Maryland State Tax Form 502 2016

What is the Maryland State Tax Form 502

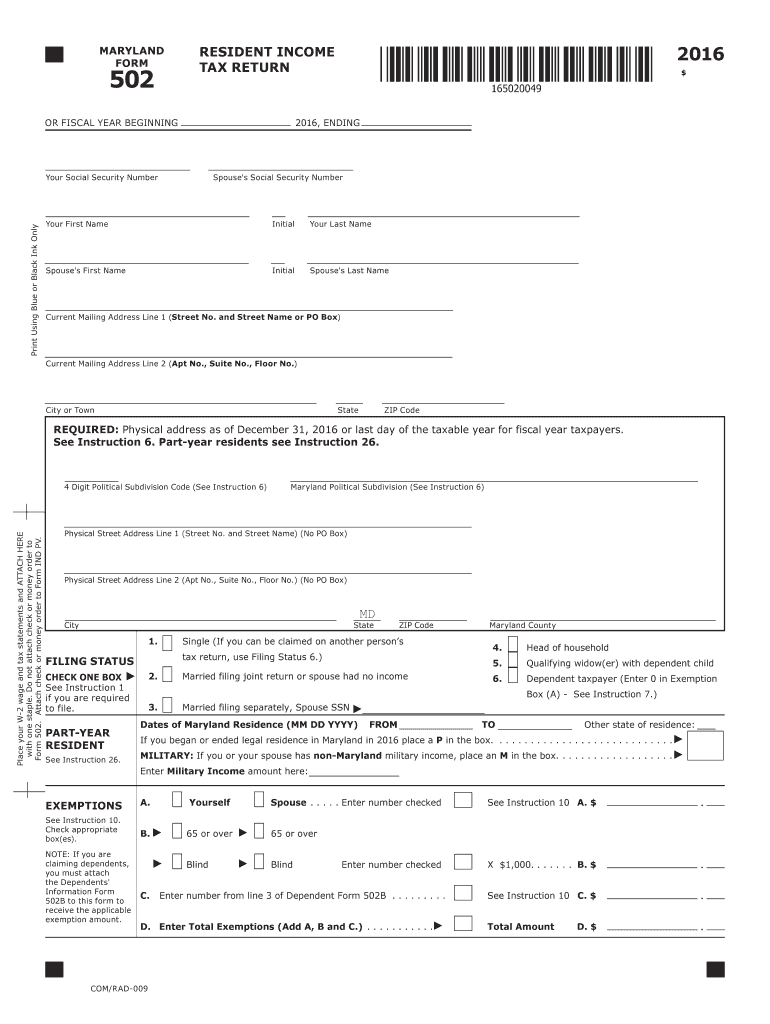

The Maryland State Tax Form 502 is a crucial document used by residents of Maryland to report their income and calculate their state tax obligations. This form is primarily designed for individual taxpayers, including those who are self-employed or have other income sources. It serves as a means for the Maryland Comptroller's office to assess and collect state income taxes effectively. Understanding the purpose and requirements of Form 502 is essential for ensuring compliance with state tax laws.

How to use the Maryland State Tax Form 502

Using the Maryland State Tax Form 502 involves several steps to ensure accurate reporting of your income and deductions. Begin by gathering all necessary financial documents, including W-2s, 1099s, and records of any additional income. Next, carefully fill out the form, providing accurate details about your income, deductions, and credits. It is important to review the instructions included with the form to ensure that you meet all requirements. Once completed, you can submit the form electronically or via mail, depending on your preference.

Steps to complete the Maryland State Tax Form 502

Completing the Maryland State Tax Form 502 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and deduction records.

- Download the Maryland State Tax Form 502 from the official state website or access it through an e-filing service.

- Fill out the form, ensuring all information is accurate and complete.

- Double-check your entries for any errors or omissions.

- Submit the completed form electronically or mail it to the appropriate address.

Legal use of the Maryland State Tax Form 502

The Maryland State Tax Form 502 is legally recognized for reporting income and calculating tax liabilities. To ensure its legal validity, it must be completed accurately and submitted within the designated filing deadlines. Electronic submissions are accepted and carry the same legal weight as paper submissions, provided they comply with eSignature regulations. Utilizing a trusted e-signature platform can enhance the security and legitimacy of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland State Tax Form 502 are critical for compliance. Typically, the deadline for submitting the form is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or additional extensions that may be granted by the state.

Required Documents

When preparing to complete the Maryland State Tax Form 502, several documents are necessary to ensure accurate reporting. Key documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will streamline the completion process and help avoid errors.

Quick guide on how to complete maryland state tax form 502 2016

Complete Maryland State Tax Form 502 seamlessly on any device

Digital document management has become increasingly favored among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Maryland State Tax Form 502 on any device utilizing airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Maryland State Tax Form 502 effortlessly

- Find Maryland State Tax Form 502 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your amendments.

- Select your preferred method for delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Maryland State Tax Form 502 to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland state tax form 502 2016

Create this form in 5 minutes!

How to create an eSignature for the maryland state tax form 502 2016

How to generate an eSignature for your Maryland State Tax Form 502 2016 online

How to generate an eSignature for your Maryland State Tax Form 502 2016 in Chrome

How to make an electronic signature for signing the Maryland State Tax Form 502 2016 in Gmail

How to create an eSignature for the Maryland State Tax Form 502 2016 straight from your mobile device

How to make an electronic signature for the Maryland State Tax Form 502 2016 on iOS devices

How to create an eSignature for the Maryland State Tax Form 502 2016 on Android

People also ask

-

What is the Maryland State Tax Form 502?

The Maryland State Tax Form 502 is a document used by residents of Maryland to report their income and calculate their state taxes. This form is essential for ensuring compliance with state tax laws and requires accurate information for proper filing.

-

How can airSlate SignNow help with Maryland State Tax Form 502?

airSlate SignNow simplifies the process of completing and eSigning the Maryland State Tax Form 502. Our platform allows you to efficiently fill out the form digitally and securely send it to the relevant authorities without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for Maryland State Tax Form 502?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. You can easily choose a plan that fits your budget while ensuring seamless eSigning of the Maryland State Tax Form 502 and other documents.

-

What features does airSlate SignNow offer for filling out tax forms like the Maryland State Tax Form 502?

Our platform includes features like customizable templates, automated workflows, and secure cloud storage to streamline your tax filing process. For the Maryland State Tax Form 502, these features ensure you can complete and manage your tax documents efficiently.

-

Can I integrate airSlate SignNow with other tools for my Maryland State Tax Form 502 needs?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This makes it easy to manage all your documents, including the Maryland State Tax Form 502, within your existing workflows.

-

What are the benefits of using airSlate SignNow for electronic signatures on tax forms?

Using airSlate SignNow for electronic signatures on the Maryland State Tax Form 502 offers multiple benefits, including faster processing times, reduced paper usage, and enhanced security. This ensures that your sensitive information remains confidential while meeting tax deadlines.

-

How secure is airSlate SignNow for completing the Maryland State Tax Form 502?

AirSlate SignNow prioritizes security, utilizing bank-level encryption to protect your data. When completing and eSigning the Maryland State Tax Form 502, you can be confident that your information is safe from unauthorized access.

Get more for Maryland State Tax Form 502

- South carolina bill of sale for automobile or vehicle including odometer statement and promissory note form

- Sample last will and testament for maryland form

- Quick claim deed form missouri

- Lawn form

- Forming a llc in michigan

- Bill of sale for a horse form

- New mexico claim of lien by individual form

- Kentucky financial statements only in connection with prenuptial premarital agreement form

Find out other Maryland State Tax Form 502

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free