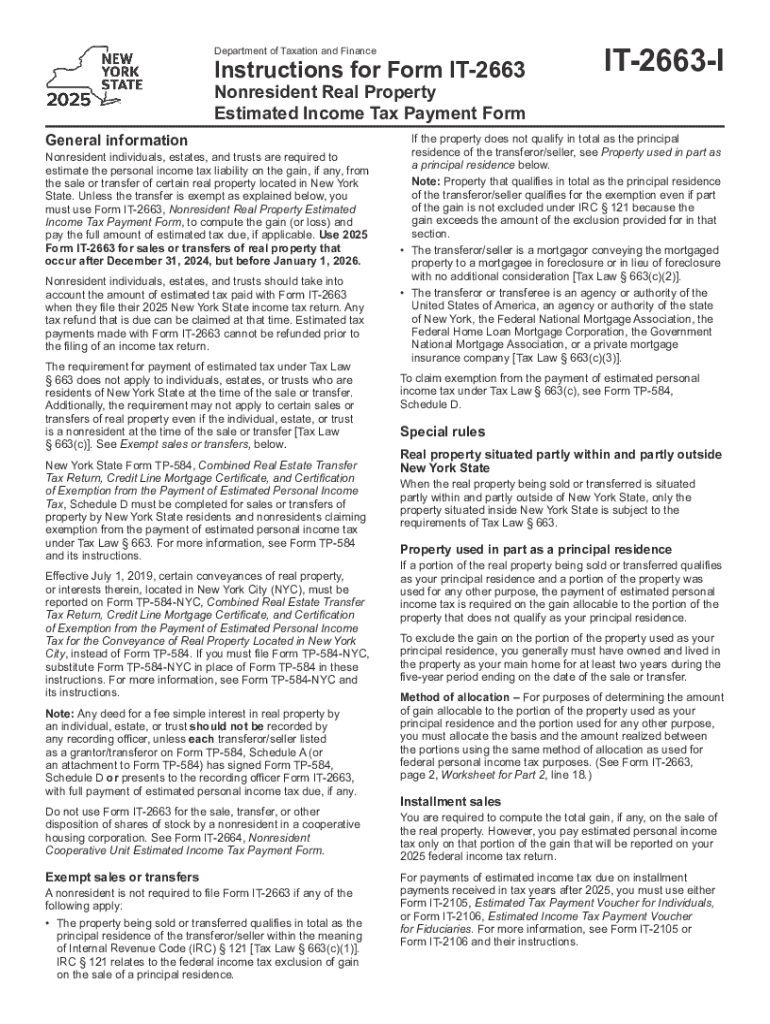

Instructions for Form it 2663 Nonresident Real Property Estimated Income Tax Payment FormTax Year 2025-2026

Understanding Form IT 2663: Nonresident Real Property Estimated Income Tax Payment

Form IT 2663 is designed for nonresident individuals who are required to make estimated income tax payments on income derived from real property in the United States. This form is crucial for ensuring compliance with state tax obligations, particularly for those who may not reside in the state where the property is located. By using this form, taxpayers can accurately report their estimated tax liabilities associated with real estate transactions.

Steps to Complete Form IT 2663

Completing Form IT 2663 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the real property, including its location and the income it generates. Next, calculate the estimated tax liability based on the income derived from the property. Fill out the form by providing personal details, property information, and the calculated tax amount. Be sure to review the form for any errors before submission. Finally, submit the form by the specified deadline to avoid penalties.

Legal Use of Form IT 2663

Form IT 2663 serves a legal purpose by providing a structured way for nonresident taxpayers to fulfill their tax obligations related to real property income. It is essential for compliance with state tax laws, helping to prevent potential legal issues that may arise from underreporting or failing to report income. Understanding the legal implications of this form can aid taxpayers in maintaining good standing with tax authorities.

Filing Deadlines for Form IT 2663

Filing deadlines for Form IT 2663 are critical to ensure timely compliance with tax obligations. Typically, estimated payments are due quarterly, aligning with the state’s tax calendar. It is important for taxpayers to be aware of these deadlines to avoid late fees or penalties. Keeping track of dates and planning ahead can facilitate smoother tax management.

Key Elements of Form IT 2663

Form IT 2663 includes several key elements that are essential for accurate completion. These elements typically encompass taxpayer identification information, details about the property, and the estimated tax calculation. Each section must be filled out carefully to ensure that the form meets all regulatory requirements. Understanding these components can help taxpayers navigate the form more effectively.

Obtaining Form IT 2663

Form IT 2663 can be obtained through official state tax department websites or by contacting the relevant tax authority directly. Many states provide downloadable versions of the form, making it accessible for taxpayers. It is advisable to ensure that the most current version of the form is used to comply with any recent changes in tax regulations.

Examples of Using Form IT 2663

Examples of using Form IT 2663 can provide clarity on its application. For instance, a nonresident property owner renting out a vacation home in the United States would use this form to report rental income and pay estimated taxes. Similarly, an investor who owns commercial property in another state would also utilize this form to meet tax obligations. These scenarios highlight the practical importance of the form in various real estate contexts.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 2663 nonresident real property estimated income tax payment formtax year

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 2663 nonresident real property estimated income tax payment formtax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2663 i feature in airSlate SignNow?

The it 2663 i feature in airSlate SignNow allows users to streamline their document signing process. This feature enhances efficiency by enabling quick and secure electronic signatures, making it ideal for businesses looking to optimize their workflows.

-

How much does airSlate SignNow cost for using the it 2663 i feature?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective for businesses of all sizes. The it 2663 i feature is included in all plans, ensuring that you get the best value for your investment in document management.

-

What are the key benefits of using the it 2663 i feature?

The it 2663 i feature offers numerous benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced security. By utilizing this feature, businesses can improve their overall productivity and customer satisfaction.

-

Can I integrate airSlate SignNow with other tools while using the it 2663 i feature?

Yes, airSlate SignNow supports integrations with various third-party applications, allowing you to enhance your workflow. The it 2663 i feature works seamlessly with popular tools like CRM systems and project management software, making it a versatile choice for businesses.

-

Is the it 2663 i feature user-friendly for non-technical users?

Absolutely! The it 2663 i feature in airSlate SignNow is designed with user-friendliness in mind. Even non-technical users can easily navigate the platform, making it accessible for everyone in your organization.

-

What types of documents can I sign using the it 2663 i feature?

You can sign a wide variety of documents using the it 2663 i feature, including contracts, agreements, and forms. This flexibility allows businesses to handle all their signing needs in one place, simplifying document management.

-

How secure is the it 2663 i feature for document signing?

The it 2663 i feature in airSlate SignNow employs advanced security measures to protect your documents. With encryption and secure access controls, you can trust that your sensitive information remains safe throughout the signing process.

Get more for Instructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormTax Year

Find out other Instructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormTax Year

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online