Fillable Online Instructions for Form 8379 Rev November 2021

Understanding the Fillable Online Instructions for Form 8379

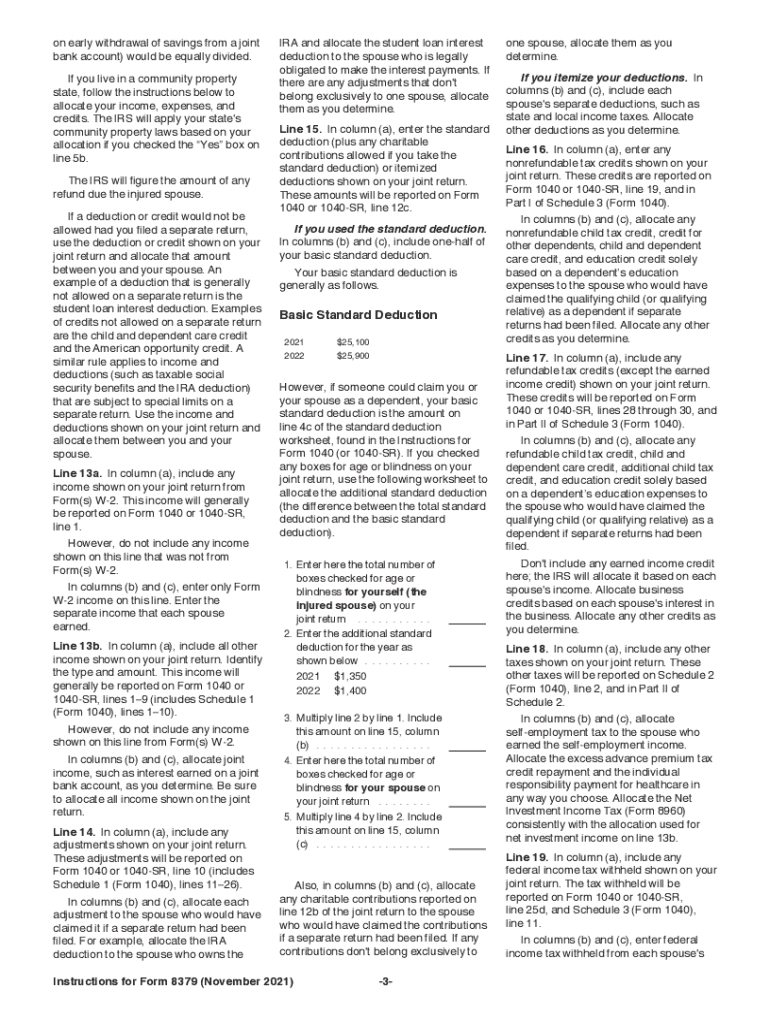

The fillable online instructions for Form 8379 provide essential guidance for individuals seeking to claim their share of a tax refund when their spouse has outstanding debts. This form is particularly relevant for those who have been affected by a tax refund offset due to their spouse's financial obligations. The instructions detail how to properly fill out the form, ensuring that all necessary information is included to facilitate the process. Understanding these instructions can help taxpayers navigate the complexities of tax filings and ensure compliance with IRS regulations.

Steps to Complete the Fillable Online Instructions for Form 8379

Completing the fillable online instructions for Form 8379 involves several key steps:

- Access the fillable form on the IRS website or through authorized tax software.

- Provide personal information, including your name, Social Security number, and details about your spouse.

- Indicate the tax year for which you are filing the form.

- Detail the reasons for claiming the injured spouse relief, including any relevant financial information.

- Review the form for accuracy before submission.

Following these steps carefully can help ensure that your submission is complete and accurate, reducing the likelihood of delays in processing.

IRS Guidelines for Form 8379

The IRS provides specific guidelines for completing Form 8379, which are crucial for ensuring compliance. These guidelines outline eligibility criteria, necessary documentation, and filing procedures. It is important to refer to the IRS instructions for the most current information, as tax laws and requirements can change. Adhering to these guidelines helps taxpayers avoid common pitfalls and ensures that their claims are processed efficiently.

Filing Deadlines and Important Dates for Form 8379

Filing deadlines for Form 8379 align with the overall tax filing deadlines set by the IRS. Generally, taxpayers must submit their forms by April 15 of the year following the tax year in question. If you are filing for an extension, it is crucial to ensure that Form 8379 is submitted by the extended deadline. Missing these deadlines can result in delays or denial of your claim, so it is important to stay informed about important dates.

Required Documents for Form 8379 Submission

To successfully submit Form 8379, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Tax returns for both you and your spouse for the relevant tax year.

- Documentation of any debts or obligations that may affect the tax refund.

Having these documents ready can streamline the process and help ensure that your form is processed without unnecessary delays.

Digital vs. Paper Version of Form 8379

Taxpayers have the option to complete Form 8379 either digitally or on paper. The digital version is often more convenient, allowing for easier corrections and faster submission. Additionally, electronic submissions typically result in quicker processing times. However, some individuals may prefer the traditional paper method for various reasons, including comfort with physical documents. Understanding the advantages of each method can help you choose the best option for your situation.

Quick guide on how to complete fillable online instructions for form 8379 rev november

Effortlessly complete Fillable Online Instructions For Form 8379 Rev November on any device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed forms, allowing you to obtain the correct template and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hindrances. Manage Fillable Online Instructions For Form 8379 Rev November on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Fillable Online Instructions For Form 8379 Rev November with ease

- Obtain Fillable Online Instructions For Form 8379 Rev November and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, text message (SMS), shareable link, or download to your computer.

Eliminate concerns about lost or mislaid files, tedious document searches, or errors that necessitate creating new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Fillable Online Instructions For Form 8379 Rev November to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online instructions for form 8379 rev november

Create this form in 5 minutes!

How to create an eSignature for the fillable online instructions for form 8379 rev november

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the injured spouse form 8379, and why is it important?

The injured spouse form 8379 is designed to protect your tax refund in the event of a joint tax return with a spouse who has overdue debts. Filing this form ensures that only your share of the refund is withheld. Understanding the injured spouse form 8379 instructions is crucial for claiming your rightful refund.

-

How do I complete the injured spouse form 8379?

Completing the injured spouse form 8379 requires gathering your financial information and filling out both parts of the form accurately. Follow the injured spouse form 8379 instructions carefully to avoid delays or rejection of your application. You can also utilize our platform for easy document completion and eSignature.

-

Are there any fees associated with filing the injured spouse form 8379 using airSlate SignNow?

At airSlate SignNow, we offer cost-effective solutions for filing documents, including the injured spouse form 8379. There may be a subscription fee for accessing premium features, but you can enjoy a free trial to assess the benefits. Our goal is to provide you with an affordable way to complete the injured spouse form 8379 instructions.

-

What features does airSlate SignNow offer for filing the injured spouse form 8379?

Our platform offers user-friendly templates, robust editing tools, and a seamless eSigning process to help you file the injured spouse form 8379. You can track the status of your documents, and collaborate easily with your tax preparer or spouse. Our solution simplifies the injured spouse form 8379 instructions for a hassle-free experience.

-

Can I save my progress while filling out the injured spouse form 8379?

Yes, airSlate SignNow allows you to save your progress while completing the injured spouse form 8379. This feature is particularly useful if you need time to gather additional information or documents. You can return at your convenience and continue following the injured spouse form 8379 instructions.

-

Is the injured spouse form 8379 accepted by the IRS when filed electronically?

Yes, the injured spouse form 8379 is accepted by the IRS when filed electronically through approved platforms like airSlate SignNow. Submitting electronically can speed up the processing time for your refund. Ensure you adhere to the injured spouse form 8379 instructions for a successful submission.

-

What should I do if my injured spouse form 8379 is denied?

If your injured spouse form 8379 is denied, carefully review the IRS's feedback and the injured spouse form 8379 instructions for any missteps. Common issues include incomplete information or incorrect signatures. You may need to resubmit the form or address any specific concerns indicated by the IRS.

Get more for Fillable Online Instructions For Form 8379 Rev November

- Notice of option for recording idaho form

- Life documents planning package including will power of attorney and living will idaho form

- General durable power of attorney for property and finances or financial effective upon disability idaho form

- Essential legal life documents for baby boomers idaho form

- Idaho general 497305779 form

- Revocation of general durable power of attorney idaho form

- Agents certification as to validity of power of attorney and agents authority idaho form

- Essential legal life documents for newlyweds idaho form

Find out other Fillable Online Instructions For Form 8379 Rev November

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast