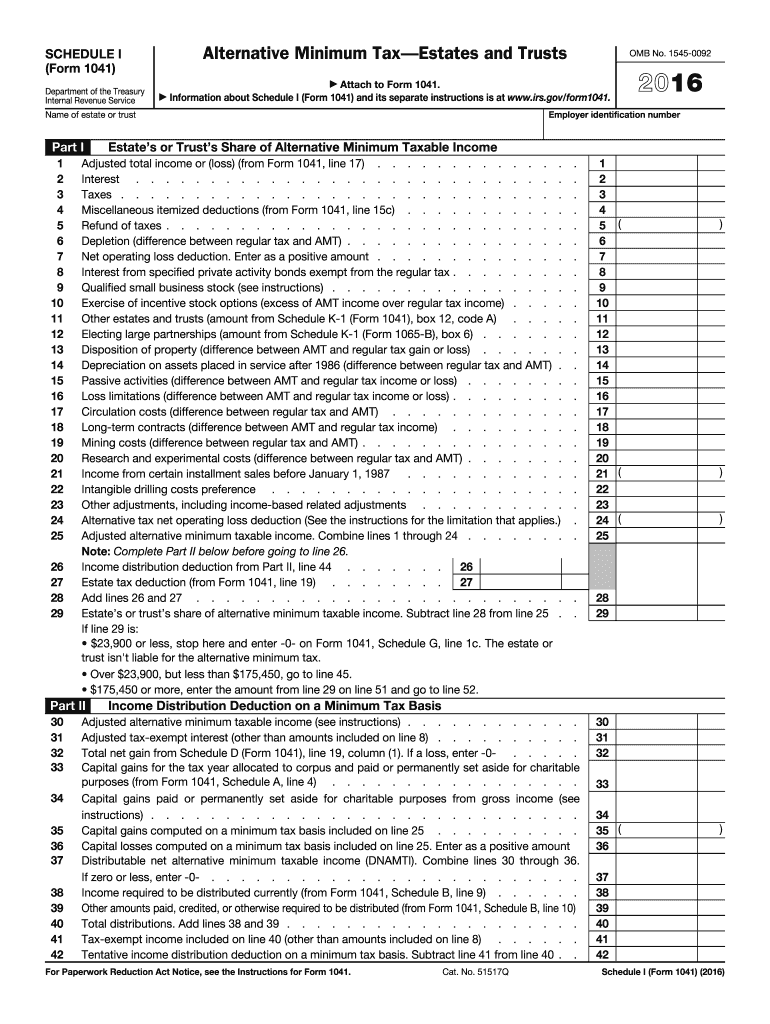

Estates Form 2016

What is the Estates Form

The Estates Form is a legal document used in the United States to manage the distribution of a deceased person's assets. This form plays a crucial role in the probate process, ensuring that the decedent's wishes are honored and that their estate is settled according to state laws. The form typically includes information about the deceased, their beneficiaries, and the assets involved. Understanding the purpose and function of the Estates Form is essential for anyone involved in estate planning or administration.

How to use the Estates Form

Using the Estates Form involves several steps to ensure accurate completion and compliance with legal requirements. First, gather all necessary information, including details about the deceased, their assets, and the beneficiaries. Next, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, it must be signed by the appropriate parties, which may include the executor or administrator of the estate. Finally, submit the form to the appropriate probate court or authority as required by state law.

Steps to complete the Estates Form

Completing the Estates Form involves a systematic approach to ensure all necessary information is included. Follow these steps:

- Collect relevant documents, such as the deceased's will, asset lists, and beneficiary information.

- Fill out the form, providing accurate details about the deceased, their assets, and the beneficiaries.

- Review the completed form for accuracy and completeness.

- Obtain the required signatures from the executor or administrator.

- File the form with the appropriate probate court in your state.

Legal use of the Estates Form

The Estates Form must be used in compliance with state laws to be considered legally binding. Each state has specific regulations governing the probate process and the use of the form. It is essential to understand these legal requirements to ensure that the form is executed correctly. Failure to comply with legal standards can lead to delays in the probate process or disputes among beneficiaries. Consulting with a legal professional can help navigate these complexities.

Required Documents

When completing the Estates Form, several documents are typically required to support the information provided. These may include:

- The deceased's will, if available.

- Death certificate to verify the passing of the individual.

- List of assets, including property, bank accounts, and personal belongings.

- Identification of beneficiaries, including their contact information.

Having these documents ready will facilitate a smoother completion and submission process.

Form Submission Methods

The Estates Form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state probate court's website, if available.

- Mailing the completed form to the appropriate probate court.

- In-person submission at the probate court office.

Each method has its own requirements and processing times, so it is important to check local guidelines for the most efficient approach.

Quick guide on how to complete 2016 estates form

Effortlessly Prepare Estates Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It presents a flawless eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Administer Estates Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Effortlessly Modify and eSign Estates Form

- Obtain Estates Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which is quick and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Estates Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 estates form

Create this form in 5 minutes!

How to create an eSignature for the 2016 estates form

How to generate an eSignature for your 2016 Estates Form online

How to make an eSignature for your 2016 Estates Form in Chrome

How to create an eSignature for putting it on the 2016 Estates Form in Gmail

How to generate an eSignature for the 2016 Estates Form from your mobile device

How to generate an electronic signature for the 2016 Estates Form on iOS devices

How to generate an electronic signature for the 2016 Estates Form on Android devices

People also ask

-

What is an Estates Form and how can airSlate SignNow help?

An Estates Form is a legal document used in estate planning to outline the distribution of assets after someone passes away. airSlate SignNow simplifies the process by allowing users to create, send, and eSign Estates Forms securely and efficiently. With its user-friendly interface, you can easily manage your estate documents, ensuring that your wishes are clearly documented.

-

Can I customize my Estates Form with airSlate SignNow?

Yes, airSlate SignNow offers customizable templates that allow you to tailor your Estates Form to meet your specific needs. You can add fields, signatures, and other necessary details to ensure that your document is comprehensive and legally binding. This flexibility makes estate planning easier and more efficient.

-

What are the pricing options for using airSlate SignNow for Estates Forms?

airSlate SignNow offers several pricing plans to accommodate different needs, including a free trial for new users. The pricing is competitive, making it a cost-effective solution for managing Estates Forms and other documents. You can choose a plan based on the volume of documents you need to handle and the features you require.

-

Is airSlate SignNow secure for handling Estates Forms?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your Estates Forms and personal information. With features like encryption, two-factor authentication, and secure cloud storage, you can trust that your sensitive documents are safe.

-

What features does airSlate SignNow offer for Estates Forms?

airSlate SignNow includes a range of features for managing Estates Forms, such as templates, customizable fields, eSignature capabilities, and automated workflows. These features streamline the process of creating and signing estate documents, making it easier for you to ensure that everything is in order.

-

Can I integrate airSlate SignNow with other software for managing Estates Forms?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow when managing Estates Forms. You can connect it with your CRM, cloud storage services, and other tools to ensure a smooth and efficient process for your estate planning needs.

-

How does eSigning an Estates Form work with airSlate SignNow?

eSigning an Estates Form with airSlate SignNow is straightforward. Once you create your document, simply send it to the signers via email. They can review and electronically sign the form from any device, ensuring a quick turnaround and legally binding agreement without the hassle of printing or scanning.

Get more for Estates Form

- Da31 xfdl form

- Smud generating facility interconnection application smud 2655 smud form

- Application for graduate awards university of iowa uiowa form

- State of iowa workforce employer tax form 65 5300 fillable

- Request for disclosure form

- Individual membership form

- Anatomical bequest programdepartment of anatomy and form

- Lire la noticecerfademande de certificat dimmatric form

Find out other Estates Form

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure