Schedule I Form 1041 Alternative Minimum TaxEstates and Trusts 2020

What is the Schedule I Form 1041 Alternative Minimum Tax

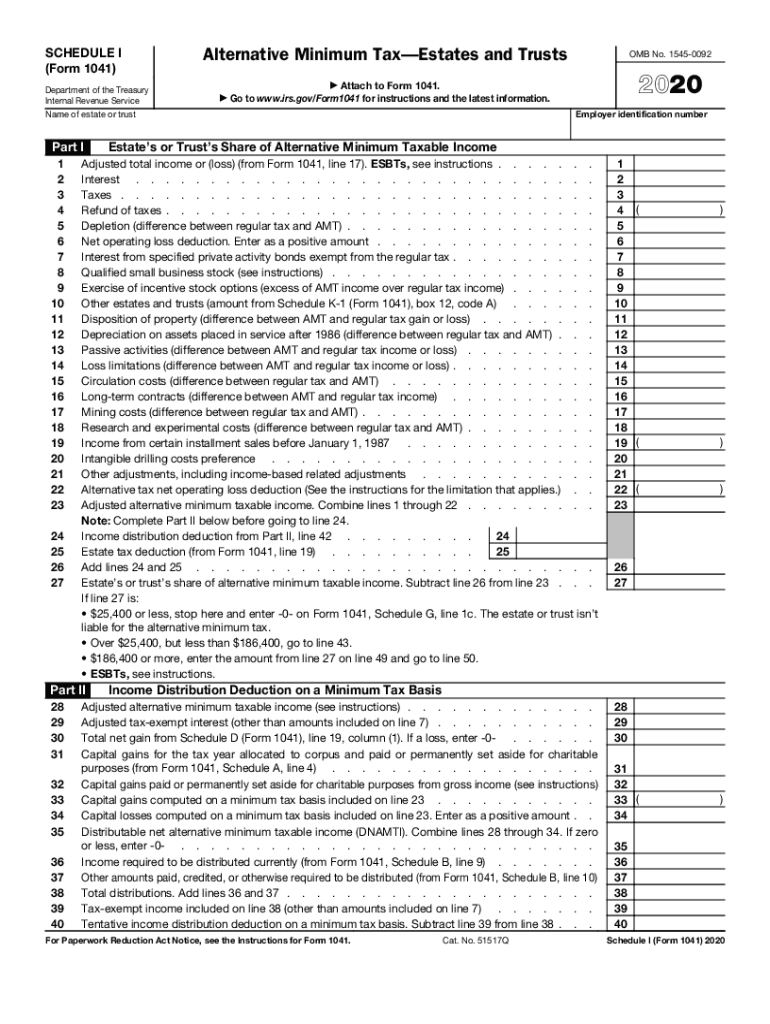

The Schedule I Form 1041 is used to calculate the Alternative Minimum Tax (AMT) for estates and trusts. This tax ensures that individuals, estates, and trusts pay a minimum amount of tax, even if they qualify for numerous deductions and credits that could otherwise reduce their tax liability to zero. The AMT applies to certain taxpayers who have a higher income level and specific tax preferences that might allow them to avoid paying regular income tax. Understanding this form is crucial for accurate tax reporting and compliance.

Steps to Complete the Schedule I Form 1041

Completing the Schedule I Form 1041 involves several key steps:

- Gather Necessary Information: Collect all relevant financial documents, including income statements, deductions, and credits related to the estate or trust.

- Determine AMT Income: Calculate the Alternative Minimum Taxable Income (AMTI) by adjusting your regular taxable income with specific preferences and adjustments.

- Complete the Form: Fill out the Schedule I Form 1041 by entering your AMTI and applying the appropriate tax rates.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid any potential issues with the IRS.

- File the Form: Submit the completed Schedule I along with the main Form 1041 by the designated deadline.

Legal Use of the Schedule I Form 1041

The Schedule I Form 1041 is legally required for estates and trusts that meet certain income thresholds and tax preference criteria. It serves as a formal declaration of the AMT liability, ensuring compliance with federal tax laws. Proper use of this form can help avoid penalties for non-compliance and ensure that the estate or trust meets its tax obligations. It is essential to understand the legal implications of failing to file this form when required.

IRS Guidelines for the Schedule I Form 1041

The IRS provides specific guidelines regarding the use of the Schedule I Form 1041. These guidelines include instructions on eligibility, filing requirements, and deadlines. Taxpayers must adhere to these regulations to ensure their filings are accepted and processed correctly. The IRS also outlines the necessary documentation and calculations required to complete the form accurately, emphasizing the importance of understanding AMT rules.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule I Form 1041 align with the general deadlines for Form 1041. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the tax year for the estate or trust. For estates and trusts operating on a calendar year, this means the deadline is April fifteenth. It is crucial to be aware of these deadlines to avoid late filing penalties and interest charges.

Required Documents for Schedule I Form 1041

To complete the Schedule I Form 1041, several documents are necessary:

- Income Statements: Documentation of all income received by the estate or trust, including interest, dividends, and capital gains.

- Deductions and Credits: Records of any deductions or credits that may apply, such as charitable contributions or administrative expenses.

- Previous Tax Returns: Copies of prior year tax returns may be helpful for reference and ensuring consistency in reporting.

Quick guide on how to complete 2020 schedule i form 1041 alternative minimum taxestates and trusts

Complete Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an optimal eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the instruments required to create, modify, and eSign your documents quickly without delays. Handle Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts without any hassle

- Locate Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or incorrectly placed documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule i form 1041 alternative minimum taxestates and trusts

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule i form 1041 alternative minimum taxestates and trusts

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What are stimulus tax forms?

Stimulus tax forms are documents that taxpayers may need to complete in order to claim government stimulus payments on their tax returns. Understanding these forms is essential for accurately reporting income and ensuring you receive the benefits you're entitled to. airSlate SignNow provides streamlined eSigning solutions to help you manage these important documents efficiently.

-

How can airSlate SignNow help with filling out stimulus tax forms?

airSlate SignNow offers an easy-to-use platform that allows you to electronically sign and send stimulus tax forms. With our intuitive interface, you can quickly fill out and share necessary documentation, ensuring you complete your taxes efficiently. This process minimizes errors and speeds up your tax submission, making it simpler to handle your financial obligations.

-

Is airSlate SignNow cost-effective for handling stimulus tax forms?

Yes, airSlate SignNow provides a cost-effective solution for managing your stimulus tax forms. Our pricing plans are designed to fit businesses of all sizes, allowing you to save money while ensuring you can handle essential documentation effortlessly. By optimizing your workflow, you reduce the costs associated with traditional paperwork.

-

What features does airSlate SignNow offer for managing stimulus tax forms?

airSlate SignNow includes features such as eSigning, template creation, and document tracking, specifically designed to facilitate the management of stimulus tax forms. These capabilities help you streamline your process, reduce turnaround times, and increase overall efficiency. Our platform is designed to enhance productivity while making sure your documents remain secure.

-

How secure is airSlate SignNow for processing stimulus tax forms?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like stimulus tax forms. We utilize advanced encryption and compliance with industry standards to protect your data. This ensures that your information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other platforms for handling stimulus tax forms?

Absolutely! airSlate SignNow offers integrations with a variety of platforms, making it easy to manage stimulus tax forms alongside your existing tools. Whether you use CRMs, accounting software, or other business applications, our solutions enhance connectivity and streamline your workflows.

-

What benefits can I expect from using airSlate SignNow for stimulus tax forms?

Using airSlate SignNow for stimulus tax forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform allows you to complete processes faster, ensuring you receive your stimulus payments in a timely manner. This efficiency translates to better resource management and improved customer satisfaction.

Get more for Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts

- Legal last will and testament form for a widow or widower with adult and minor children wyoming

- Legal last will and testament form for divorced and remarried person with mine yours and ours children wyoming

- Legal last will and testament form with all property to trust called a pour over will wyoming

- Written revocation of will wyoming form

- Last will and testament for other persons wyoming form

- Notice to beneficiaries of being named in will wyoming form

- Estate planning questionnaire and worksheets wyoming form

- Document locator and personal information package including burial information form wyoming

Find out other Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document