it 2663 I 2018

What is the IT 2663 I

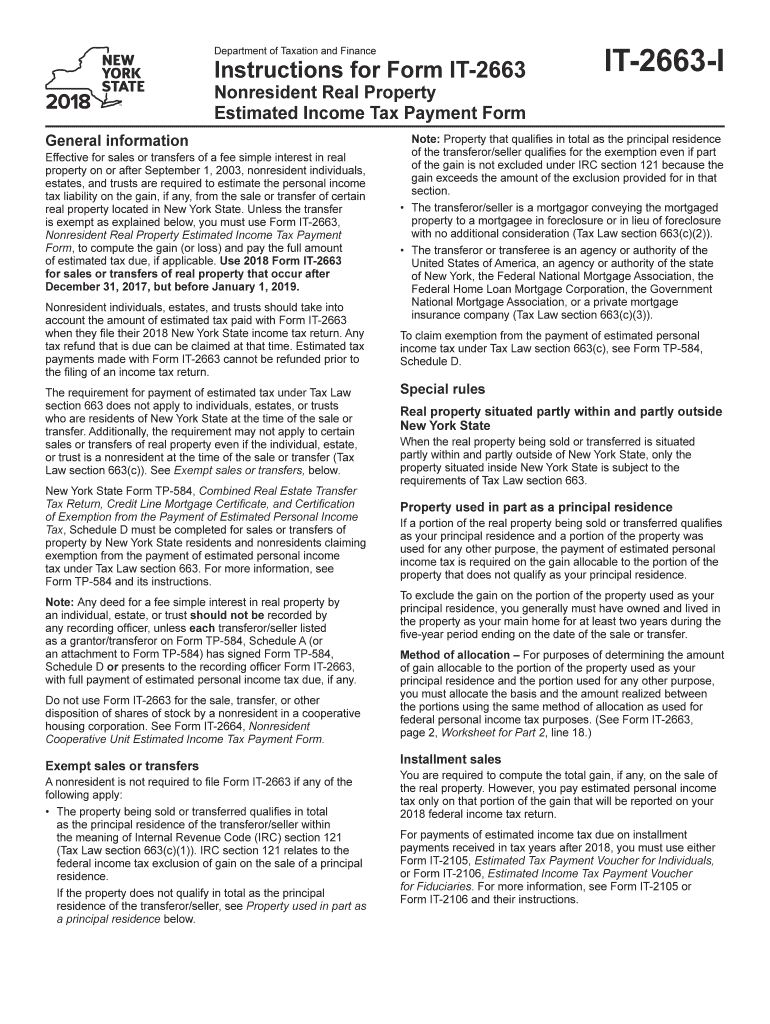

The IT 2663 I is a tax form used in the United States for reporting income derived from nonresident real property. This form is essential for individuals and entities that engage in real estate transactions involving nonresident properties. It ensures compliance with federal tax regulations and helps in accurately reporting income to the Internal Revenue Service (IRS).

How to use the IT 2663 I

Using the IT 2663 I involves filling out the form with accurate information regarding the property and the income generated. Taxpayers must provide details such as the property's location, the amount of income earned, and any applicable deductions. It is important to ensure that all information is complete and accurate to avoid issues with the IRS.

Steps to complete the IT 2663 I

Completing the IT 2663 I requires several steps:

- Gather necessary information about the property and income.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the specified deadline.

Legal use of the IT 2663 I

The IT 2663 I is legally binding when filled out correctly and submitted on time. It adheres to IRS regulations, ensuring that taxpayers fulfill their obligations regarding nonresident real property income. Proper use of this form helps prevent legal complications and penalties associated with non-compliance.

IRS Guidelines

The IRS provides specific guidelines for completing the IT 2663 I. These guidelines include instructions on what information is required, how to report income, and the importance of accurate reporting. Taxpayers should familiarize themselves with these guidelines to ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IT 2663 I. Typically, the form must be submitted by the tax filing deadline for the year in which the income was earned. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

When completing the IT 2663 I, taxpayers may need to provide additional documentation to support their claims. This may include:

- Proof of property ownership.

- Records of income earned from the property.

- Any relevant tax documents that pertain to the transaction.

Quick guide on how to complete how and where do i file form it 2663 nonresident real property

Effortlessly manage It 2663 I on any gadget

Digital document administration has become increasingly favored by both companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow supplies all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle It 2663 I on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

Steps to modify and electronically sign It 2663 I effortlessly

- Obtain It 2663 I and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen gadget. Modify and electronically sign It 2663 I and ensure outstanding communication at every level of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how and where do i file form it 2663 nonresident real property

Create this form in 5 minutes!

How to create an eSignature for the how and where do i file form it 2663 nonresident real property

How to make an electronic signature for the How And Where Do I File Form It 2663 Nonresident Real Property online

How to make an eSignature for your How And Where Do I File Form It 2663 Nonresident Real Property in Google Chrome

How to create an eSignature for putting it on the How And Where Do I File Form It 2663 Nonresident Real Property in Gmail

How to make an electronic signature for the How And Where Do I File Form It 2663 Nonresident Real Property from your mobile device

How to make an electronic signature for the How And Where Do I File Form It 2663 Nonresident Real Property on iOS

How to create an electronic signature for the How And Where Do I File Form It 2663 Nonresident Real Property on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 2663 i?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and eSign documents seamlessly. The term 'it 2663 i' is often associated with our product's capabilities, emphasizing our commitment to delivering an intuitive and effective signing experience.

-

How much does airSlate SignNow cost for the it 2663 i plan?

Pricing for airSlate SignNow varies based on the features and scale of your needs. The it 2663 i plan offers competitive rates designed to provide value while ensuring you have access to essential eSignature tools and features.

-

What features are included in the airSlate SignNow it 2663 i package?

The airSlate SignNow it 2663 i package includes a range of features such as document templates, real-time tracking, and secure cloud storage. These tools are designed to make the signing process fast and efficient for users.

-

How can airSlate SignNow benefit businesses using it 2663 i?

Businesses utilizing the airSlate SignNow it 2663 i solution can streamline their document workflows, reduce turnaround time, and improve overall efficiency. This leads to increased productivity and better customer satisfaction through faster service.

-

Is it 2663 i suitable for small businesses?

Absolutely! The airSlate SignNow it 2663 i plan is tailored to meet the needs of small businesses, providing an accessible and cost-effective eSignature solution. With its user-friendly interface, even those without technical skills can navigate the platform easily.

-

Can airSlate SignNow integrate with other software while using it 2663 i?

Yes, airSlate SignNow supports integrations with a variety of platforms such as CRMs and accounting software while utilizing the it 2663 i plan. This enhances your existing workflows, allowing for seamless document management across different tools.

-

How secure is the airSlate SignNow it 2663 i solution?

Security is a top priority for airSlate SignNow's it 2663 i solution. We employ advanced encryption and compliance measures to ensure that all documents signed using our platform are protected against unauthorized access and data bsignNowes.

Get more for It 2663 I

- Form ptr 818

- Athabasca osap papers form

- Rc151 fillable form

- Application for automobile insurance alberta finance and enterprise finance alberta form

- Brinks application form

- Sears job application pdf form

- Replying to an application filed by an applicant ministry of justice ag gov bc form

- Record of suspension 2013 form

Find out other It 2663 I

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple