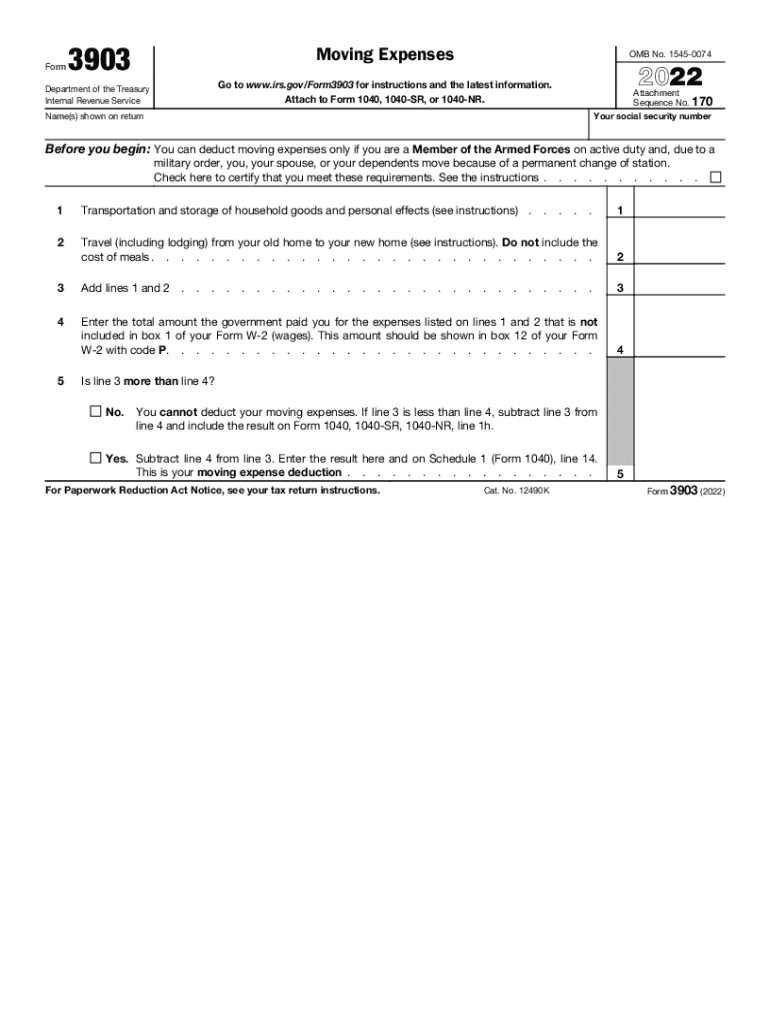

Form 3903 Moving Expenses 2022

What is the Form 3903 Moving Expenses

The Form 3903 is a tax form used by individuals in the United States to report moving expenses that may be deductible on their federal income tax return. This form is particularly relevant for those who have relocated for work-related reasons. The IRS allows certain moving expenses to be deductible, which can help reduce the overall tax burden for eligible taxpayers. Understanding the specifics of this form is essential for anyone looking to maximize their deductions related to moving costs.

How to use the Form 3903 Moving Expenses

To use the Form 3903 effectively, taxpayers must first determine their eligibility based on IRS guidelines. Once eligibility is confirmed, individuals should gather all relevant documentation related to their moving expenses, such as receipts for transportation, storage, and travel. The next step involves accurately completing the form by entering the total moving expenses incurred. It is crucial to follow the instructions provided by the IRS to ensure that all applicable expenses are reported properly.

Steps to complete the Form 3903 Moving Expenses

Completing the Form 3903 involves several important steps:

- Gather Documentation: Collect all receipts and records related to the moving expenses.

- Determine Eligibility: Verify that the move meets IRS criteria for deductible expenses.

- Fill Out the Form: Enter your personal information and itemize your moving expenses as instructed.

- Review for Accuracy: Double-check all entries for completeness and correctness.

- Submit the Form: Include the completed Form 3903 with your federal tax return.

IRS Guidelines

The IRS provides specific guidelines regarding which moving expenses are deductible. Generally, deductible expenses may include costs for transportation of household goods, travel expenses for moving to a new home, and storage fees incurred during the move. It's important to consult IRS Publication 521, which details the moving expense deduction and outlines eligibility requirements. Adhering to these guidelines ensures compliance and maximizes potential deductions.

Required Documents

When completing the Form 3903, several documents are necessary to substantiate the moving expenses claimed. These may include:

- Receipts for moving services or rental trucks

- Invoices for storage fees

- Travel receipts, including lodging and meals during the move

- Documentation proving the new job location and the distance moved

Having these documents ready can facilitate a smoother filing process and support claims in case of an audit.

Eligibility Criteria

To qualify for moving expense deductions using Form 3903, taxpayers must meet specific criteria set forth by the IRS. Generally, the move must be closely related to the start of a new job, and the distance between the old home and the new workplace must exceed a certain mileage threshold. Additionally, the taxpayer must work full-time in the new location for a minimum period to maintain eligibility. Understanding these criteria is crucial for ensuring that the moving expenses can be deducted appropriately.

Quick guide on how to complete 2022 form 3903 moving expenses

Complete Form 3903 Moving Expenses effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form 3903 Moving Expenses on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

The easiest method to modify and eSign Form 3903 Moving Expenses without hassle

- Obtain Form 3903 Moving Expenses and then click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 3903 Moving Expenses while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 3903 moving expenses

Create this form in 5 minutes!

People also ask

-

What are moving expenses taxes and how do they affect my relocation?

Moving expenses taxes refer to the potential tax liabilities associated with the costs incurred during a move. Understanding these taxes is crucial, as they can affect your overall budget and relocation expenses. To minimize moving expenses taxes, it’s vital to keep detailed records of all moving-related costs and consult a tax professional.

-

Are moving expenses tax-deductible this year?

Currently, most individuals cannot deduct moving expenses taxes unless they are active duty military members moving due to a military order. Due to changes in tax legislation, the ability to deduct moving expenses has been limited for the general public. For accurate details regarding your specific situation, it’s advisable to consult with a tax professional.

-

How can airSlate SignNow help manage moving expenses efficiently?

airSlate SignNow streamlines document management, making it easier to track and organize all paperwork related to moving expenses taxes. With our easy-to-use eSignature solution, you can quickly send, sign, and store important moving documents electronically. This organization can help ensure you don’t miss any potential tax deductions.

-

What features does airSlate SignNow offer for tracking moving expenses?

AirSlate SignNow offers features such as document templates, automated reminders, and secure storage, which are essential for managing moving expenses taxes effectively. These tools allow you to keep all your moving documentation in one place, making it easier to report expenses when filing your taxes. Additionally, our platform integrates seamlessly with other financial tools for enhanced tracking.

-

What integrations does airSlate SignNow support that can assist with moving expense documentation?

airSlate SignNow integrates with various financial and accounting tools that can help you manage your moving expenses taxes. Integrations with platforms like QuickBooks and Excel allow you to sync your moving costs directly for easier expense tracking. This compatibility enhances your workflow by keeping all your financial information in one secure location.

-

Is there any pricing flexibility for businesses needing to manage moving expense taxes?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes aiming to streamline their management of moving expenses taxes. Our cost-effective solutions provide various features that cater specifically to the needs of organizations handling employee relocations. You can choose a plan that provides the right level of service for your business’s volume and requirements.

-

Can airSlate SignNow assist with electronic signatures for moving expense reimbursements?

Absolutely! AirSlate SignNow is designed to facilitate electronic signatures for any documents related to moving expense reimbursements. This capability allows you to send and receive approvals quickly, which is vital for timely processing of moving expenses taxes. With our platform, you can easily track the status of all signed documents.

Get more for Form 3903 Moving Expenses

- Legal last will and testament form for divorced person not remarried with adult and minor children iowa

- Last will married form

- Legal last will and testament form for a married person with no children iowa

- Iowa married form

- Iowa will form

- Mutual wills package with last wills and testaments for married couple with adult children iowa form

- Mutual wills package with last wills and testaments for married couple with no children iowa form

- Mutual wills package with last wills and testaments for married couple with minor children iowa form

Find out other Form 3903 Moving Expenses

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later