Schedule C Form 990 or 990 EZ Political Campaign and Lobbying Activities 2020

What is the Schedule C Form 990 or 990 EZ Political Campaign and Lobbying Activities

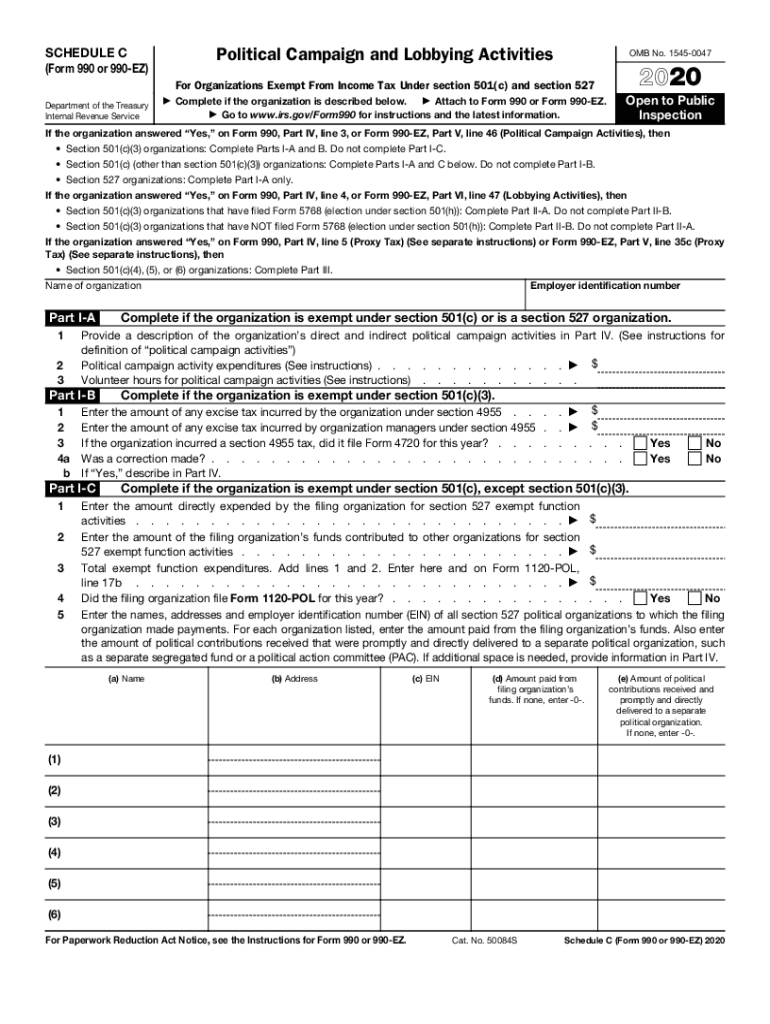

The Schedule C Form 990 or 990 EZ is designed for organizations that engage in political campaign activities or lobbying efforts. This form allows tax-exempt organizations to report their political activities and expenditures, ensuring compliance with IRS regulations. It is particularly relevant for organizations that want to maintain their tax-exempt status while participating in political advocacy or campaign-related efforts.

Understanding the nuances of this form is essential for organizations to accurately disclose their activities. The information reported helps the IRS assess whether an organization is adhering to the legal limitations placed on political engagement by tax-exempt entities.

How to Use the Schedule C Form 990 or 990 EZ Political Campaign and Lobbying Activities

To effectively use the Schedule C Form 990 or 990 EZ, organizations must first determine if their activities qualify for reporting. This involves evaluating the nature of their political campaign and lobbying activities against IRS guidelines. Organizations should gather all relevant financial data, including expenditures related to political campaigns and lobbying efforts.

Once the necessary information is compiled, organizations can complete the form by accurately reporting their activities and expenditures. It is crucial to provide detailed descriptions and amounts to ensure transparency and compliance. After completing the form, it should be submitted along with the main Form 990 or 990 EZ during the annual filing process.

Steps to Complete the Schedule C Form 990 or 990 EZ Political Campaign and Lobbying Activities

Completing the Schedule C Form 990 or 990 EZ involves several key steps:

- Determine Eligibility: Assess whether your organization engages in political campaign or lobbying activities that require reporting.

- Gather Financial Data: Collect all relevant financial information related to political activities, including expenditures and contributions.

- Complete the Form: Fill out the Schedule C, providing accurate descriptions and amounts for each activity.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid potential issues with the IRS.

- File with Form 990 or 990 EZ: Submit the completed Schedule C along with your organization's annual Form 990 or 990 EZ.

Legal Use of the Schedule C Form 990 or 990 EZ Political Campaign and Lobbying Activities

The legal use of the Schedule C Form 990 or 990 EZ is governed by IRS regulations that outline the permissible levels of political engagement for tax-exempt organizations. Organizations must ensure that their political activities do not exceed the limits set by the IRS, as excessive involvement can jeopardize their tax-exempt status.

It is essential for organizations to be aware of the legal implications of their political activities and to accurately report them on the Schedule C. This form serves as a tool for transparency and accountability, ensuring that organizations remain compliant with federal laws while participating in political discourse.

IRS Guidelines for the Schedule C Form 990 or 990 EZ Political Campaign and Lobbying Activities

The IRS provides specific guidelines regarding the completion and submission of the Schedule C Form 990 or 990 EZ. These guidelines include definitions of political campaign activities and lobbying, as well as the reporting requirements for each type of activity. Organizations must familiarize themselves with these guidelines to ensure compliance.

Additionally, the IRS outlines the consequences of failing to report political activities accurately, which can include penalties or loss of tax-exempt status. Adhering to these guidelines is crucial for maintaining the integrity and compliance of an organization’s operations.

Filing Deadlines for the Schedule C Form 990 or 990 EZ Political Campaign and Lobbying Activities

The filing deadlines for the Schedule C Form 990 or 990 EZ coincide with the due dates for the main Form 990 or 990 EZ. Typically, organizations must file their forms by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth.

It is important for organizations to be aware of these deadlines to avoid late filing penalties and ensure timely compliance with IRS requirements. Extensions may be available, but organizations must adhere to the rules regarding extensions to maintain their tax-exempt status.

Quick guide on how to complete 2020 schedule c form 990 or 990 ez political campaign and lobbying activities

Accomplish Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying Activities seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying Activities on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

Steps to modify and eSign Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying Activities effortlessly

- Find Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying Activities and click on Get Form to initiate.

- Employ the tools available to fill in your form.

- Mark important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying Activities and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule c form 990 or 990 ez political campaign and lobbying activities

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule c form 990 or 990 ez political campaign and lobbying activities

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 990 ez schedule c and who needs it?

The 990 ez schedule c is a tax form used by small organizations to report their financial activities to the IRS. It's essential for nonprofits and other smaller entities to ensure compliance with federal regulations. Using the 990 ez schedule c can simplify the tax reporting process, making it easier to manage your organization's finances.

-

How can airSlate SignNow assist with the 990 ez schedule c process?

airSlate SignNow can streamline the process of completing and filing the 990 ez schedule c by allowing you to eSign and share documents securely. This helps eliminate paperwork hassles and ensures all necessary signatures are collected efficiently. Our user-friendly platform makes it easy for nonprofits to manage their tax documents in a digital format.

-

What are the pricing options for using airSlate SignNow for the 990 ez schedule c?

airSlate SignNow offers various pricing tiers designed to suit different needs, ensuring you can choose a plan that fits your budget. Check our website for the most current pricing details, which often includes special offers for nonprofits. Investing in our solution can save you time and improve your document management for tasks like the 990 ez schedule c.

-

Are there any key features that support the 990 ez schedule c filing?

Yes, airSlate SignNow provides features like electronic signatures, document templates, and real-time collaboration, all of which can signNowly aid in the preparation of the 990 ez schedule c. These features help ensure that your documentation is filled out accurately and submitted on time. Streamlining your document workflows enhances overall efficiency.

-

Can airSlate SignNow integrate with other accounting software for easier 990 ez schedule c management?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting and financial software. This allows for easier data transfer and document management when preparing the 990 ez schedule c, ensuring that all necessary financial information is up-to-date and readily available.

-

What benefits does using airSlate SignNow offer for organizations preparing the 990 ez schedule c?

Using airSlate SignNow for your 990 ez schedule c preparation can save time, reduce errors, and enhance compliance with IRS regulations. The platform’s automation tools help simplify repetitive tasks, so you can focus on your organization’s mission. Overall, it provides a more organized approach to managing essential documentation.

-

Is there a mobile version of airSlate SignNow for on-the-go access to 990 ez schedule c?

Yes, airSlate SignNow offers a mobile app that allows users to access documents and manage eSignature requests from anywhere. This flexibility is especially beneficial for busy professionals needing to handle the 990 ez schedule c remotely. You can easily review and sign documents on the go, ensuring your organization stays compliant.

Get more for Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying Activities

Find out other Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying Activities

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors