to detail. Here are the key steps to follow:

- Gather necessary financial records and documentation related to lobbying activities.

- Fill out the identifying information at the top of the form, including the organization's name and EIN.

- Detail the lobbying expenditures in the appropriate sections, categorizing them by type.

- Provide a narrative description of the lobbying activities conducted during the reporting period.

- Review the completed form for accuracy and completeness before submission.

Legal Use of IRS Form 990 Schedule C

The legal use of IRS Form 990 Schedule C is essential for maintaining compliance with tax laws governing tax-exempt organizations. This form must be filed annually, and accurate reporting of lobbying activities is necessary to avoid penalties. Organizations must ensure that their lobbying efforts do not exceed the allowable limits set by the IRS, as exceeding these limits can jeopardize their tax-exempt status.

Filing Deadlines for IRS Form 990 Schedule C

Filing deadlines for IRS Form 990 Schedule C align with the annual filing of Form 990. Typically, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For organizations with a fiscal year ending on December 31, this means the form is due by May 15 of the following year. Extensions may be available, but organizations should be aware of the implications of late filings.

Required Documents for IRS Form 990 Schedule C

To complete IRS Form 990 Schedule C, organizations need to gather several key documents, including:

- Financial statements detailing income and expenses related to lobbying.

- Records of lobbying activities, including dates, amounts spent, and purposes.

- Any contracts or agreements related to lobbying efforts.

- Documentation of communications with government officials, if applicable.

Examples of Lobbying Activities to Report on Schedule C

When filling out IRS Form 990 Schedule C, organizations should report various lobbying activities, such as:

- Direct communication with legislators regarding specific legislation.

- Grassroots lobbying efforts aimed at mobilizing public opinion.

- Research and analysis conducted to support lobbying positions.

- Participation in coalitions or advocacy groups focused on legislative issues.

Quick guide on how to complete instructions for schedule c form 990 2021internal revenue service

Finalize Instructions For Schedule C Form 990 Internal Revenue Service effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to construct, alter, and electronically sign your documents swiftly and without delays. Oversee Instructions For Schedule C Form 990 Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to alter and electronically sign Instructions For Schedule C Form 990 Internal Revenue Service easily

- Locate Instructions For Schedule C Form 990 Internal Revenue Service and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Instructions For Schedule C Form 990 Internal Revenue Service and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule c form 990 2021internal revenue service

Create this form in 5 minutes!

People also ask

-

What is the 2023 schedule poliyical for airSlate SignNow's features?

The 2023 schedule poliyical highlights the features of airSlate SignNow, including advanced eSignature capabilities, document templates, and automated workflows. These features are designed to streamline document management for businesses of all sizes. Explore our updated offerings for 2023 to maximize productivity.

-

How much does airSlate SignNow cost for the 2023 schedule poliyical?

Pricing for airSlate SignNow varies based on the plan you choose. Our 2023 schedule poliyical includes affordable options for small businesses and enterprises, offering features tailored to different needs. For detailed pricing information, visit our pricing page.

-

What integrations are available in the 2023 schedule poliyical for airSlate SignNow?

In our 2023 schedule poliyical, airSlate SignNow offers integrations with popular platforms such as Google Drive, Dropbox, and Salesforce. These integrations enhance your document workflows, making it easier to manage and eSign documents directly within your existing systems. Check our integrations page for a full list.

-

What are the benefits of using airSlate SignNow in the 2023 schedule poliyical?

Using airSlate SignNow in the 2023 schedule poliyical empowers businesses to enhance efficiency and reduce paper waste. The platform facilitates quick document signing, collaboration, and tracking, making it ideal for modern business needs. Experience these benefits to streamline your operations.

-

Is airSlate SignNow suitable for small businesses according to the 2023 schedule poliyical?

Absolutely! The 2023 schedule poliyical emphasizes that airSlate SignNow caters to small businesses with its user-friendly interface and cost-effective pricing. It provides essential eSigning features without overwhelming complexities, making it a perfect choice for small teams.

-

How secure is airSlate SignNow according to the 2023 schedule poliyical?

Security is a top priority for airSlate SignNow, as highlighted in the 2023 schedule poliyical. Our platform employs industry-leading security measures, including bank-level encryption and secure cloud storage. You can trust that your documents and signatures are safe with us.

-

Can I customize documents using airSlate SignNow as per the 2023 schedule poliyical?

Yes, the 2023 schedule poliyical emphasizes that airSlate SignNow offers extensive document customization options. Users can create templates, add fields, and automate workflows to fit their specific requirements. This flexibility helps tailor the documentation process for various business needs.

Get more for Instructions For Schedule C Form 990 Internal Revenue Service

- Lease subordination agreement new york form

- Apartment rules and regulations new york form

- Cancellation lease 497321535 form

- Amendment of residential lease new york form

- Payment rent form 497321537

- Commercial lease assignment from tenant to new tenant new york form

- Tenant consent to background and reference check new york form

- Residential lease or rental agreement for month to month new york form

Find out other Instructions For Schedule C Form 990 Internal Revenue Service

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple