Form 3903 2016

What is the Form 3903

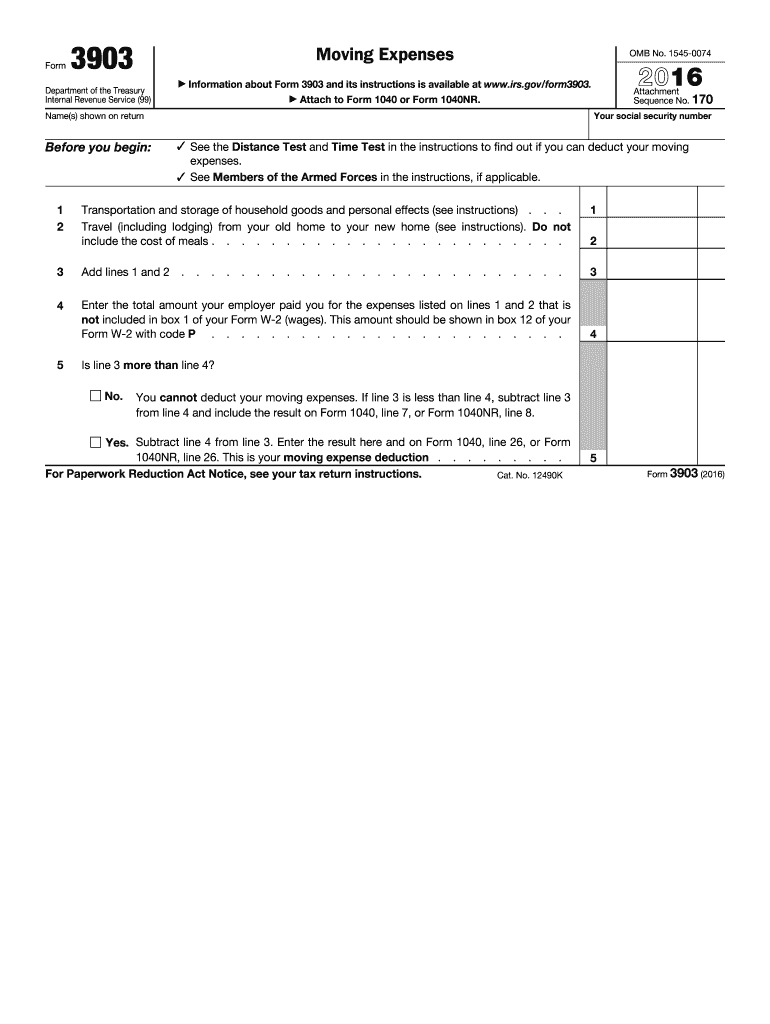

The Form 3903, officially known as the "Moving Expenses Deduction," is a tax form used by individuals in the United States to claim deductions for moving expenses related to a job change. This form allows taxpayers to report qualified moving expenses that are necessary for relocating to a new job location. The form is particularly relevant for those who have moved for work-related reasons, such as a new job, a job transfer, or a change in workplace location.

How to use the Form 3903

To use Form 3903 effectively, taxpayers should first ensure they meet the eligibility criteria for claiming moving expenses. Once eligibility is confirmed, individuals can fill out the form by detailing their moving expenses, including transportation and storage costs. After completing the form, it should be attached to the taxpayer's federal income tax return. It is important to retain records of all moving expenses, as they may be required for verification by the IRS.

Steps to complete the Form 3903

Completing Form 3903 involves several key steps:

- Gather necessary documentation, including receipts for moving expenses.

- Fill out the personal information section, including your name, address, and Social Security number.

- Detail the moving expenses incurred, categorizing them into transportation and storage costs.

- Calculate the total deductible moving expenses.

- Review the completed form for accuracy before submission.

Legal use of the Form 3903

The legal use of Form 3903 is governed by IRS regulations. To ensure compliance, taxpayers must adhere to the rules regarding what constitutes a qualified moving expense. This includes expenses directly related to the move, such as transportation of household goods and travel costs. It is essential to maintain accurate records and documentation to support the claims made on the form, as failure to do so may result in penalties or disallowance of the deduction.

Filing Deadlines / Important Dates

Filing deadlines for Form 3903 align with the general tax return deadlines. Typically, the form must be submitted by April 15 of the tax year following the move. If taxpayers need additional time, they may file for an extension, but it is important to ensure that Form 3903 is included in the extended return. Keeping track of these deadlines helps avoid penalties and ensures that taxpayers can claim their deductions in a timely manner.

Required Documents

When completing Form 3903, taxpayers need to have several documents on hand:

- Receipts for all moving expenses incurred.

- Proof of employment change, such as a job offer letter or transfer notice.

- Documentation of the previous and new addresses.

Having these documents ready will facilitate a smoother completion of the form and support the claims made.

Quick guide on how to complete 2016 form 3903

Complete Form 3903 effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the proper form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any issues. Handle Form 3903 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Form 3903 with ease

- Find Form 3903 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 3903 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 3903

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 3903

How to make an electronic signature for the 2016 Form 3903 online

How to generate an eSignature for your 2016 Form 3903 in Chrome

How to make an eSignature for putting it on the 2016 Form 3903 in Gmail

How to make an electronic signature for the 2016 Form 3903 straight from your mobile device

How to generate an eSignature for the 2016 Form 3903 on iOS devices

How to make an eSignature for the 2016 Form 3903 on Android devices

People also ask

-

What is Form 3903 and how can airSlate SignNow help with it?

Form 3903 is used for claiming a moving expense deduction. With airSlate SignNow, you can easily eSign and manage your Form 3903 documents online, streamlining the process of filing and ensuring your paperwork is accurate and complete.

-

How much does it cost to use airSlate SignNow for Form 3903?

airSlate SignNow offers a range of pricing plans to suit different needs, starting from a free trial. For users needing to eSign documents like Form 3903, our affordable plans provide unlimited signing and document management features.

-

What features does airSlate SignNow offer for completing Form 3903?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage for your Form 3903. These tools make it easy to fill out, sign, and share your forms efficiently and securely.

-

Can I integrate airSlate SignNow with other software for handling Form 3903?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive and Microsoft Office. This allows you to easily manage your Form 3903 alongside your other business documents for a more cohesive workflow.

-

Is airSlate SignNow secure for signing sensitive documents like Form 3903?

Absolutely! airSlate SignNow prioritizes security with features like encryption, secure access, and compliance with industry standards. You can confidently eSign your Form 3903 knowing that your information is protected.

-

How can I track the status of my Form 3903 with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Form 3903 in real-time. You will receive notifications when your document is viewed, signed, or completed, ensuring you are always updated on its progress.

-

Can I use airSlate SignNow on my mobile device for Form 3903?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to complete your Form 3903 from anywhere. Whether you're on a phone or tablet, you can eSign and manage your documents easily and quickly.

Get more for Form 3903

Find out other Form 3903

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple