What is a Schedule a IRS Form? TurboTax Tax Tips & Videos 2019

What is a Schedule A IRS Form?

The Schedule A IRS Form is a crucial document for taxpayers who wish to itemize their deductions instead of taking the standard deduction. This form allows individuals to report various deductible expenses, including medical expenses, state and local taxes, mortgage interest, and charitable contributions. By using Schedule A, taxpayers can potentially reduce their taxable income, leading to a lower tax liability.

Steps to complete the Schedule A IRS Form

Completing the Schedule A form involves several steps that require careful attention to detail. First, gather all necessary documentation, such as receipts for medical expenses, mortgage statements, and records of charitable donations. Next, fill out the form by entering the total amounts for each category of deduction. It's essential to follow the instructions provided by the IRS to ensure accuracy. After completing the form, review it thoroughly before submitting it with your tax return.

Key elements of the Schedule A IRS Form

Understanding the key elements of the Schedule A form is vital for effective completion. The form includes sections for various types of deductions, such as:

- Medical and dental expenses: Deductible amounts exceeding a certain percentage of adjusted gross income.

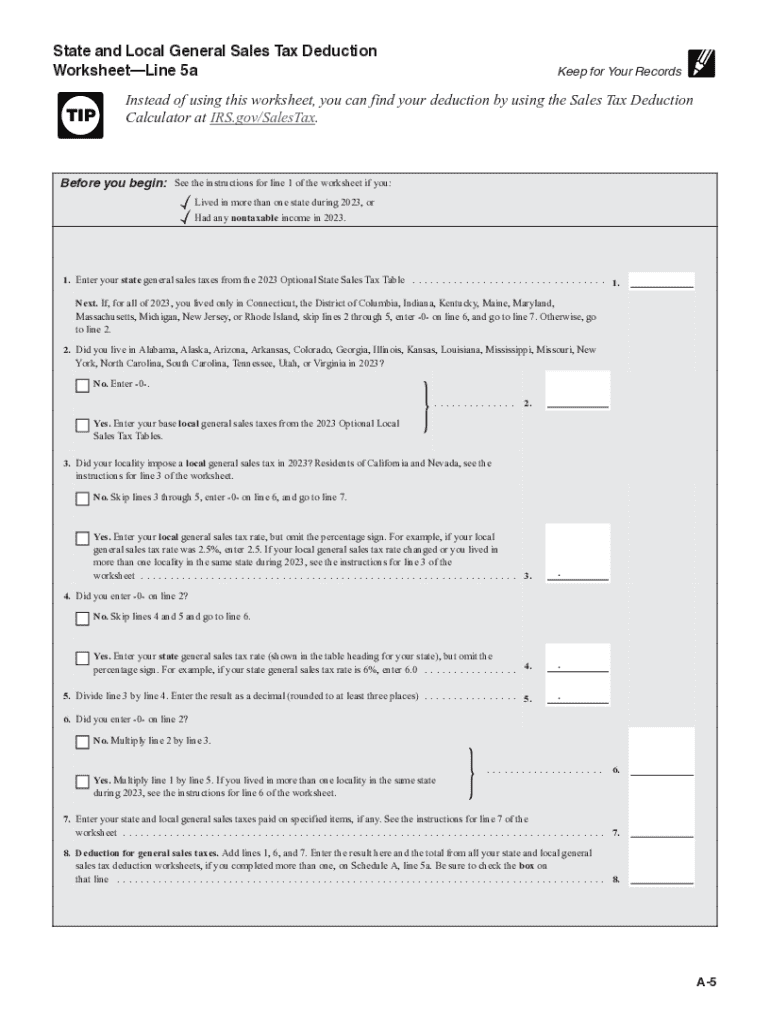

- State and local taxes: Includes income or sales taxes and property taxes.

- Mortgage interest: Interest paid on loans secured by your home.

- Charitable contributions: Donations made to qualified organizations.

Each section has specific requirements and limitations, so it is important to refer to the IRS guidelines for detailed instructions.

Legal use of the Schedule A IRS Form

The Schedule A form is legally recognized by the IRS for itemizing deductions on individual income tax returns. Taxpayers must ensure that the deductions claimed are legitimate and supported by appropriate documentation. Misrepresentation of information on this form can lead to penalties, including fines or audits. Therefore, it is crucial to maintain accurate records and adhere to IRS regulations when using Schedule A.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule A form. Generally, individual tax returns, including Schedule A, are due on April 15 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers needing additional time can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Schedule A form. These guidelines include eligibility criteria for various deductions, specific documentation requirements, and instructions on how to report each type of deduction. Taxpayers should consult the latest IRS publications or the official IRS website to ensure compliance with current tax laws and regulations, as these can change annually.

Quick guide on how to complete what is a schedule a irs form turbotax tax tips ampamp videos

Prepare What Is A Schedule A IRS Form? TurboTax Tax Tips & Videos seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents rapidly without delays. Handle What Is A Schedule A IRS Form? TurboTax Tax Tips & Videos on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign What Is A Schedule A IRS Form? TurboTax Tax Tips & Videos effortlessly

- Find What Is A Schedule A IRS Form? TurboTax Tax Tips & Videos and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign What Is A Schedule A IRS Form? TurboTax Tax Tips & Videos to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is a schedule a irs form turbotax tax tips ampamp videos

Create this form in 5 minutes!

How to create an eSignature for the what is a schedule a irs form turbotax tax tips ampamp videos

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer to help me schedule a form?

airSlate SignNow provides intuitive features like customizable templates and automated workflows that allow you to easily schedule a form. With these tools, you can streamline the signing process, ensuring that your documents are sent and signed efficiently.

-

How can I schedule a form for my team?

To schedule a form for your team, simply create a document on airSlate SignNow and set the appropriate timelines for when the form should be completed. You can assign roles and due dates, making it easy for your team to stay on track with submissions and signatures.

-

Is there a cost associated with scheduling a form using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. By scheduling a form, you gain access to a comprehensive toolset that enhances your document management without breaking your budget.

-

Can I schedule a form with integrations to other software?

Yes, airSlate SignNow enables you to schedule a form alongside various integrations with popular software such as Google Drive, Salesforce, and Microsoft Office. This seamless integration enhances workflow efficiency and document management for your business.

-

What benefits does scheduling a form provide for my business?

Scheduling a form with airSlate SignNow streamlines the document signing process, reduces turnaround times, and enhances productivity. By automating these tasks, your team can focus on more critical activities while maintaining compliance and effectiveness.

-

Is it easy to schedule a form for remote teams?

Absolutely! airSlate SignNow is designed to accommodate remote teams, allowing you to easily schedule a form for digital signing across various locations. The platform is user-friendly, ensuring that all team members can access and complete their forms from anywhere.

-

What types of documents can I schedule a form for?

You can schedule a form for a wide range of documents, including contracts, agreements, HR forms, and more on airSlate SignNow. This versatility allows you to manage all your document needs in one platform efficiently.

Get more for What Is A Schedule A IRS Form? TurboTax Tax Tips & Videos

- Sixty day new hire survey form

- Sick leave to care for a family member with a serious health form

- Job description for an admin assistant position do you form

- Defenses to negligence claims findlaw form

- Comparative fault as a defense in products liability form

- Breach of contract with fraud claimslegalmatch form

- Joint and several liability for breach of fiduciary duty form

- Swoosh inside nike answer key form

Find out other What Is A Schedule A IRS Form? TurboTax Tax Tips & Videos

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple