Instructions for Form 1041 and Schedules A, B, G, J IRS Gov 2015

What is the Instructions For Form 1041 And Schedules A, B, G, J

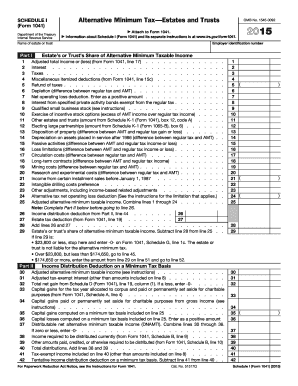

The Instructions for Form 1041 and Schedules A, B, G, J are essential documents provided by the IRS for fiduciaries managing estates and trusts. Form 1041 is used to report income, deductions, gains, losses, and other tax-related information for estates and trusts. Schedules A, B, G, and J serve specific purposes within this context, detailing deductions, income distribution, and other relevant financial activities. Understanding these instructions is crucial for accurate tax reporting and compliance with federal regulations.

Steps to complete the Instructions For Form 1041 And Schedules A, B, G, J

Completing the Instructions for Form 1041 and Schedules A, B, G, J involves several key steps:

- Gather all necessary financial documents, including income statements and expense records related to the estate or trust.

- Review the specific instructions for each schedule to understand what information is required.

- Fill out Form 1041, ensuring that all income and deductions are accurately reported.

- Complete the applicable schedules: Schedule A for deductions, Schedule B for income distribution, Schedule G for tax credits, and Schedule J for income averaging.

- Double-check all entries for accuracy before submission.

Legal use of the Instructions For Form 1041 And Schedules A, B, G, J

The legal use of the Instructions for Form 1041 and Schedules A, B, G, J is vital for ensuring compliance with IRS regulations. Properly filled forms can protect fiduciaries from potential penalties and legal issues. Digital signatures can enhance the validity of the documents, provided they meet the necessary legal requirements. Utilizing a compliant eSignature solution can further streamline the process while ensuring that all signatures are legally binding.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 and its associated schedules are critical for compliance. Generally, the due date for Form 1041 is the 15th day of the fourth month following the end of the tax year. For calendar year estates and trusts, this typically falls on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these dates to avoid late filing penalties.

Required Documents

To complete Form 1041 and Schedules A, B, G, J, several documents are required:

- Income statements for the estate or trust, including interest, dividends, and capital gains.

- Records of expenses incurred by the estate or trust, which may qualify as deductions.

- Documentation of distributions made to beneficiaries, which is necessary for Schedule B.

- Any relevant tax documents that may affect the overall tax liability.

Form Submission Methods (Online / Mail / In-Person)

Form 1041 and its schedules can be submitted through various methods. The IRS allows for electronic filing, which is often faster and more secure. Alternatively, forms can be mailed to the appropriate IRS address based on the state of residence. In-person submissions are generally not available for this form, making electronic filing or mail the most viable options for most fiduciaries. Ensure that all forms are signed and dated appropriately before submission.

Quick guide on how to complete 2017 instructions for form 1041 and schedules a b g j irsgov

Prepare Instructions For Form 1041 And Schedules A, B, G, J IRS gov effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right forms and keep them securely online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form 1041 And Schedules A, B, G, J IRS gov on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Instructions For Form 1041 And Schedules A, B, G, J IRS gov with ease

- Locate Instructions For Form 1041 And Schedules A, B, G, J IRS gov and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Alter and eSign Instructions For Form 1041 And Schedules A, B, G, J IRS gov and ensure excellent communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 instructions for form 1041 and schedules a b g j irsgov

Create this form in 5 minutes!

How to create an eSignature for the 2017 instructions for form 1041 and schedules a b g j irsgov

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What are the 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'?

The 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.' provide detailed guidance on how to complete Form 1041 for fiduciary income tax returns, including specific directions for applicable schedules. These instructions ensure accurate reporting and compliance with IRS regulations, making them essential for estate and trust tax filings.

-

How can airSlate SignNow help with filling out the 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'?

airSlate SignNow streamlines the process of completing the 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.' by allowing users to eSign documents digitally. With our user-friendly platform, you can ensure that all forms are filled out correctly and signed by the necessary parties, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing tax documents like 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'?

airSlate SignNow offers features such as customizable templates, audit trails, and secure document storage, which are ideal for managing tax documents, including 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'. These features enhance collaboration and ensure that your documents meet all compliance requirements.

-

What is the pricing structure for airSlate SignNow in relation to tax document preparation like 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'?

airSlate SignNow provides a cost-effective solution for businesses looking to manage tax documents including the 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'. Our pricing plans are designed to fit different business needs, offering flexibility without compromising on features or ease of use.

-

Can I integrate airSlate SignNow with my existing accounting software for tax documents including 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easy to link your tax document needs, including the 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'. This integration allows for streamlined workflows and efficient document management.

-

Is airSlate SignNow secure for handling sensitive tax documents like 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'?

Absolutely! airSlate SignNow prioritizes security, ensuring that sensitive tax documents such as 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.' are protected. We utilize advanced encryption and secure cloud storage, giving users peace of mind while managing critical documents.

-

How does airSlate SignNow improve collaboration on tax forms such as 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.'?

airSlate SignNow enhances collaboration for tax forms including 'Instructions For Form 1041 And Schedules A, B, G, J IRS gov.' by providing a platform where multiple users can edit and review documents in real-time. This feature reduces the back-and-forth typically associated with tax document preparation, expediting the process.

Get more for Instructions For Form 1041 And Schedules A, B, G, J IRS gov

Find out other Instructions For Form 1041 And Schedules A, B, G, J IRS gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors