Instructions for Form it 196 Tax Ny Gov 2021

IRS Guidelines for Form 1040 Schedule A

The IRS provides specific guidelines for completing Form 1040 Schedule A, which is used for itemizing deductions. Understanding these guidelines is crucial to ensure that taxpayers maximize their eligible deductions. The form allows individuals to report various expenses, such as medical costs, mortgage interest, and charitable contributions, which can significantly reduce taxable income.

Taxpayers should familiarize themselves with the latest IRS instructions to ensure compliance and accuracy. This includes knowing which deductions are allowable and any limitations that may apply. Keeping detailed records and receipts is essential for substantiating claims made on the form.

Steps to Complete Form 1040 Schedule A

Completing Form 1040 Schedule A involves several key steps. First, gather all necessary documentation, including receipts and statements related to deductible expenses. Next, follow these steps:

- Enter personal information at the top of the form.

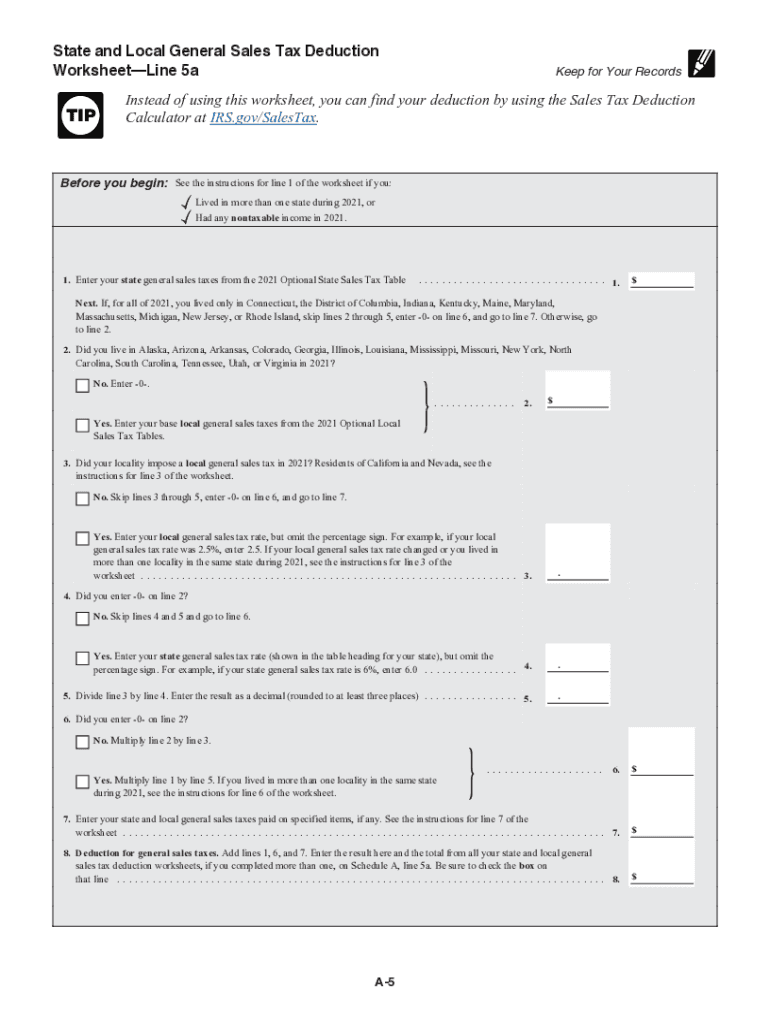

- List each type of deduction in the appropriate section, such as medical expenses or state taxes.

- Calculate the total for each category and sum them up to get the total itemized deductions.

- Transfer the total to the main Form 1040.

Review the completed form for accuracy before submission, as errors can lead to delays or penalties.

Filing Deadlines for Form 1040 Schedule A

Filing deadlines for Form 1040 Schedule A align with the standard tax return deadlines established by the IRS. Generally, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers seeking additional time can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents for Form 1040 Schedule A

To complete Form 1040 Schedule A accurately, taxpayers need to gather several key documents:

- Receipts for medical expenses and insurance premiums.

