Tax Custhelp ComappanswersHow and Where Do I File Form it 2663, Nonresident Real 2023

Understanding Form IT-2663

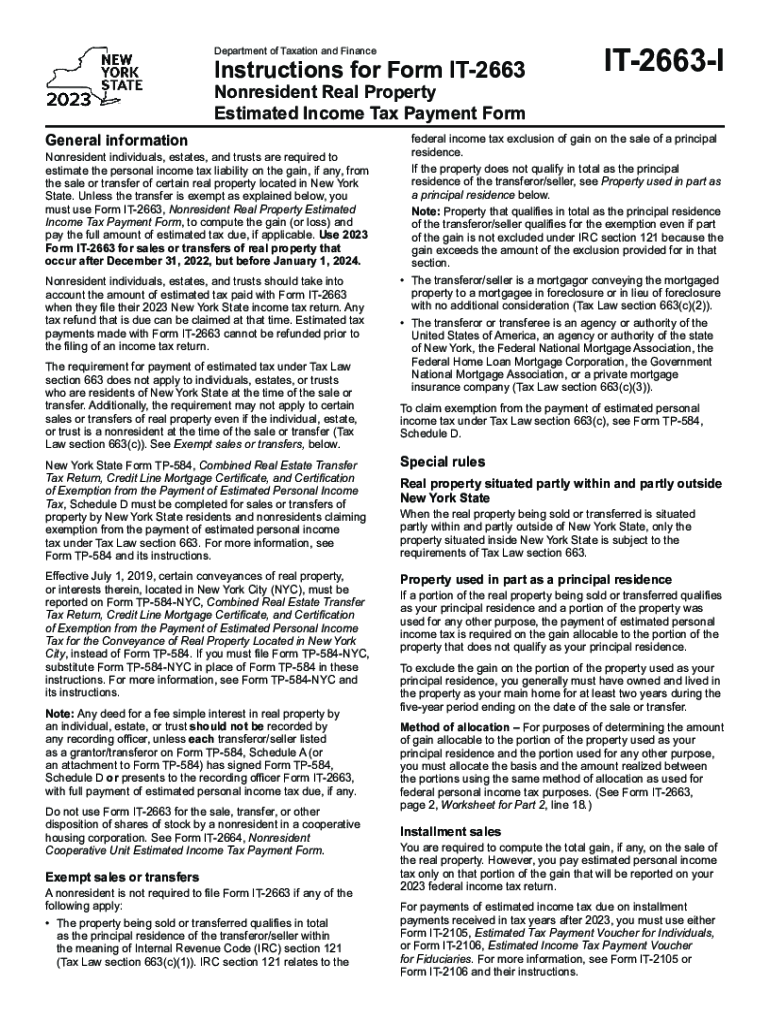

Form IT-2663 is a tax document used by nonresidents in the United States to report and pay tax on the sale of real property located in New York State. This form is essential for ensuring compliance with state tax laws and is typically required when a nonresident sells real estate in New York. Understanding the purpose of this form is crucial for nonresidents to avoid penalties and ensure proper tax reporting.

Steps to Complete Form IT-2663

Completing Form IT-2663 involves several key steps. First, gather all necessary information regarding the property being sold, including the sales price and any adjustments. Next, fill out the form accurately, providing details such as your name, address, and the property’s location. Ensure that you calculate the tax due based on the sale price and any applicable deductions. Finally, review the form for accuracy before submission.

Filing Methods for Form IT-2663

Form IT-2663 can be submitted through various methods. Nonresidents have the option to file the form online, via mail, or in person at designated tax offices. Online filing is often the most efficient method, allowing for quicker processing. If submitting by mail, ensure that you send the form to the correct address specified by the New York State Department of Taxation and Finance. In-person submissions may be made at local tax offices, providing an opportunity to ask questions directly.

Key Elements of Form IT-2663

Several key elements must be included when completing Form IT-2663. These include the seller's information, the buyer's details, the property description, and the sale price. Additionally, it is important to include any deductions or exemptions that apply to the sale. Accurate reporting of these elements is essential for calculating the correct tax amount owed and ensuring compliance with state tax regulations.

Important Deadlines for Filing Form IT-2663

Timely filing of Form IT-2663 is crucial to avoid penalties. The form must be filed within a specific timeframe following the sale of the property. Typically, the deadline aligns with the closing date of the sale. Nonresidents should be aware of these deadlines to ensure they submit the form on time and avoid any additional fees or complications.

Eligibility Criteria for Using Form IT-2663

Eligibility to use Form IT-2663 is primarily determined by residency status. Nonresidents who sell real property in New York State must file this form to report the sale and pay any applicable taxes. It is important for sellers to confirm their nonresident status and understand any specific conditions that may affect their eligibility to use this form.

Quick guide on how to complete tax custhelp comappanswershow and where do i file form it 2663 nonresident real

Effortlessly Complete Tax custhelp comappanswersHow And Where Do I File Form IT 2663, Nonresident Real on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Tax custhelp comappanswersHow And Where Do I File Form IT 2663, Nonresident Real on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and eSign Tax custhelp comappanswersHow And Where Do I File Form IT 2663, Nonresident Real Effortlessly

- Locate Tax custhelp comappanswersHow And Where Do I File Form IT 2663, Nonresident Real and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Tax custhelp comappanswersHow And Where Do I File Form IT 2663, Nonresident Real and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax custhelp comappanswershow and where do i file form it 2663 nonresident real

Create this form in 5 minutes!

How to create an eSignature for the tax custhelp comappanswershow and where do i file form it 2663 nonresident real

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 2663 i and how does it work with airSlate SignNow?

The 'it 2663 i' refers to our document eSigning process integrated within airSlate SignNow. This robust solution allows users to send, sign, and manage documents seamlessly online, ensuring that all signed documents are legally binding and secure.

-

How much does airSlate SignNow cost for using it 2663 i?

airSlate SignNow offers competitive pricing options for users wanting to utilize the it 2663 i service. Plans start at an affordable monthly rate, and there are tiered packages available to fit various business sizes and needs, ensuring flexibility and cost-effectiveness.

-

What features are included in the it 2663 i package?

The it 2663 i package includes features like customizable templates, real-time tracking of document status, and user permissions to streamline workflow. Additionally, users can benefit from automated reminders and comprehensive analytics to enhance their document management process.

-

Can I integrate airSlate SignNow with other applications for the it 2663 i workflow?

Yes, airSlate SignNow allows seamless integrations with various applications, making it easy to enhance your it 2663 i workflow. You can connect with popular platforms like Google Drive, Salesforce, and Zapier, allowing for a more cohesive and efficient digital ecosystem.

-

What are the benefits of using it 2663 i with airSlate SignNow?

Using it 2663 i with airSlate SignNow offers businesses improved efficiency and reduced turnaround times for document signing. The easy-to-use interface enhances user experience, while compliance and security features ensure that all documents are managed safely and legally.

-

Is the it 2663 i feature suitable for large enterprises?

Absolutely! The it 2663 i feature of airSlate SignNow is designed to cater to businesses of all sizes, including large enterprises. With scalability and robust security features, it meets the complex needs of larger organizations looking for efficient eSigning solutions.

-

How does airSlate SignNow ensure the security of documents signed via it 2663 i?

AirSlate SignNow employs advanced encryption and secure storage protocols to protect documents signed through the it 2663 i feature. Compliance with industry standards and regulations ensures that your documents remain confidential and secure throughout the signing process.

Get more for Tax custhelp comappanswersHow And Where Do I File Form IT 2663, Nonresident Real

Find out other Tax custhelp comappanswersHow And Where Do I File Form IT 2663, Nonresident Real

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure