Instructions for Form it 2663Nonresident Real Property Estimated 2021

What is the IT-2663 Form for Nonresident Real Property Estimated Tax?

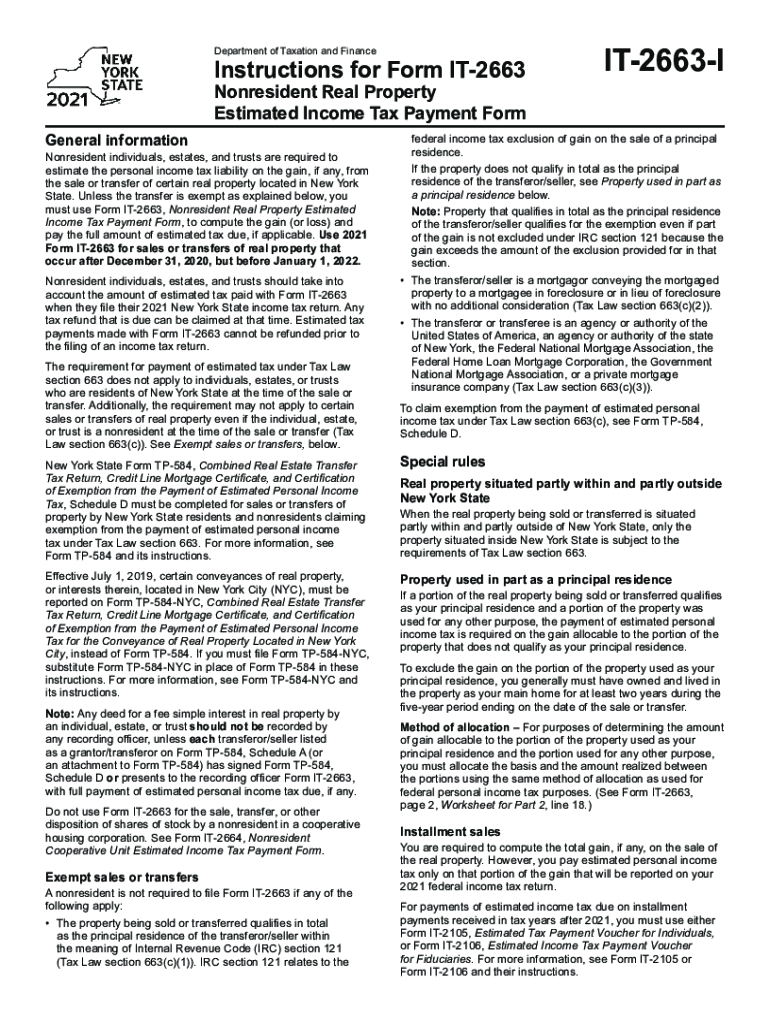

The IT-2663 form is a tax document used by nonresident individuals and entities to report and pay estimated taxes on income derived from the sale of real property located in New York State. This form is essential for ensuring compliance with state tax obligations when a nonresident sells property in New York. The form helps calculate the estimated tax liability based on the anticipated gain from the sale, allowing the seller to remit the appropriate amount to the New York State Department of Taxation and Finance.

Steps to Complete the IT-2663 Form

Completing the IT-2663 form involves several key steps:

- Gather necessary information, including the property address, sale price, and purchase price.

- Calculate the estimated gain from the sale by subtracting the purchase price from the sale price.

- Determine the applicable tax rate based on the estimated gain and your residency status.

- Fill out the form accurately, ensuring all figures are correct and that you provide any required identification numbers.

- Review the completed form for accuracy before submission.

Required Documents for IT-2663 Form Submission

When completing the IT-2663 form, certain documents may be required to support your submission. These include:

- Proof of property ownership, such as a deed or title.

- Documentation of the sale agreement, including the sale price.

- Any previous tax returns that may affect your estimated tax calculation.

Filing Deadlines for the IT-2663 Form

It is crucial to be aware of the filing deadlines associated with the IT-2663 form. Typically, the form must be submitted by the date of the property sale or within a specified period following the sale. Failure to file on time may result in penalties or interest on unpaid taxes. Always check the New York State Department of Taxation and Finance for the most current deadlines.

Form Submission Methods for IT-2663

The IT-2663 form can be submitted through various methods to accommodate different preferences:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Legal Use of the IT-2663 Form

The IT-2663 form is legally binding when completed and submitted according to New York State tax laws. Proper execution ensures that nonresidents fulfill their tax obligations, thereby avoiding potential legal issues related to unpaid taxes. It is essential to follow all instructions carefully and maintain records of the submission for future reference.

Quick guide on how to complete instructions for form it 2663nonresident real property estimated

Complete Instructions For Form IT 2663Nonresident Real Property Estimated effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Instructions For Form IT 2663Nonresident Real Property Estimated across any platform with airSlate SignNow apps for Android or iOS and streamline any document-focused task today.

How to modify and eSign Instructions For Form IT 2663Nonresident Real Property Estimated with ease

- Locate Instructions For Form IT 2663Nonresident Real Property Estimated and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Review all the details and then select the Done button to save your modifications.

- Choose your preferred method of submission for your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Instructions For Form IT 2663Nonresident Real Property Estimated and maintain outstanding communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 2663nonresident real property estimated

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 2663nonresident real property estimated

The way to generate an e-signature for your PDF in the online mode

The way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the 2663 form and why do I need it for New York State?

The 2663 form is a vital document for certain legal and administrative processes in New York State. To ensure compliance with state regulations, it's important to understand how do I complete it 2663 form for New York State correctly, as errors can lead to delays or legal issues.

-

How do I access the 2663 form on airSlate SignNow?

You can easily access the 2663 form on airSlate SignNow by navigating to our template library. To learn how do I complete it 2663 form for New York State, simply select the form, and our platform will guide you through the completion process.

-

Are there any costs associated with using airSlate SignNow for the 2663 form?

While airSlate SignNow offers various pricing plans, the cost will depend on the features you choose. Our platform provides cost-effective solutions for document signing, so you can efficiently find out how do I complete it 2663 form for New York State within your budget.

-

Can airSlate SignNow help me with electronic signatures for my 2663 form?

Absolutely! airSlate SignNow allows you to electronically sign documents securely and legally. If you're wondering how do I complete it 2663 form for New York State, our eSigning feature ensures your form is valid and accepted by state authorities.

-

What features does airSlate SignNow offer for completing documents like the 2663 form?

AirSlate SignNow offers a user-friendly interface, document templates, and streamlined workflows. To see how do I complete it 2663 form for New York State efficiently, take advantage of our features like drag-and-drop fields and automated reminders.

-

Is there customer support available if I need help with the 2663 form?

Yes, airSlate SignNow provides dedicated customer support to assist you with your queries. If you're stuck on how do I complete it 2663 form for New York State, our support team is ready to guide you through the process.

-

Can I integrate airSlate SignNow with other tools I use for document management?

Yes, airSlate SignNow seamlessly integrates with various platforms like Google Drive, Dropbox, and others. This integration can enhance your workflow as you learn how do I complete it 2663 form for New York State alongside your other documents.

Get more for Instructions For Form IT 2663Nonresident Real Property Estimated

- Mutual wills package with last wills and testaments for married couple with no children alabama form

- Mutual wills package with last wills and testaments for married couple with minor children alabama form

- Legal last will and testament form for married person with adult and minor children from prior marriage alabama

- Legal last will and testament form for married person with adult and minor children alabama

- Mutual wills package with last wills and testaments for married couple with adult and minor children alabama form

- Al widow 497296216 form

- Legal last will and testament form for widow or widower with minor children alabama

- Legal last will form for a widow or widower with no children alabama

Find out other Instructions For Form IT 2663Nonresident Real Property Estimated

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe