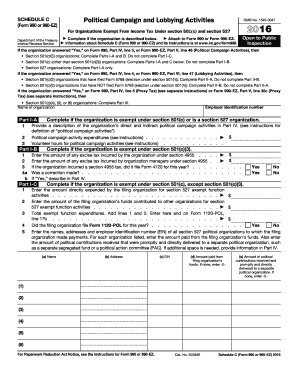

Form 990 or 990 EZ Schedule C Political Campaign and Lobbying Activities Irs 2016

What is the Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities IRS

The Form 990 or 990 EZ Schedule C is a crucial document for tax-exempt organizations in the United States that engage in political campaign and lobbying activities. This form provides the IRS with detailed information about the organization's political expenditures, lobbying efforts, and related activities. It is essential for ensuring transparency and compliance with federal regulations governing political activities by nonprofits. Organizations must accurately report their financial activities to maintain their tax-exempt status and avoid potential penalties.

Steps to complete the Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities IRS

Completing the Form 990 or 990 EZ Schedule C involves several key steps:

- Gather Information: Collect all necessary financial records, including income statements, expense reports, and documentation of lobbying activities.

- Determine Eligibility: Confirm whether your organization qualifies to use the 990 EZ form or if you need to complete the full 990.

- Fill Out the Form: Accurately enter all required information, ensuring that all figures are correct and reflect your organization's activities.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: File the completed form with the IRS by the designated deadline, either electronically or by mail.

Legal use of the Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities IRS

The legal use of the Form 990 or 990 EZ Schedule C is governed by IRS regulations that dictate how tax-exempt organizations report their political and lobbying activities. Organizations must adhere to specific guidelines to ensure compliance with federal laws. Failure to accurately report this information can result in penalties, including loss of tax-exempt status. It is crucial for organizations to understand the legal implications of their reporting obligations and to maintain thorough records of their political and lobbying expenditures.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Form 990 or 990 EZ Schedule C. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is typically due by May fifteenth. It is important to monitor these deadlines to avoid late filing penalties. Organizations may also apply for an extension if necessary, but they must still file the form by the extended deadline to maintain compliance.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Form 990 or 990 EZ Schedule C. These guidelines outline the necessary information required, including financial data, descriptions of lobbying activities, and political expenditures. Organizations should refer to the IRS instructions for the form to ensure they are following the latest requirements and regulations. Understanding these guidelines is essential for accurate reporting and maintaining compliance with federal laws governing political activities.

Key elements of the Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities IRS

Key elements of the Form 990 or 990 EZ Schedule C include:

- Political Campaign Expenditures: Detailed reporting of funds spent on political campaigns.

- Lobbying Activities: Information about lobbying efforts, including the amount spent and the issues addressed.

- Disclosure of Contributions: Reporting of contributions made to political entities or campaigns.

- Compliance Statements: Affirmations that the organization is compliant with applicable laws regarding political activities.

Quick guide on how to complete 2016 form 990 or 990 ez schedule c political campaign and lobbying activities irs

Effortlessly Prepare Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The Best Way to Modify and Electronically Sign Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs with Ease

- Obtain Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for such tasks.

- Generate your electronic signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 990 or 990 ez schedule c political campaign and lobbying activities irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 990 or 990 ez schedule c political campaign and lobbying activities irs

How to make an electronic signature for the 2016 Form 990 Or 990 Ez Schedule C Political Campaign And Lobbying Activities Irs online

How to create an electronic signature for your 2016 Form 990 Or 990 Ez Schedule C Political Campaign And Lobbying Activities Irs in Google Chrome

How to generate an eSignature for signing the 2016 Form 990 Or 990 Ez Schedule C Political Campaign And Lobbying Activities Irs in Gmail

How to make an eSignature for the 2016 Form 990 Or 990 Ez Schedule C Political Campaign And Lobbying Activities Irs from your mobile device

How to create an eSignature for the 2016 Form 990 Or 990 Ez Schedule C Political Campaign And Lobbying Activities Irs on iOS devices

How to create an eSignature for the 2016 Form 990 Or 990 Ez Schedule C Political Campaign And Lobbying Activities Irs on Android

People also ask

-

What is the Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs?

The Form 990 Or 990 EZ Schedule C is a required document for certain organizations that engage in political campaign activities or lobbying. It provides details on the campaign and lobbying expenditures to the IRS. Understanding how to fill this out accurately is crucial for compliance and transparency.

-

How can airSlate SignNow help with Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs?

airSlate SignNow streamlines the preparation and submission of the Form 990 Or 990 EZ Schedule C by allowing users to easily eSign and send necessary documents. This solution ensures that all required information is accurately captured and filed on time. Additionally, its intuitive interface simplifies the overall process.

-

What are the costs associated with using airSlate SignNow for filing Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs?

airSlate SignNow offers competitive pricing plans that cater to various organizational needs and budgets. Users can choose from several subscription options that provide access to features necessary for efficiently managing their Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs processes. A free trial is also available for users to explore the software.

-

What features does airSlate SignNow provide for managing Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs?

Key features of airSlate SignNow include document templates, e-signature functionality, and automated workflows. These tools signNowly enhance the effectiveness of managing Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs requirements. Users can also track document status and receive notifications for any updates.

-

Can airSlate SignNow integrate with other software for Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs management?

Yes, airSlate SignNow integrates seamlessly with a variety of third-party applications, such as accounting software and customer relationship management (CRM) tools. This integration allows for a more comprehensive management approach to Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs. Thus, users can synchronize data and streamline their workflows.

-

What benefits does airSlate SignNow offer for non-profit organizations working with Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs?

AirSlate SignNow provides non-profit organizations with cost-effective solutions to manage their Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs filings. The ease of use and automation reduces the time spent on paperwork, allowing organizations to focus on their missions. Enhanced security also ensures that sensitive data remains protected.

-

How does airSlate SignNow ensure the security of documents related to Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs?

airSlate SignNow prioritizes the security of user documents with features like encryption, secure data storage, and multi-factor authentication. This helps to protect sensitive information related to Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs from unauthorized access. Users can trust that their documents are handled with the utmost care and confidentiality.

Get more for Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs

- Pr application costco form

- Fatburger application form

- Migrant and seasonal agricultural worker protection act spanish dol form

- Notice and acknowledgement of pay rate and paydayaviso y labor ny form

- Income in kind verification form

- Gabelli coverdell funds online ap form

- Sf 26 fillable 2008 form

- Checks word templates page 26 form

Find out other Form 990 Or 990 EZ Schedule C Political Campaign And Lobbying Activities Irs

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online