Income Tax Forms for Tax Year Maryland 2022

What is the Maryland State Income Tax Form?

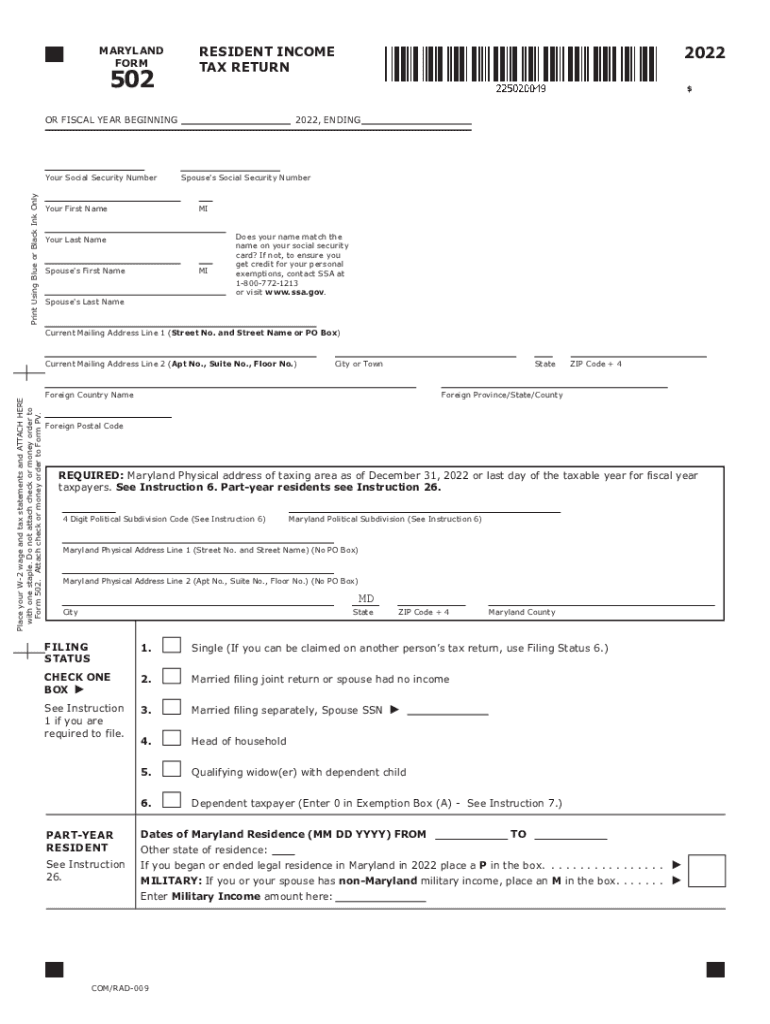

The Maryland State Income Tax Form, commonly referred to as the Maryland Form 502, is a document that residents of Maryland use to report their annual income to the state tax authority. This form is essential for individuals to calculate their tax liability based on their earnings, deductions, and credits for the tax year. The Maryland tax forms are structured to accommodate various income types, including wages, self-employment income, and investment earnings, ensuring that taxpayers can accurately report their financial situation.

Steps to Complete the Maryland State Income Tax Form

Completing the Maryland Form 502 involves several key steps to ensure accuracy and compliance with state tax regulations. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total income on the form, including all applicable deductions and credits. Be sure to double-check your calculations to avoid errors. Finally, sign and date the form before submitting it to the Maryland State Comptroller's office.

Legal Use of the Maryland State Income Tax Form

The Maryland Form 502 is legally binding when completed accurately and submitted in accordance with state guidelines. To ensure that the form is recognized as valid, it must include a proper signature and adhere to the requirements set forth by Maryland tax law. Using a reliable electronic signature tool, such as signNow, can facilitate the signing process and enhance the legal standing of the document. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is crucial for the form's acceptance.

Filing Deadlines for the Maryland State Income Tax Form

Maryland residents must be aware of the filing deadlines for the Maryland State Income Tax Form to avoid penalties. Typically, the deadline for submitting the Form 502 is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may apply for, which can provide additional time to file but do not extend the deadline for payment of taxes owed.

Required Documents for Completing the Maryland State Income Tax Form

To accurately complete the Maryland Form 502, taxpayers need to gather several key documents. These typically include:

- W-2 forms from employers, detailing annual income and withheld taxes

- 1099 forms for other income sources, such as freelance work or interest

- Receipts for deductible expenses, including medical and educational costs

- Records of any tax credits that may apply, such as the Earned Income Tax Credit

Having these documents ready will streamline the filing process and help ensure that all income and deductions are reported accurately.

Form Submission Methods for the Maryland State Income Tax Form

Taxpayers have multiple options for submitting the Maryland Form 502. The form can be filed electronically using approved e-filing software, which often provides a faster processing time and immediate confirmation of receipt. Alternatively, taxpayers can print the completed form and mail it to the Maryland Comptroller's office. In-person submissions are also possible at designated tax offices throughout the state. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete income tax forms 2022 for tax year 2021 maryland

Complete Income Tax Forms for Tax Year Maryland effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious alternative to conventional printed and signed documents, as you can easily obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to efficiently create, edit, and electronically sign your documents without delays. Manage Income Tax Forms for Tax Year Maryland on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The simplest way to modify and eSign Income Tax Forms for Tax Year Maryland with ease

- Locate Income Tax Forms for Tax Year Maryland and click Get Form to begin.

- Take advantage of the tools we offer to submit your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal authority as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it onto your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Income Tax Forms for Tax Year Maryland and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax forms 2022 for tax year 2021 maryland

Create this form in 5 minutes!

How to create an eSignature for the income tax forms 2022 for tax year 2021 maryland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for businesses in Maryland state?

airSlate SignNow provides a variety of features tailored for businesses in Maryland state, including customizable templates, team management tools, and secure electronic signatures. These tools streamline the document signing process, enhancing efficiency and productivity. With a user-friendly interface, users can easily navigate and utilize these features.

-

How does pricing work for airSlate SignNow in Maryland state?

The pricing for airSlate SignNow in Maryland state is competitive and tiered based on the features and number of users required. You can choose from different plans to best fit your business needs, ensuring that you only pay for what you use. Additionally, there are no hidden fees, making it a transparent solution for document management.

-

Can I integrate airSlate SignNow with other software my business uses in Maryland state?

Yes, airSlate SignNow offers robust integrations with various software platforms commonly used by businesses in Maryland state, such as CRM and project management tools. These integrations help streamline workflows and enhance collaboration within your team. This flexibility ensures that your document signing and management process fits seamlessly within your existing systems.

-

Is airSlate SignNow legally compliant in Maryland state?

Absolutely, airSlate SignNow adheres to all legal standards and regulations for electronic signatures in Maryland state. The platform complies with the ESIGN Act and UETA, ensuring that all signed documents are legally binding and recognized. This compliance allows businesses to safely utilize electronic signatures without legal concerns.

-

What industries in Maryland state benefit the most from using airSlate SignNow?

Various industries in Maryland state, including real estate, healthcare, and education, benefit signNowly from using airSlate SignNow. By simplifying the document signing process, businesses in these sectors can enhance their operational efficiency and improve client satisfaction. The flexibility and ease of use make it suitable for any industry needing secure document management.

-

Does airSlate SignNow offer customer support for Maryland state users?

Yes, airSlate SignNow provides dedicated customer support for users in Maryland state. Whether you need assistance with setup, integration, or troubleshooting, their support team is available to help. This commitment to customer service ensures that users can maximize the benefits of the platform with minimal disruptions.

-

What are the benefits of using airSlate SignNow for document management in Maryland state?

Using airSlate SignNow for document management in Maryland state offers numerous benefits, including increased efficiency, reduced turnaround times, and lower paper costs. Businesses can streamline their processes and minimize delays associated with traditional paper signing. This efficiency ultimately leads to greater satisfaction for both businesses and their clients.

Get more for Income Tax Forms for Tax Year Maryland

- Sample a service form

- Sample transmittal letter for articles of incorporation rhode island form

- New resident guide rhode island form

- Satisfaction release or cancellation of mortgage by corporation rhode island form

- Satisfaction release or cancellation of mortgage by individual rhode island form

- Partial release of property from mortgage for corporation rhode island form

- Partial release of property from mortgage by individual holder rhode island form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy rhode island form

Find out other Income Tax Forms for Tax Year Maryland

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document