Schedule I Form 1041 Alternative Minimum TaxEstates and Trusts 2021

Understanding the Schedule I Form 1041 for Alternative Minimum Tax

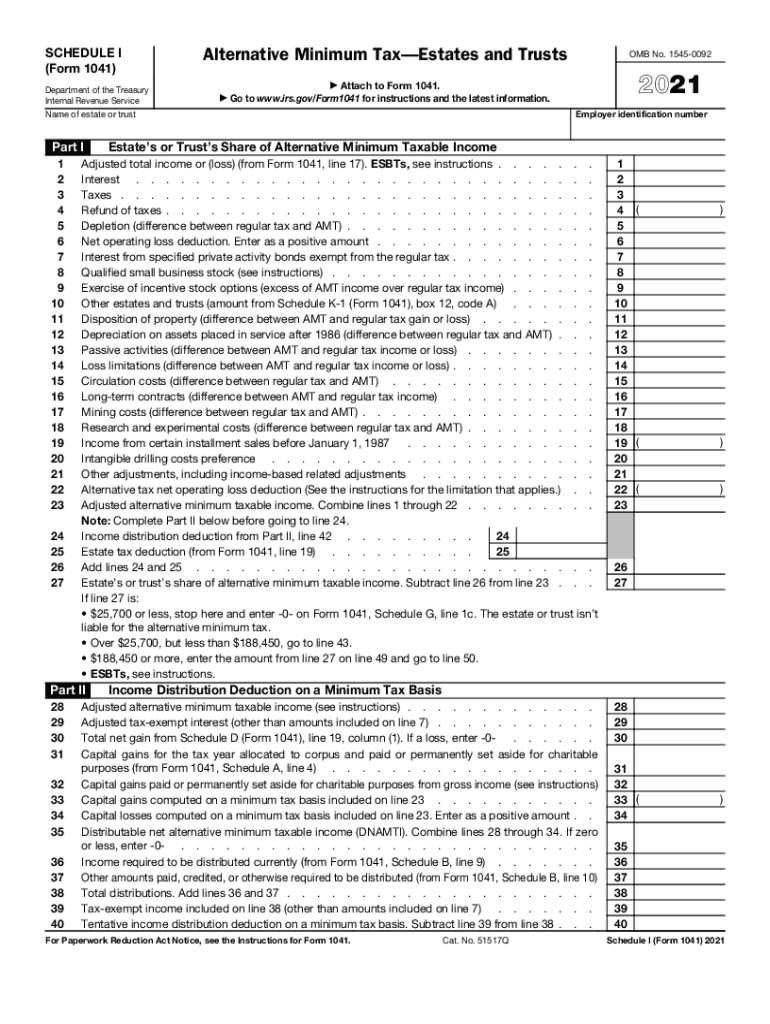

The Schedule I Form 1041 is specifically designed for estates and trusts to report Alternative Minimum Tax (AMT) liabilities. This form is essential for ensuring compliance with tax regulations, particularly for entities that may have income subject to AMT. The IRS requires this form to calculate the AMT, which is a separate tax calculation that ensures individuals and entities pay a minimum amount of tax, regardless of deductions and credits. Understanding the nuances of this form can help in accurate reporting and compliance.

How to Complete the Schedule I Form 1041

Completing the Schedule I Form 1041 involves several steps. First, gather all necessary financial documents related to the estate or trust's income, deductions, and credits. Next, follow the instructions provided by the IRS for filling out each section of the form. Key sections include reporting income, calculating deductions, and determining any AMT adjustments. It is crucial to ensure that all figures are accurate and that the form is signed and dated before submission. Utilizing electronic tools can streamline this process, making it easier to fill out and eSign the document securely.

Filing Deadlines for the Schedule I Form 1041

Filing deadlines for the Schedule I Form 1041 align with the due dates for Form 1041, which is typically due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this means the form is generally due by April fifteenth. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is vital to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Required Documents for Schedule I Form 1041

To complete the Schedule I Form 1041, several documents are necessary. These include the estate or trust's financial statements, prior year tax returns, and any supporting documentation for income and deductions. Additionally, records of any AMT adjustments must be included. Having these documents organized and readily available can facilitate a smoother filing process and help ensure that all information reported is accurate and complete.

IRS Guidelines for the Schedule I Form 1041

The IRS provides specific guidelines for completing and submitting the Schedule I Form 1041. These guidelines outline the necessary steps for calculating AMT, the information required for each section of the form, and the importance of compliance with tax laws. Reviewing these guidelines thoroughly can help ensure that the form is completed correctly and that the estate or trust meets all legal obligations. The IRS website offers resources and instructions that can assist in understanding these requirements.

Legal Use of the Schedule I Form 1041

The Schedule I Form 1041 is legally recognized as a valid document for reporting AMT for estates and trusts. To ensure its legal standing, it must be filled out accurately and submitted in accordance with IRS guidelines. The form must include the appropriate signatures and dates, and any required attachments must be provided. Utilizing a reliable electronic signing solution can enhance the legal validity of the submission, ensuring that all parties involved are properly authenticated.

Quick guide on how to complete 2021 schedule i form 1041 alternative minimum taxestates and trusts

Complete Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts effortlessly on any gadget

Web-based document management has become favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your files swiftly without any hold-ups. Manage Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts without any hassle

- Locate Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form hunts, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and electronically sign Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule i form 1041 alternative minimum taxestates and trusts

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule i form 1041 alternative minimum taxestates and trusts

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the significance of Schedule 1 2021 in airSlate SignNow?

The Schedule 1 2021 refers to a specific document format that allows businesses to properly categorize and submit their taxes. With airSlate SignNow, users can easily eSign and send Schedule 1 2021 documents, enhancing the overall efficiency of the filing process.

-

How does airSlate SignNow handle Schedule 1 2021 document security?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like Schedule 1 2021. All documents are encrypted during transmission, ensuring your information remains confidential and secure throughout the eSigning process.

-

Can I integrate Schedule 1 2021 document management with other software?

Yes, airSlate SignNow seamlessly integrates with various software solutions, making it convenient to manage Schedule 1 2021 documents alongside your existing tools. This integration enhances productivity and ensures a smooth workflow in handling your documents.

-

What are the pricing options for using airSlate SignNow for Schedule 1 2021?

airSlate SignNow offers a range of pricing plans to fit different business needs for managing Schedule 1 2021 documents. With its cost-effective solutions, you can choose a plan that offers the best value while still providing all the necessary features for eSigning.

-

Does airSlate SignNow support mobile eSigning for Schedule 1 2021?

Absolutely! With airSlate SignNow, you can easily eSign Schedule 1 2021 documents on the go using your mobile device. The mobile-friendly interface ensures that you can manage your important documents from anywhere, anytime.

-

What features does airSlate SignNow offer for Schedule 1 2021 management?

airSlate SignNow provides numerous features for managing Schedule 1 2021 documents, such as template creation, bulk sending, and customizable workflows. These features simplify the process of handling tax-related documents, making it efficient and user-friendly.

-

Is support available for using airSlate SignNow with Schedule 1 2021?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions related to Schedule 1 2021. Whether you need help with document preparation or eSigning, the support team is available through various channels to ensure your experience is smooth.

Get more for Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts

- Security contractor package louisiana form

- Insulation contractor package louisiana form

- Paving contractor package louisiana form

- Site work contractor package louisiana form

- Siding contractor package louisiana form

- Refrigeration contractor package louisiana form

- Louisiana drainage 497309380 form

- Tax free exchange package louisiana form

Find out other Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later