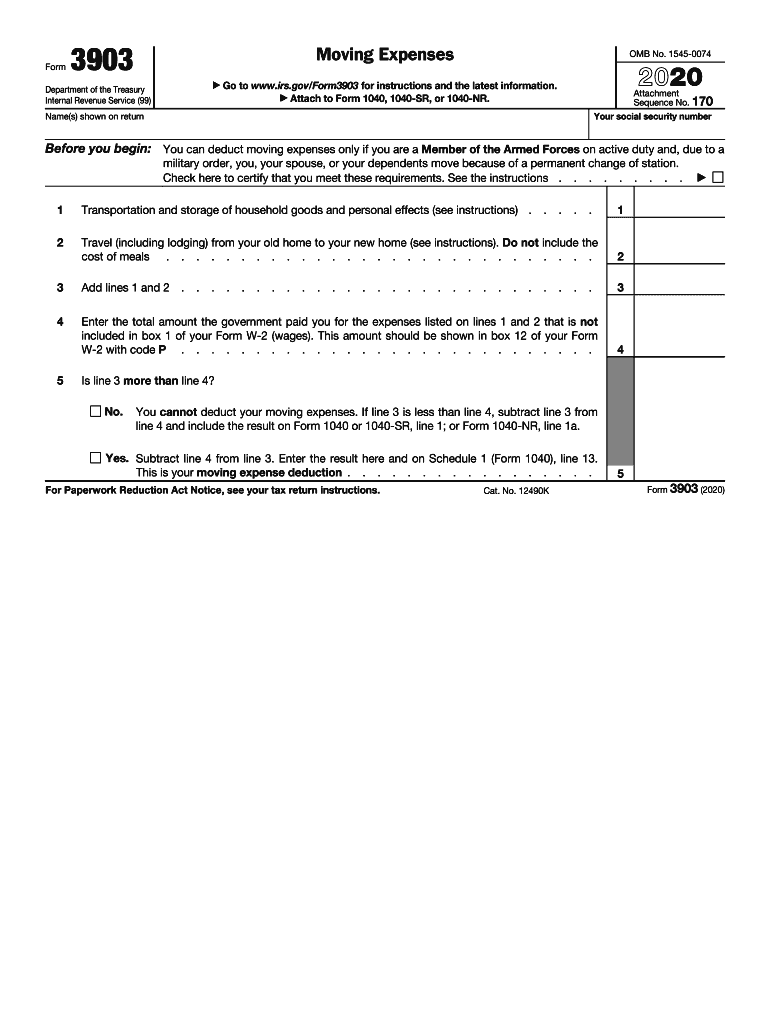

Form 3903 Moving Expenses 2020

What is the Form 3903 Moving Expenses

The 2017 Form 3903 is a tax form used by individuals to claim moving expenses related to a change in job location. This form allows taxpayers to report qualified moving expenses and potentially receive a deduction on their federal income tax return. The IRS provides guidelines on what types of expenses are eligible, including transportation and storage costs. Understanding the purpose of this form is essential for those who have relocated for work-related reasons and wish to benefit from moving expenses deductions.

How to use the Form 3903 Moving Expenses

Using the 2017 Form 3903 involves several steps to ensure accurate reporting of moving expenses. Taxpayers must first gather all relevant documentation, including receipts for moving costs. The form requires detailed information about the move, including the old and new addresses, the reason for the move, and the dates of relocation. After filling out the form, it should be attached to the taxpayer's federal income tax return. It is important to follow IRS instructions carefully to avoid errors that could lead to delays or penalties.

Steps to complete the Form 3903 Moving Expenses

Completing the 2017 Form 3903 involves a systematic approach:

- Gather necessary documents, such as receipts and records of moving expenses.

- Enter personal information, including your name, address, and Social Security number.

- Provide details of the move, including the old and new addresses and the reason for the move.

- List all qualifying moving expenses, ensuring they align with IRS guidelines.

- Calculate the total moving expenses and report them on the appropriate lines of the form.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS has specific guidelines regarding the use of Form 3903. Taxpayers must meet certain eligibility criteria to claim moving expenses, such as the distance test and the time test. The distance test requires that the new job location is at least fifty miles farther from the old home than the previous job location. Additionally, the time test stipulates that the taxpayer must work full-time for at least thirty-nine weeks during the first twelve months after the move. Familiarizing oneself with these guidelines is crucial for successful filing.

Required Documents

To complete the 2017 Form 3903 accurately, taxpayers need to prepare several documents, including:

- Receipts for all moving expenses, such as transportation and storage costs.

- Proof of employment, such as a job offer letter or pay stubs.

- Documentation that verifies the distance between the old and new residences.

- Any additional records that support the claim for moving expenses.

Form Submission Methods

The 2017 Form 3903 can be submitted in various ways, depending on the taxpayer's preference. It can be filed electronically as part of an e-filed tax return or mailed directly to the IRS with the paper return. If submitting by mail, it is important to send the form to the correct address based on the taxpayer's state of residence. Ensuring proper submission helps prevent delays in processing and potential issues with the IRS.

Quick guide on how to complete 2020 form 3903 moving expenses

Complete Form 3903 Moving Expenses effortlessly on any device

Online document management has gained popularity with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 3903 Moving Expenses on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The most efficient way to modify and eSign Form 3903 Moving Expenses with ease

- Obtain Form 3903 Moving Expenses and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow caters to all your needs in document management with just a few clicks from your preferred device. Edit and eSign Form 3903 Moving Expenses and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 3903 moving expenses

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3903 moving expenses

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2017 form 3903 moving expenses?

The 2017 form 3903 moving expenses is a tax form used by individuals to report moving expenses related to a job change. This form allows you to deduct specific moving costs, making it essential for those relocating for work. Proper understanding of this form can help you maximize your tax deductions.

-

How can airSlate SignNow assist with filing the 2017 form 3903 moving expenses?

airSlate SignNow simplifies the process of preparing and signing documents, including your 2017 form 3903 moving expenses. Our platform allows you to easily gather necessary signatures and share the form securely with tax professionals, ensuring a smooth filing process for your moving expense deductions.

-

What features does airSlate SignNow offer for managing moving expense documents?

airSlate SignNow offers a range of features for managing documents related to your 2017 form 3903 moving expenses. Users can streamline document creation, automate workflows, and obtain secure electronic signatures, making the management of moving expenses efficient and hassle-free.

-

Is airSlate SignNow cost-effective for individuals needing to file the 2017 form 3903 moving expenses?

Yes, airSlate SignNow provides a cost-effective solution for individuals looking to file their 2017 form 3903 moving expenses. With competitive pricing plans, you can access powerful eSigning features without breaking the bank, helping you save on administrative costs.

-

Can I integrate airSlate SignNow with other accounting software for 2017 form 3903 moving expenses?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, enhancing your ability to manage your 2017 form 3903 moving expenses. This integration allows you to streamline document sharing, ensuring that all financial records are accurately collected and filed.

-

What are the benefits of using airSlate SignNow for my 2017 form 3903 moving expenses?

Using airSlate SignNow for your 2017 form 3903 moving expenses brings numerous benefits, including time savings and enhanced efficiency. You can quickly prepare, sign, and send documents, reducing the hassles traditionally associated with filing moving expenses on your taxes.

-

Does airSlate SignNow provide customer support for questions regarding the 2017 form 3903 moving expenses?

Yes, airSlate SignNow offers dedicated customer support to assist with any questions regarding the 2017 form 3903 moving expenses. Our knowledgeable team can help you navigate the document preparation process, ensuring you get the most out of your moving expense deductions.

Get more for Form 3903 Moving Expenses

- Letter from landlord to tenant as notice of default on commercial lease vermont form

- Residential or rental lease extension agreement vermont form

- Commercial rental lease application questionnaire vermont form

- Rental application vermont form

- Residential rental lease application vermont form

- Salary verification form for potential lease vermont

- Landlord agreement to allow tenant alterations to premises vermont form

- Notice of default on residential lease vermont form

Find out other Form 3903 Moving Expenses

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure