Federal Form 990 or 990 EZ Sch C Political Campaign and 2019

What is the Federal Form 990 or 990 EZ Schedule C Political Campaign?

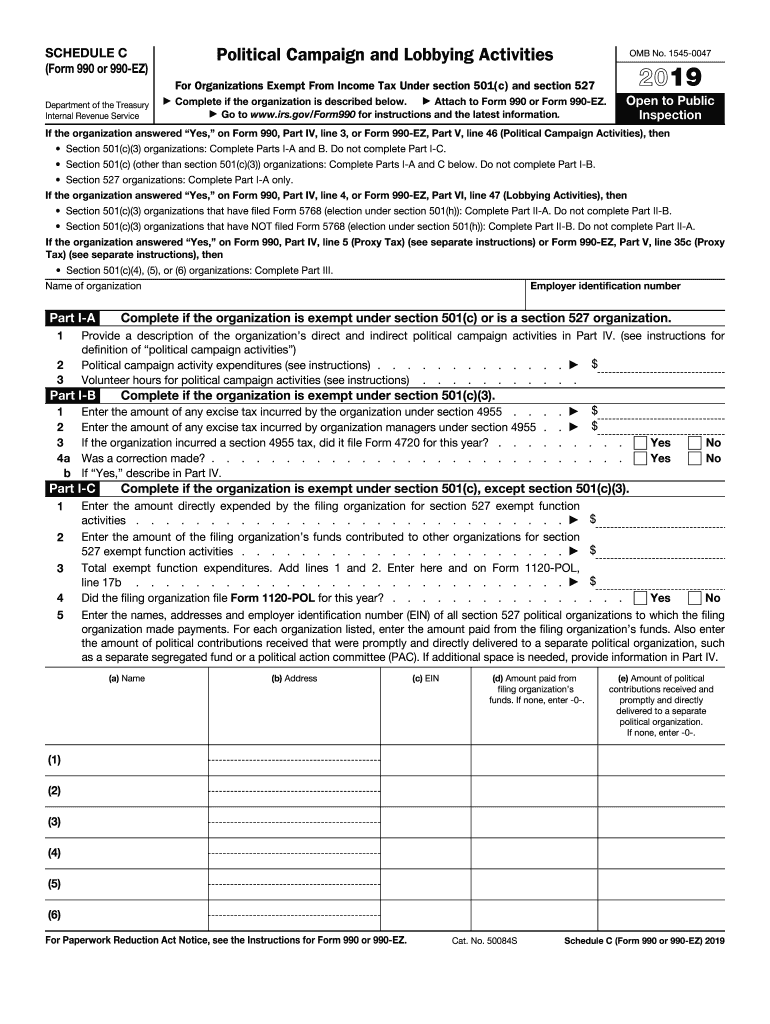

The Federal Form 990 and 990 EZ Schedule C are essential documents for tax-exempt organizations, particularly those involved in political campaigns. These forms are used to report financial information to the Internal Revenue Service (IRS), detailing the organization's income, expenditures, and activities related to political campaigns. The Schedule C specifically focuses on the political campaign activities of the organization, providing transparency and accountability for funds spent in this area. Understanding these forms is crucial for compliance with federal regulations and for maintaining tax-exempt status.

Steps to Complete the Federal Form 990 or 990 EZ Schedule C Political Campaign

Completing the Federal Form 990 or 990 EZ Schedule C involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements, expense receipts, and documentation of political activities. Next, fill out the form accurately, ensuring that all income and expenditures related to political campaigns are reported. It is essential to provide detailed descriptions of campaign activities and to categorize expenses correctly. Once the form is completed, review it thoroughly for any errors before submission. Finally, ensure that the form is submitted by the designated deadline to avoid penalties.

IRS Guidelines for the Federal Form 990 or 990 EZ Schedule C Political Campaign

The IRS has established specific guidelines for completing and submitting the Federal Form 990 and 990 EZ Schedule C. Organizations must adhere to these guidelines to maintain compliance and avoid potential penalties. Key aspects include accurately reporting all income and expenses, providing detailed descriptions of political activities, and ensuring that the form is signed by an authorized representative. Additionally, organizations must keep detailed records of all transactions and activities related to political campaigns for at least three years. Familiarizing oneself with these guidelines is crucial for successful filing.

Filing Deadlines for the Federal Form 990 or 990 EZ Schedule C Political Campaign

Filing deadlines for the Federal Form 990 and 990 EZ Schedule C are critical for organizations to meet to avoid penalties. Generally, these forms are due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form would be due on May 15 of the following year. Organizations can apply for an automatic six-month extension if needed, but they must file the extension request before the original deadline. Staying informed about these deadlines is essential for compliance.

Penalties for Non-Compliance with the Federal Form 990 or 990 EZ Schedule C

Failure to comply with the filing requirements for the Federal Form 990 or 990 EZ Schedule C can result in significant penalties. The IRS may impose fines based on the size of the organization and the length of the delay in filing. For instance, organizations that fail to file on time may face penalties ranging from $20 to $100 per day, with a maximum penalty cap. In severe cases, non-compliance may lead to the loss of tax-exempt status. Understanding these penalties underscores the importance of timely and accurate filing.

Required Documents for the Federal Form 990 or 990 EZ Schedule C Political Campaign

To complete the Federal Form 990 or 990 EZ Schedule C, certain documents are required to ensure accurate reporting. Organizations should gather financial statements, including income and expense reports, bank statements, and receipts for all expenditures related to political activities. Additionally, any documentation that supports claims of income or expenses, such as contracts or invoices, should be included. Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with IRS regulations.

Quick guide on how to complete federal form 990 or 990 ez sch c political campaign and

Complete Federal Form 990 Or 990 EZ Sch C Political Campaign And seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Federal Form 990 Or 990 EZ Sch C Political Campaign And on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Federal Form 990 Or 990 EZ Sch C Political Campaign And with ease

- Obtain Federal Form 990 Or 990 EZ Sch C Political Campaign And and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your preference. Edit and eSign Federal Form 990 Or 990 EZ Sch C Political Campaign And to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 990 or 990 ez sch c political campaign and

Create this form in 5 minutes!

How to create an eSignature for the federal form 990 or 990 ez sch c political campaign and

How to make an electronic signature for the Federal Form 990 Or 990 Ez Sch C Political Campaign And in the online mode

How to make an electronic signature for your Federal Form 990 Or 990 Ez Sch C Political Campaign And in Google Chrome

How to make an eSignature for putting it on the Federal Form 990 Or 990 Ez Sch C Political Campaign And in Gmail

How to create an eSignature for the Federal Form 990 Or 990 Ez Sch C Political Campaign And from your smartphone

How to create an electronic signature for the Federal Form 990 Or 990 Ez Sch C Political Campaign And on iOS

How to create an eSignature for the Federal Form 990 Or 990 Ez Sch C Political Campaign And on Android OS

People also ask

-

What is Schedule C 990 2019, and why is it important for businesses?

Schedule C 990 2019 is a tax form used by sole proprietors to report income or loss from their business. Understanding this form is crucial for accurate tax reporting, potentially impacting your deductions and overall tax liabilities. Proper management of your Schedule C 990 2019 can help ensure compliance with tax laws and maximize your profits.

-

How can airSlate SignNow help with preparing Schedule C 990 2019?

airSlate SignNow offers an easy-to-use platform for managing and signing essential documents needed for preparing Schedule C 990 2019. With our digital signature capabilities, you can streamline the process of gathering necessary signatures, improving efficiency and accuracy, and ensuring timely submissions of your tax documentation.

-

What features does airSlate SignNow offer for managing tax documents like Schedule C 990 2019?

AirSlate SignNow provides features such as customizable templates, document tracking, and secure storage, specifically designed to simplify the management of tax documents like Schedule C 990 2019. These features allow users to create, edit, and sign documents seamlessly, ensuring that all your tax-related paperwork is organized and easily accessible.

-

Is there a cost associated with using airSlate SignNow for Schedule C 990 2019?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our solutions are designed to be cost-effective, allowing you to streamline document management for Schedule C 990 2019 without incurring unnecessary expenses. Check our website for current pricing and features covered under each plan.

-

Can I integrate airSlate SignNow with other financial tools for better handling of Schedule C 990 2019?

Absolutely! airSlate SignNow offers seamless integrations with popular financial and accounting software, allowing you to streamline your workflow when handling Schedule C 990 2019. By connecting with tools you already use, you can ensure that your documentation process is efficient and coherent, reducing the chances of errors.

-

How does airSlate SignNow ensure the security of my Schedule C 990 2019 documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption protocols and authentication measures to protect your Schedule C 990 2019 documents from unauthorized access. You can confidently manage your sensitive tax information, knowing that it is securely stored and handled.

-

What benefits does using airSlate SignNow provide when filing Schedule C 990 2019?

Using airSlate SignNow to manage your Schedule C 990 2019 provides multiple benefits, including increased efficiency, reduced paperwork, and improved accuracy in document handling. Our platform simplifies the signing process and helps ensure that all necessary documents are completed correctly, reducing stress during tax season.

Get more for Federal Form 990 Or 990 EZ Sch C Political Campaign And

Find out other Federal Form 990 Or 990 EZ Sch C Political Campaign And

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template