- Mortgage interest statements (Form 1098).

- Records of state and local taxes paid.

- Documentation for charitable contributions.

- Any other relevant financial statements that support deductions.

Having these documents organized will streamline the process and help ensure that all eligible deductions are claimed.

Form Submission Methods for 1040 Schedule A

Taxpayers have several options for submitting Form 1040 Schedule A. The form can be filed electronically through various tax preparation software, which often simplifies the process and reduces the likelihood of errors. Alternatively, taxpayers may choose to print the form and submit it via mail. In-person submission at designated IRS offices is also an option for those who prefer direct interaction.

Penalties for Non-Compliance with Form 1040 Schedule A

Failing to comply with IRS regulations regarding Form 1040 Schedule A can result in penalties. Common issues include underreporting income, claiming ineligible deductions, or failing to file the form altogether. Penalties may include monetary fines and interest on unpaid taxes. In severe cases, taxpayers may face audits or legal action. It is essential to ensure that all information is accurate and complete to avoid these consequences.

Quick guide on how to complete instructions for form it 196 taxnygov

Prepare Instructions For Form IT 196 Tax ny gov effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly and without delays. Manage Instructions For Form IT 196 Tax ny gov across any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Instructions For Form IT 196 Tax ny gov with ease

- Obtain Instructions For Form IT 196 Tax ny gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form IT 196 Tax ny gov to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 196 taxnygov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 196 taxnygov

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is 1040 schedule a and how does it work?

The 1040 schedule a is a form used by taxpayers to itemize their deductions when filing their federal income tax return. By using airSlate SignNow, you can easily fill out, sign, and send your 1040 schedule a documents securely online. This streamlines the tax preparation process and ensures accuracy in your submissions.

-

How can airSlate SignNow help me with my 1040 schedule a?

airSlate SignNow provides an intuitive platform to manage your 1040 schedule a paperwork, allowing you to eSign documents and track their status in real-time. With our easy-to-use tools, you can reduce the hassle of traditional pen-and-paper processes and ensure that your tax documents are completed efficiently.

-

What are the pricing options for using airSlate SignNow for my 1040 schedule a?

airSlate SignNow offers various pricing plans tailored to meet different needs, starting from a basic plan suitable for individuals to advanced options for businesses. Each plan includes features that simplify the management of your 1040 schedule a forms, allowing you to choose the right fit for your budget and requirements.

-

Does airSlate SignNow support integrations for tax software?

Yes, airSlate SignNow integrates seamlessly with popular tax software that may require the completion of a 1040 schedule a. These integrations enhance your workflow by allowing you to directly import data and eSign documents within your existing tax filing applications, making the process more efficient.

-

What security measures does airSlate SignNow implement for 1040 schedule a forms?

airSlate SignNow prioritizes the security of your sensitive data, employing industry-standard encryption and secure cloud storage for your 1040 schedule a forms. This ensures that your personal information remains protected while you complete your tax filings online.

-

Can I use airSlate SignNow to share my completed 1040 schedule a with my tax advisor?

Absolutely! airSlate SignNow allows you to easily share your completed 1040 schedule a with your tax advisor via secure links or direct email. This convenience enables your advisor to review your documents promptly and provide any necessary advice for your tax situation.

-

Is eSigning a 1040 schedule a legally binding?

Yes, eSigning your 1040 schedule a using airSlate SignNow is legally binding and compliant with federal regulations. This means you can confidently submit your signed forms without concerns about authenticity or validity.

Get more for Instructions For Form IT 196 Tax ny gov

- Premarital agreements package illinois form

- Painting contractor package illinois form

- Framing contractor package illinois form

- Foundation contractor package illinois form

- Plumbing contractor package illinois form

- Brick mason contractor package illinois form

- Roofing contractor package illinois form

- Electrical contractor package illinois form

Find out other Instructions For Form IT 196 Tax ny gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors