MD RESIDENT INCOME TAX RETURN 2020

What is the Maryland Resident Income Tax Return?

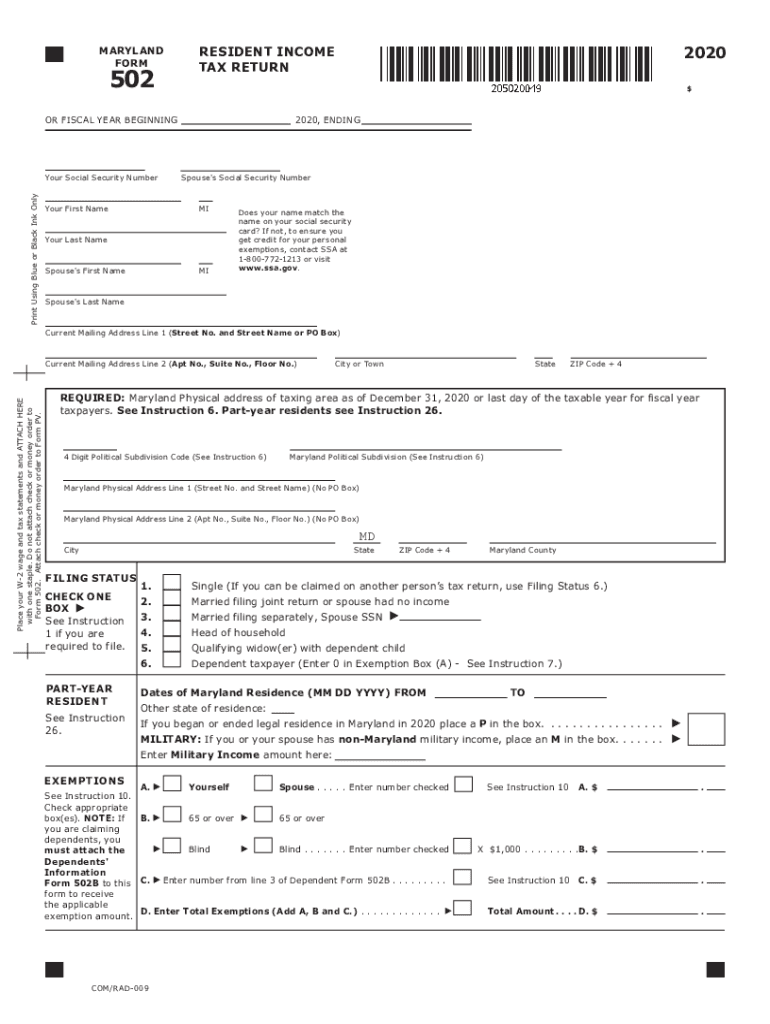

The Maryland Resident Income Tax Return, often referred to as Form 502, is the official document used by residents of Maryland to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and are required to pay state income tax. The information reported on this form includes wages, salaries, tips, and other sources of income, as well as applicable deductions and credits. Understanding this form is crucial for ensuring compliance with state tax laws.

Steps to Complete the Maryland Resident Income Tax Return

Completing the Maryland Resident Income Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, fill out the personal information section at the top of the form, including your name, address, and Social Security number. Then, report your total income in the designated sections, ensuring to include all sources of income. After calculating your total tax liability, apply any deductions or credits you may qualify for. Finally, review the completed form for accuracy before submitting it.

Required Documents for Filing

When preparing to file the Maryland Resident Income Tax Return, it is important to have several key documents on hand. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions

- Previous year’s tax return for reference

Having these documents ready will streamline the filing process and help ensure that all income is accurately reported.

Form Submission Methods

The Maryland Resident Income Tax Return can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file online using the Maryland Comptroller's e-file system, which provides a convenient and efficient way to submit the form. Alternatively, individuals can print the completed form and mail it to the appropriate address provided in the filing instructions. In-person submission is also an option at local tax offices, allowing for direct assistance if needed.

Legal Use of the Maryland Resident Income Tax Return

The Maryland Resident Income Tax Return is a legally binding document once submitted to the state. It is essential that all information provided is accurate and truthful, as any discrepancies can lead to penalties or legal consequences. The form must be signed and dated by the taxpayer to validate the submission. Additionally, electronic signatures are accepted, provided they comply with the legal standards set forth by the state. Understanding the legal implications of this form is vital for all taxpayers in Maryland.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Resident Income Tax Return are crucial for avoiding penalties. Typically, the deadline for filing is April 15 of each year, aligning with federal tax deadlines. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, which must be filed before the original deadline. Keeping track of these important dates ensures timely compliance with state tax laws.

Quick guide on how to complete md resident income tax return

Easily prepare MD RESIDENT INCOME TAX RETURN on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to quickly create, modify, and eSign your documents without any delays. Handle MD RESIDENT INCOME TAX RETURN on any device with the airSlate SignNow Android or iOS applications and enhance your document-based processes today.

How to modify and eSign MD RESIDENT INCOME TAX RETURN effortlessly

- Locate MD RESIDENT INCOME TAX RETURN and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the specialized tools that airSlate SignNow provides.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly, then click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, and errors that require new document prints. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign MD RESIDENT INCOME TAX RETURN to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct md resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the md resident income tax return

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing Maryland state tax forms 2014?

airSlate SignNow offers a user-friendly interface that simplifies the process of preparing and sending Maryland state tax forms 2014. You can easily upload documents, add eSignatures, and track the status of your forms, making tax season less stressful.

-

How can I eSign Maryland state tax forms 2014 using airSlate SignNow?

To eSign Maryland state tax forms 2014 with airSlate SignNow, simply upload your completed forms to the platform. You can then add your electronic signature and send them directly to the appropriate tax authority, ensuring a smooth filing process.

-

Is there a cost associated with using airSlate SignNow for Maryland state tax forms 2014?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs. The cost varies based on features and usage, but it remains a cost-effective solution for handling Maryland state tax forms 2014 efficiently.

-

Can I integrate airSlate SignNow with other tools for handling Maryland state tax forms 2014?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enabling you to streamline your workflow for Maryland state tax forms 2014. Integrations with cloud storage solutions and business software enhance your document management efficiency.

-

What are the benefits of using airSlate SignNow for Maryland state tax forms 2014?

Using airSlate SignNow for Maryland state tax forms 2014 allows for faster processing and improved accuracy in document handling. It reduces paperwork and the need for physical signatures, speeding up your tax filing process and ensuring compliance with state regulations.

-

Is airSlate SignNow secure for handling sensitive documents like Maryland state tax forms 2014?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Maryland state tax forms 2014 are protected. The platform employs industry-standard encryption methods and adheres to security protocols, safeguarding your personal and financial information.

-

What types of documents can I manage with airSlate SignNow besides Maryland state tax forms 2014?

In addition to Maryland state tax forms 2014, airSlate SignNow can be used for a wide variety of documents, including contracts, consent forms, and agreements. This flexibility makes it an ideal choice for businesses looking to streamline their entire document workflow.

Get more for MD RESIDENT INCOME TAX RETURN

- 6cit form

- Afc hfa licensing record clearance form for administrators only

- Gsis hospitalization benefits form

- Name of court form 36a certificate at of clerk divorce

- Court file number form 33d statement of agreed facts

- Social welfare servicesapplication form morop 1da

- Small rural school achievement program form

- Hqp aaf 103 form

Find out other MD RESIDENT INCOME TAX RETURN

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy