Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year 2023

Understanding the Maryland Tax Form 502

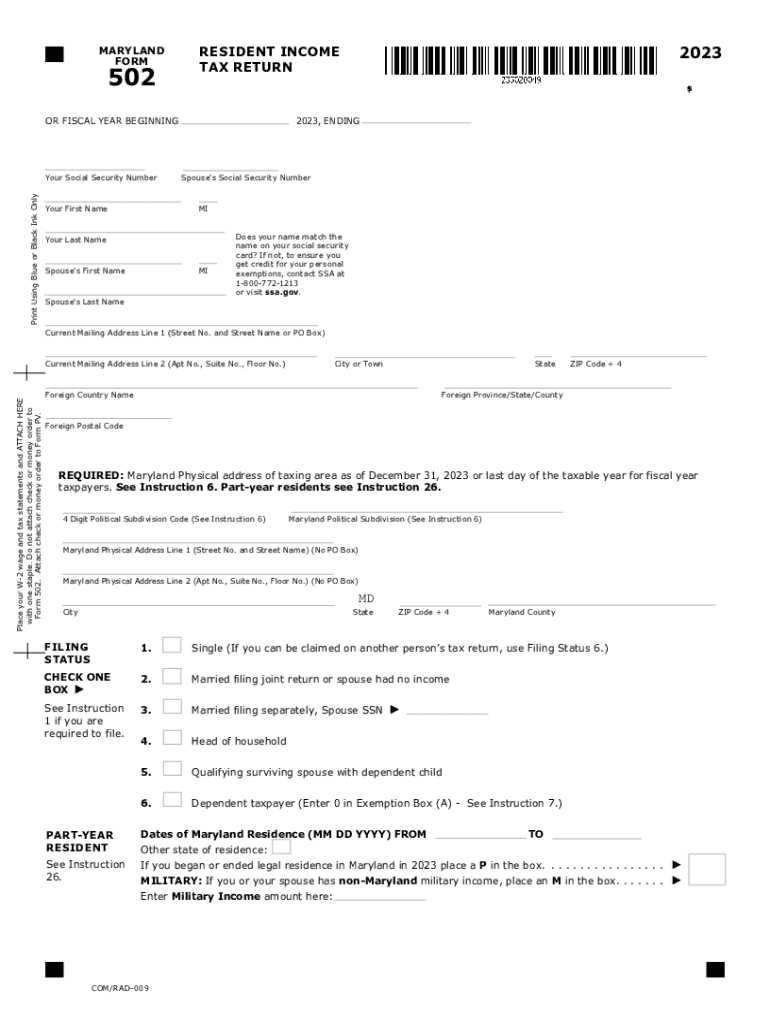

The Maryland Tax Form 502 is the Resident Income Tax Return used by individuals to report their income to the state of Maryland. This form is essential for residents who earn income within the state and need to fulfill their tax obligations. The form is designed to calculate the amount of state income tax owed based on the taxpayer's total income, deductions, and credits. It is important to note that the form is specific to the tax year being filed, which can vary from year to year.

Steps to Complete the Maryland Tax Form 502

Completing the Maryland Tax Form 502 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability using the tax tables provided by the state.

- Review the completed form for accuracy before submission.

Obtaining the Maryland Tax Form 502

The Maryland Tax Form 502 can be obtained through several methods. Taxpayers can download the form directly from the Maryland State Comptroller's website or request a physical copy by contacting their office. Additionally, many tax preparation software programs include the Maryland Tax Form 502, allowing users to complete and file their returns electronically.

Key Elements of the Maryland Tax Form 502

Several key elements must be included when filling out the Maryland Tax Form 502:

- Personal Information: This includes your name, address, and Social Security number.

- Income Reporting: All sources of income must be accurately reported.

- Deductions: Taxpayers can claim various deductions, such as standard or itemized deductions.

- Tax Calculation: The form provides instructions on how to calculate your tax liability based on your income and deductions.

Filing Deadlines for the Maryland Tax Form 502

It is crucial to be aware of the filing deadlines for the Maryland Tax Form 502. Typically, the form must be submitted by April 15 of the following year for which the income is reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply if they are unable to file by the deadline.

Legal Use of the Maryland Tax Form 502

The Maryland Tax Form 502 is legally required for residents who meet the income thresholds set by the state. Failure to file this form can result in penalties, including fines and interest on any unpaid taxes. It is important for taxpayers to ensure that they are compliant with state tax laws and to seek assistance if they have questions about their filing obligations.

Quick guide on how to complete tax year 502 resident income tax return maryland form 502 resident income tax return tax year

Complete Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Handle Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year effortlessly

- Locate Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, be it email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that necessitate the printing of new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you select. Alter and eSign Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year and ensure superior communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 502 resident income tax return maryland form 502 resident income tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the tax year 502 resident income tax return maryland form 502 resident income tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for businesses in Maryland State?

airSlate SignNow provides a suite of features specifically designed for Maryland State businesses, including customizable templates, real-time tracking, and team collaboration options. These tools allow users to streamline their document management processes and improve overall efficiency. With airSlate SignNow, you can easily create, send, and track documents in compliance with Maryland State regulations.

-

How much does airSlate SignNow cost for Maryland State users?

The pricing for airSlate SignNow varies based on the plans chosen, designed to suit businesses of all sizes in Maryland State. Our plans are cost-effective and provide comprehensive features to enhance your eSigning experience. You can get started with a free trial, allowing Maryland State users to explore all the capabilities before committing.

-

Is airSlate SignNow compliant with Maryland State eSignature laws?

Yes, airSlate SignNow is fully compliant with Maryland State eSignature laws. We ensure that every document you sign meets the legal requirements, giving you peace of mind when conducting business. Our platform adheres to both federal and state regulations, making it a reliable option for Maryland State businesses.

-

Can I integrate airSlate SignNow with other tools commonly used in Maryland State?

Absolutely! airSlate SignNow offers a range of integrations with popular applications like Salesforce, Google Drive, and Microsoft Office, which are widely used by Maryland State professionals. These integrations enhance workflow efficiency and ensure seamless access to documents across various platforms.

-

What are the benefits of using airSlate SignNow for businesses in Maryland State?

Using airSlate SignNow provides numerous benefits for Maryland State businesses, including reduced turnaround times, enhanced security, and improved customer experience. By digitalizing the signature process, you can save time and reduce costs associated with paper-based workflows. This results in increased productivity and customer satisfaction.

-

How secure is airSlate SignNow for Maryland State users?

airSlate SignNow prioritizes security for all of its users, including those in Maryland State. Our platform employs industry-leading encryption and compliance protocols to protect sensitive information. You can confidently send and receive documents knowing that they are secure and compliant with Maryland State standards.

-

Does airSlate SignNow provide customer support for Maryland State businesses?

Yes, airSlate SignNow offers dedicated customer support tailored to businesses in Maryland State. Our support team is available via multiple channels to assist with any questions or issues you may encounter while using our platform. We strive to ensure that Maryland State users have a seamless experience.

Get more for Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year

- Breach of contract cases in small claims courtnolo form

- Western district of louisiana united states courts form

- Bankruptcy forms eastern district of virginia united states

- Which is attached hereto form

- Flood prone as defined by the national flood insurance act of 1968 form

- Florida gaming corp security offering and investment secreport form

- State of kentucky form

- Occupy the subject property as follows form

Find out other Tax Year 502 Resident Income Tax Return Maryland Form 502 Resident Income Tax Return, Tax Year

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile