State of Georgia Department of Revenue Withholding 2022

What is the State Of Georgia Department Of Revenue Withholding

The State Of Georgia Department Of Revenue Withholding refers to the process by which employers withhold a portion of employees' wages for state income tax purposes. This withholding is essential for ensuring that state taxes are collected efficiently and helps employees meet their tax obligations throughout the year. The withheld amounts are then remitted to the Georgia Department of Revenue on behalf of the employees, contributing to state revenue and funding public services.

How to use the State Of Georgia Department Of Revenue Withholding

To utilize the State Of Georgia Department Of Revenue Withholding effectively, employers must first register with the Georgia Department of Revenue. This involves obtaining a Georgia Withholding Tax Number. Once registered, employers can calculate the appropriate withholding amounts based on employee wages and the information provided on their W-4 forms. It's important to stay updated on any changes in withholding rates or regulations to ensure compliance.

Steps to complete the State Of Georgia Department Of Revenue Withholding

Completing the State Of Georgia Department Of Revenue Withholding involves several key steps:

- Register for a Georgia Withholding Tax Number with the Department of Revenue.

- Collect completed W-4 forms from employees to determine their withholding allowances.

- Calculate the withholding amount based on the employee's wages and withholding allowances.

- Withhold the calculated amount from each paycheck and keep accurate records.

- Remit the withheld taxes to the Georgia Department of Revenue on a regular schedule.

Legal use of the State Of Georgia Department Of Revenue Withholding

The legal use of the State Of Georgia Department Of Revenue Withholding is governed by state tax laws. Employers are required to withhold the appropriate amounts from employees' wages and remit these taxes to the state. Failure to comply with these laws can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to understand their obligations and ensure timely and accurate withholding to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Georgia Department Of Revenue Withholding are crucial for compliance. Employers must remit withheld taxes on a monthly or quarterly basis, depending on their total tax liability. Key dates include:

- Monthly filers must submit payments by the 15th of the following month.

- Quarterly filers must submit payments by the last day of the month following the end of the quarter.

Penalties for Non-Compliance

Non-compliance with the State Of Georgia Department Of Revenue Withholding can lead to significant penalties. Employers may face fines for failing to withhold the correct amounts, late payments, or for not filing required forms. Additionally, interest may accrue on unpaid taxes. Understanding these penalties emphasizes the importance of accurate and timely compliance with withholding requirements.

Quick guide on how to complete state of georgia department of revenue withholding

Complete State Of Georgia Department Of Revenue Withholding effortlessly on any device

Online document management has gained immense popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documentation, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, edit, and electronically sign your documents swiftly without interruptions. Handle State Of Georgia Department Of Revenue Withholding on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign State Of Georgia Department Of Revenue Withholding with ease

- Find State Of Georgia Department Of Revenue Withholding and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Banish concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any chosen device. Edit and electronically sign State Of Georgia Department Of Revenue Withholding and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of georgia department of revenue withholding

Create this form in 5 minutes!

How to create an eSignature for the state of georgia department of revenue withholding

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

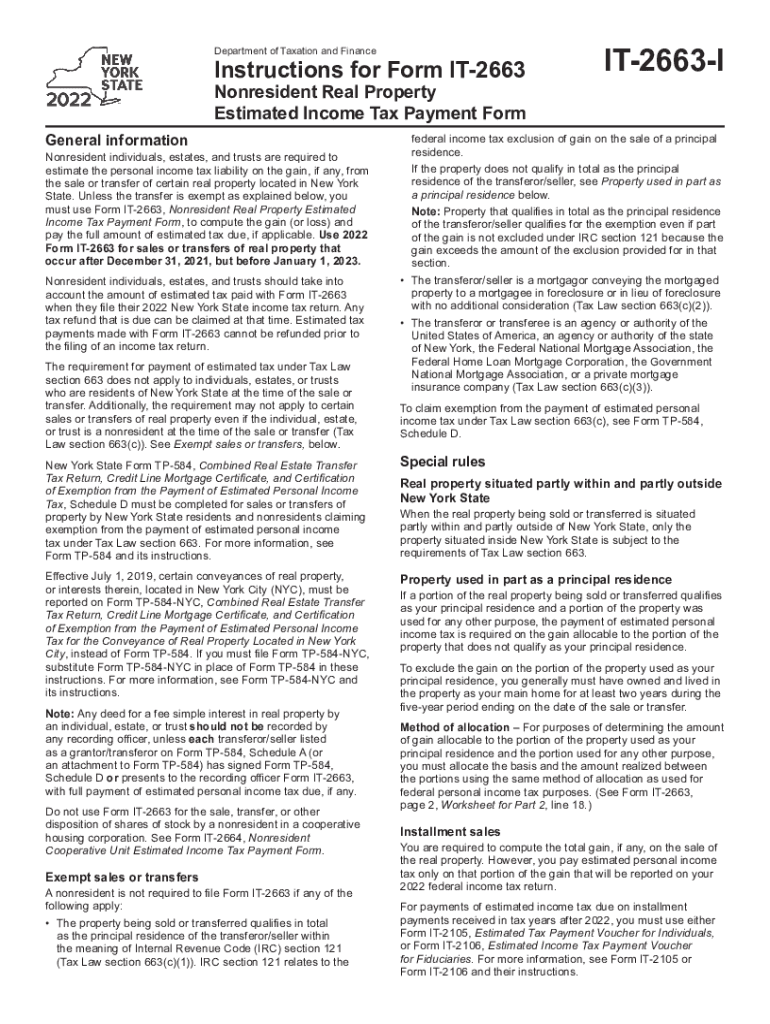

What is the IT 2663 form 2023?

The IT 2663 form 2023 is a New York State tax form used to report the sale of real estate by non-residents. This form is essential for ensuring compliance with state tax obligations and helps streamline the tax process for sellers.

-

How can airSlate SignNow assist with the IT 2663 form 2023?

airSlate SignNow provides a user-friendly platform for digitally signing and sending the IT 2663 form 2023. Our e-signature solution simplifies the process, making it easy to manage documents efficiently while ensuring legal compliance.

-

Is there a cost associated with using airSlate SignNow for the IT 2663 form 2023?

Yes, there are various pricing plans available for using airSlate SignNow's services. Each plan is designed to suit different business needs and provides access to features that help streamline the filing and signing of the IT 2663 form 2023.

-

What features does airSlate SignNow offer for the IT 2663 form 2023?

airSlate SignNow offers features such as customizable templates, secure storage, and automated workflows that enhance the management of the IT 2663 form 2023. These features ensure that you can efficiently prepare, send, and receive signed documents.

-

Are there any integrations available for airSlate SignNow when handling the IT 2663 form 2023?

Yes, airSlate SignNow integrates with various applications, including CRM and document management systems, making it convenient to manage the IT 2663 form 2023 alongside your other business processes. This seamless integration enhances efficiency and organization.

-

Can airSlate SignNow help me track the status of my IT 2663 form 2023?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your IT 2663 form 2023. This ensures that you are always updated on where your document is in the signing process.

-

Is airSlate SignNow compliant with regulations for the IT 2663 form 2023?

Yes, airSlate SignNow is designed to be compliant with various legal and industry regulations, ensuring that all electronic signatures on the IT 2663 form 2023 are valid and enforceable. Our platform prioritizes security and compliance for your peace of mind.

Get more for State Of Georgia Department Of Revenue Withholding

- Postnuptial agreements package louisiana form

- Louisiana recommendation 497309399 form

- Louisiana construction or mechanics lien package individual louisiana form

- Louisiana mechanics lien form

- Storage business package louisiana form

- Child care services package louisiana form

- Special or limited power of attorney for real estate purchase transaction by purchaser louisiana form

- Limited power of attorney where you specify powers with sample powers included louisiana form

Find out other State Of Georgia Department Of Revenue Withholding

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF