3903 2023

What is the IRS Form 3903?

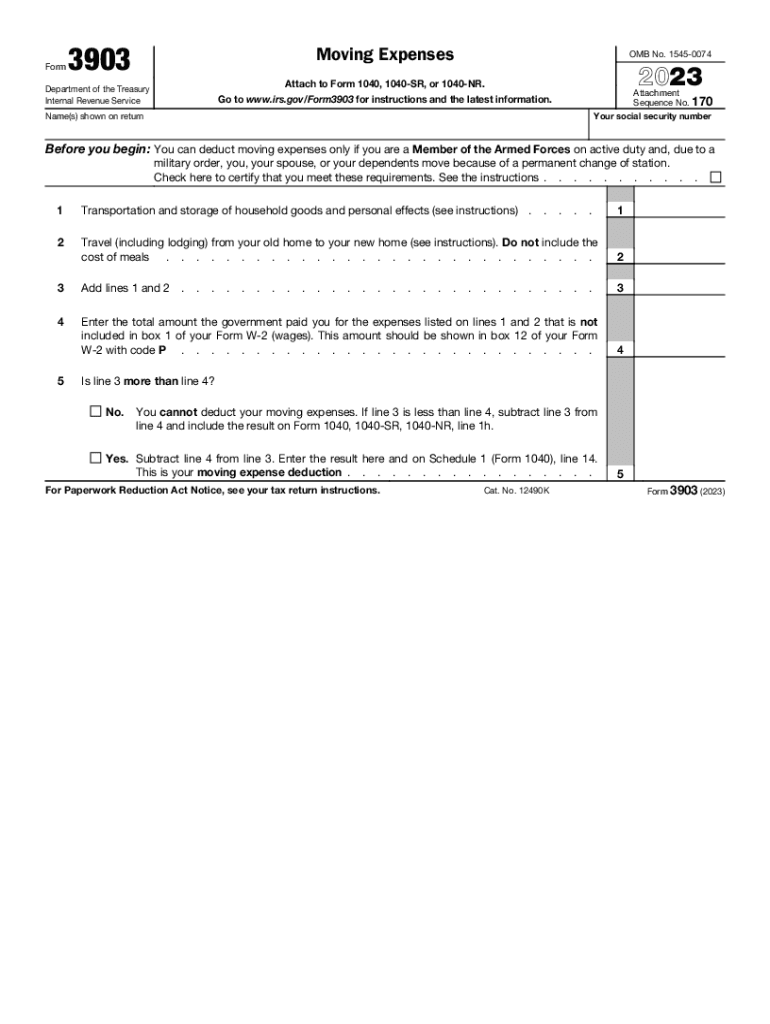

The IRS Form 3903 is a tax form used by individuals to claim moving expenses related to a job relocation. This form is essential for taxpayers who qualify for the moving expense deduction, allowing them to report costs associated with moving their household goods and personal effects. The form outlines eligible expenses, such as transportation and storage costs, and ensures that taxpayers receive the appropriate deductions on their federal tax returns.

Steps to Complete the IRS Form 3903

Completing the IRS Form 3903 involves several key steps:

- Gather Required Information: Collect all necessary documents, including receipts for moving expenses, proof of employment, and any relevant travel itineraries.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Detail Moving Expenses: In Part I, list all eligible moving expenses, such as transportation and storage costs. Be sure to include only those expenses that meet IRS guidelines.

- Calculate Deductions: In Part II, calculate the total moving expenses and determine the amount you can deduct from your taxable income.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return.

IRS Guidelines for Moving Expenses

The IRS has specific guidelines regarding which moving expenses are deductible. According to IRS regulations, taxpayers must meet certain criteria to qualify for the moving expense deduction. Key guidelines include:

- The move must be closely related to the start of work at a new job location.

- The distance from the old home to the new job must be at least 50 miles farther than the distance from the old home to the previous job.

- Expenses must be reasonable and necessary for the move.

Eligibility Criteria for Using Form 3903

To use the IRS Form 3903, taxpayers must meet specific eligibility criteria. These include:

- Being an employee or self-employed individual who is relocating for work.

- The move must occur within one year of starting a new job.

- Meeting the distance test, which requires the new job location to be at least 50 miles farther from the previous home than the old job location was.

Required Documents for Filing Form 3903

When filing IRS Form 3903, it is important to have the following documents on hand:

- Receipts for moving expenses, including transportation and storage.

- Proof of employment, such as a job offer letter or pay stubs.

- Documentation of the distance between the old home and new job location.

Form Submission Methods

Taxpayers can submit IRS Form 3903 in several ways:

- Online: Many tax software programs allow for electronic filing of Form 3903 along with the federal tax return.

- By Mail: Taxpayers can print the completed form and mail it to the appropriate IRS address listed in the form instructions.

- In-Person: Some taxpayers may choose to file their returns in person at local IRS offices, bringing the completed form along with their tax return.

Quick guide on how to complete 3903

Complete 3903 effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the features you need to generate, edit, and electronically sign your documents quickly without delays. Manage 3903 on any device with airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The simplest way to modify and eSign 3903 without hassle

- Find 3903 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign 3903 and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3903

Create this form in 5 minutes!

How to create an eSignature for the 3903

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are fillable moving 2018 forms, and how can airSlate SignNow help?

Fillable moving 2018 forms are customizable documents that allow you to collect information efficiently during the moving process. AirSlate SignNow simplifies the creation and distribution of these forms, enabling you to gather signatures and data seamlessly. With our easy-to-use platform, even those unfamiliar with technology can utilize fillable moving 2018 forms effortlessly.

-

Is there a cost associated with using airSlate SignNow for fillable moving 2018?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing tiers that cater to different business needs. Consumers can choose a plan based on their usage of fillable moving 2018 forms, ensuring you only pay for what you need. Our solutions remain cost-effective, allowing you to maximize your budget.

-

What features does airSlate SignNow offer for creating fillable moving 2018 forms?

AirSlate SignNow provides advanced features for creating fillable moving 2018 forms, including drag-and-drop functionality, customizable templates, and integration options. You can easily add text fields, checkboxes, and other elements to tailor the document to your needs. Additionally, our platform ensures compliance with eSignature laws, giving you peace of mind.

-

Can I integrate airSlate SignNow with other applications when using fillable moving 2018?

Absolutely! AirSlate SignNow offers seamless integrations with numerous applications, enhancing your experience with fillable moving 2018 forms. Whether you're using CRM systems, project management tools, or cloud storage services, you can easily connect your accounts to streamline processes and maximize efficiency.

-

How does airSlate SignNow enhance the efficiency of fillable moving 2018 workflows?

AirSlate SignNow boosts the efficiency of fillable moving 2018 workflows by automating document management and eSigning processes. This reduces manual tasks, allowing your team to focus on more critical elements of the move. Our platform also provides tracking features so you can monitor the progress of your documents in real-time.

-

Are fillable moving 2018 forms secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your fillable moving 2018 forms and user data. You can rest assured that sensitive information is safeguarded during transmission and storage.

-

Can fillable moving 2018 forms be customized for different needs?

Absolutely! With airSlate SignNow, you can customize fillable moving 2018 forms to suit various requirements. Whether you need different fields, annotations, or branding elements, our user-friendly interface allows you to tailor documents effortlessly, ensuring they meet your specific moving needs.

Get more for 3903

Find out other 3903

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF