Fillable Online Maryland Form 502502B Maryland 2021

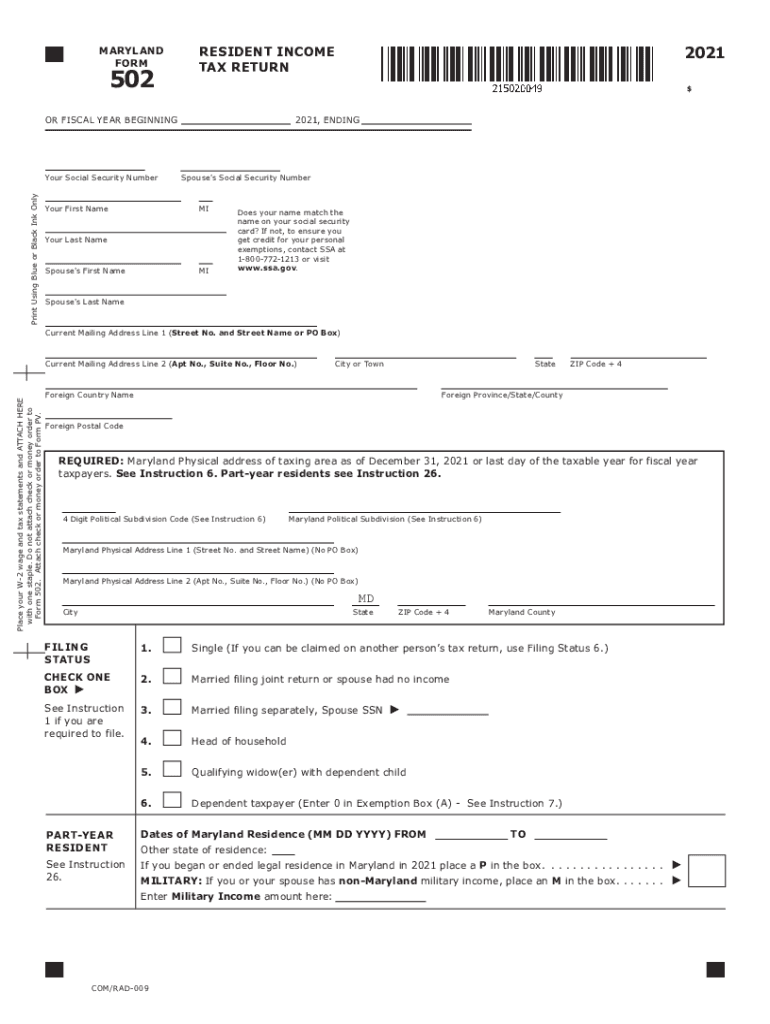

What is the Maryland Form 502?

The Maryland Form 502, also known as the Maryland Resident Income Tax Return, is a tax document that residents of Maryland must complete to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it ensures compliance with Maryland state tax laws. The form captures various income sources, deductions, and credits applicable to Maryland residents, allowing for an accurate assessment of the taxpayer's financial obligations for the year.

Steps to Complete the Maryland Form 502

Completing the Maryland Form 502 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the designated lines.

- Claim any applicable deductions and credits, which can reduce your taxable income.

- Calculate your total tax liability using the provided tax tables or software.

- Sign and date the form before submission.

Legal Use of the Maryland Form 502

The Maryland Form 502 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must provide accurate information and adhere to all filing deadlines. E-signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Using a reliable e-signature platform can enhance the security and authenticity of your submission.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the Maryland Form 502 is crucial for avoiding penalties. Typically, the deadline for filing is April 15 of each year. If April 15 falls on a weekend or holiday, the due date may be extended. Taxpayers should also be aware of any additional deadlines for extensions or specific credits that may apply. Staying informed about these dates can help ensure timely and compliant submissions.

Required Documents for the Maryland Form 502

To accurately complete the Maryland Form 502, taxpayers should prepare several key documents, including:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Having these documents on hand will streamline the completion process and help ensure accuracy.

Form Submission Methods

The Maryland Form 502 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using e-filing systems, which often provide a faster and more efficient process. Alternatively, the form can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is essential to select the option that best suits your needs.

Quick guide on how to complete fillable online maryland form 502502b 2020 2020 maryland

Complete Fillable Online Maryland Form 502502B Maryland effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Fillable Online Maryland Form 502502B Maryland on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Fillable Online Maryland Form 502502B Maryland with ease

- Find Fillable Online Maryland Form 502502B Maryland and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or redact sensitive information using the tools available through airSlate SignNow specifically designed for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds exactly the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online Maryland Form 502502B Maryland and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online maryland form 502502b 2020 2020 maryland

Create this form in 5 minutes!

How to create an eSignature for the fillable online maryland form 502502b 2020 2020 maryland

The best way to create an e-signature for a PDF file online

The best way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the MD 502 form?

The MD 502 form is a crucial document used in various administrative processes, particularly within healthcare settings in Maryland. Understanding its purpose is essential for anyone involved in medical documentation or record-keeping. airSlate SignNow can help streamline the process of completing and sending the MD 502 form efficiently.

-

How can airSlate SignNow assist with completing the MD 502 form?

airSlate SignNow provides an easy-to-use platform that allows users to fill out and eSign the MD 502 form electronically. This feature not only saves time but also ensures that the form is completed accurately and securely. By using our solution, you can eliminate paper waste and simplify document management.

-

Is airSlate SignNow cost-effective for managing the MD 502 form?

Yes, airSlate SignNow is a cost-effective solution for managing the MD 502 form and other critical documents. With transparent pricing plans, businesses can choose an option that fits their budget while still enjoying robust features. This allows teams to spend less on administrative tasks and focus more on their core activities.

-

What features does airSlate SignNow offer for the MD 502 form?

airSlate SignNow offers a range of features for handling the MD 502 form, including templates, electronic signatures, and real-time collaboration. These functionalities enhance the efficiency and accuracy of document handling. Users can also track the status of the MD 502 form to ensure timely processing.

-

Can I integrate airSlate SignNow with other tools for managing the MD 502 form?

Absolutely! airSlate SignNow boasts integrations with various third-party applications which can enhance the management of the MD 502 form. Whether you are using CRM systems, cloud storage, or other productivity tools, our platform seamlessly connects to your existing workflow, boosting efficiency.

-

How secure is the MD 502 form when using airSlate SignNow?

Security is a top priority for airSlate SignNow when handling sensitive documents like the MD 502 form. Our platform employs advanced encryption measures and complies with industry regulations to ensure that your data remains protected. You can confidently manage and store your MD 502 form without worrying about security bsignNowes.

-

What are the benefits of using airSlate SignNow for the MD 502 form?

Using airSlate SignNow for the MD 502 form offers several benefits, including improved efficiency, reduced processing time, and enhanced document management. Users can quickly fill, sign, and share the MD 502 form from any device, facilitating rapid turnaround. This user-friendly solution ultimately leads to a more organized workflow.

Get more for Fillable Online Maryland Form 502502B Maryland

- Letter landlord tenant 497310249 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497310250 form

- Md letter landlord form

- Maryland law enforcement form

- Maryland violation form

- Md rent increase form

- Md tenant landlord 497310255 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase maryland form

Find out other Fillable Online Maryland Form 502502B Maryland

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house