3903 Form 3903 Moving Expenses Department of the Treasury 2021

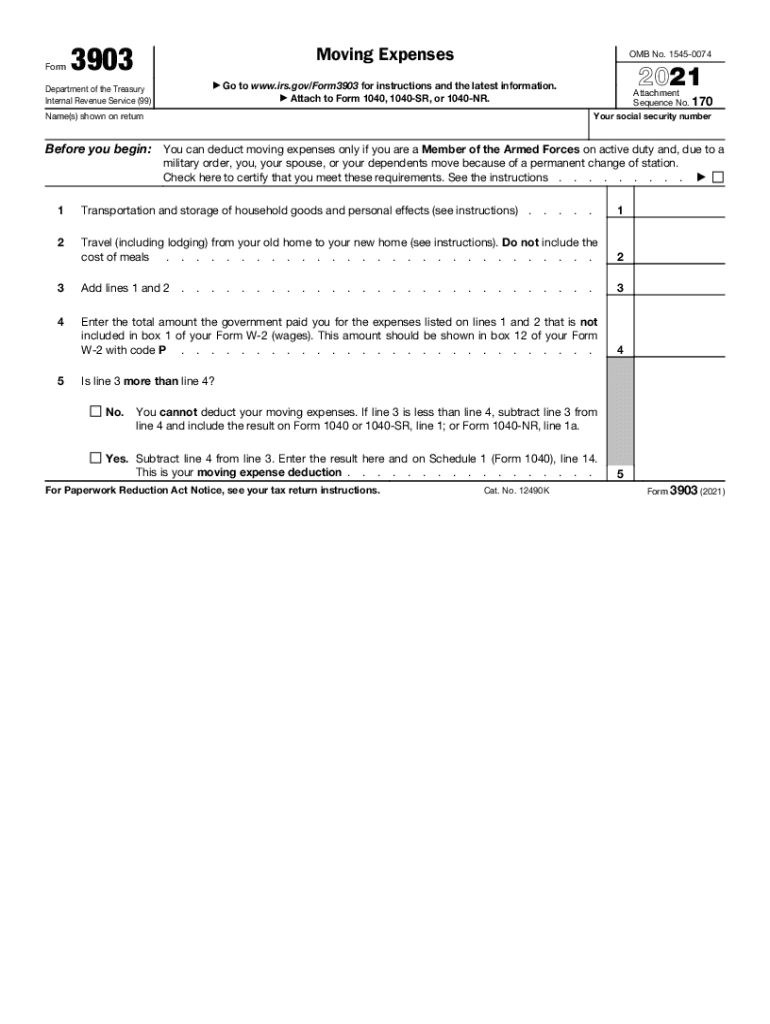

What is the Form 3903 Moving Expenses?

The Form 3903 is a tax form issued by the Department of the Treasury that allows taxpayers to report moving expenses incurred during a job-related move. This form is particularly relevant for individuals who have moved due to a change in employment or a new job location. The IRS form 3903 helps taxpayers determine which moving expenses are deductible, ensuring compliance with tax regulations. It is essential to understand the eligibility criteria and the types of expenses that can be claimed to maximize potential deductions.

Steps to Complete the Form 3903

Completing the Form 3903 involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation related to your moving expenses, including receipts for transportation, storage, and travel. Next, fill out the form by providing your personal information and detailing your moving expenses in the designated sections. It is crucial to accurately classify each expense as qualified or non-qualified to avoid any issues with the IRS. Finally, review the completed form for any errors before submission to ensure all information is correct.

IRS Guidelines for Using Form 3903

The IRS provides specific guidelines for the use of Form 3903, which include eligibility criteria for claiming moving expenses. Generally, to qualify, the move must be closely related to the start of a new job, and the distance between your old home and new workplace must meet IRS standards. Additionally, the IRS outlines which expenses are deductible, such as transportation costs, packing and shipping of personal items, and temporary lodging expenses. Familiarizing yourself with these guidelines is essential for proper completion of the form.

Required Documents for Form 3903

When filing Form 3903, certain documents are necessary to substantiate your claims. These may include receipts for moving services, invoices for storage facilities, and travel expenses incurred during the move. Additionally, documentation proving the relationship between the move and your employment is crucial. Keeping organized records will facilitate the completion of the form and support your deductions in case of an IRS audit.

Filing Deadlines for Form 3903

Filing deadlines for Form 3903 align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their tax returns by April 15 of the following tax year. If you are claiming moving expenses, it is essential to ensure that Form 3903 is included with your tax return by this deadline. If additional time is needed, taxpayers may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Eligibility Criteria for Form 3903

To be eligible to use Form 3903, taxpayers must meet specific criteria established by the IRS. The move must be work-related, and the distance between the old home and the new workplace must exceed a minimum threshold. Additionally, the taxpayer must have started a new job within a certain timeframe relative to the move. Understanding these criteria is vital to ensure that you qualify for the deductions available through this form.

Quick guide on how to complete 3903 form 3903 moving expenses department of the treasury

Complete 3903 Form 3903 Moving Expenses Department Of The Treasury effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without any hold-ups. Manage 3903 Form 3903 Moving Expenses Department Of The Treasury on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 3903 Form 3903 Moving Expenses Department Of The Treasury without hassle

- Obtain 3903 Form 3903 Moving Expenses Department Of The Treasury and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 3903 Form 3903 Moving Expenses Department Of The Treasury and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3903 form 3903 moving expenses department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the 3903 form 3903 moving expenses department of the treasury

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 3903?

airSlate SignNow is an intuitive eSignature solution that enables businesses to send and sign documents seamlessly. The product, labeled under the code 3903, offers a user-friendly interface that simplifies document management and enhances workflow efficiency. It is designed for both small and large businesses looking to streamline their signing processes.

-

What are the pricing options available for airSlate SignNow, specifically for the 3903 plan?

The 3903 plan in airSlate SignNow offers competitive pricing tailored for businesses of all sizes. It includes various tiers, ensuring you can choose the one that best fits your needs. With each plan, you gain access to essential features and flexible billing options, making it a cost-effective choice for eSigning.

-

What key features are included in the 3903 offering of airSlate SignNow?

The 3903 offering of airSlate SignNow includes essential features such as templates, advanced routing, and real-time tracking. Additionally, it supports mobile signing and provides a secure cloud-based platform for document management. These features make the 3903 plan ideal for organizations aiming to enhance their signing workflows.

-

How can using airSlate SignNow's 3903 benefit my business?

Utilizing airSlate SignNow's 3903 plan can signNowly reduce the time it takes to manage and sign documents. Businesses experience improved efficiency and reduced costs associated with paper-based processes. Additionally, the ease of use encourages quicker adoption across teams, improving overall productivity.

-

Is airSlate SignNow's 3903 plan compatible with other software integrations?

Yes, airSlate SignNow's 3903 plan offers seamless integration with a variety of third-party applications, including CRM and project management tools. This compatibility enhances your workflow by allowing for document sending and signing directly within your existing software suite. Integration options help businesses work more efficiently.

-

What security features does the 3903 plan of airSlate SignNow offer?

The security of your documents is a top priority for airSlate SignNow's 3903 plan. It adheres to industry-leading security standards, including data encryption and two-factor authentication. This ensures that your sensitive information remains protected throughout the signing process.

-

Can I access airSlate SignNow's 3903 plan on mobile devices?

Absolutely! The 3903 plan of airSlate SignNow is fully optimized for mobile devices, allowing users to send and sign documents on the go. This accessibility ensures that you can manage your document workflow from anywhere, thus increasing productivity and flexibility in business operations.

Get more for 3903 Form 3903 Moving Expenses Department Of The Treasury

- Idaho easement 497305728 form

- Idaho easement 497305729 form

- Easement for utilities streets subdivision idaho form

- Utility easement 497305731 form

- Assumption agreement of deed of trust and release of original mortgagors idaho form

- Idaho foreign judgment enrollment idaho form

- Summary administration package for small estates idaho form

- Tenant eviction form

Find out other 3903 Form 3903 Moving Expenses Department Of The Treasury

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document