Irs Instructions 1040 Schedule Form 2017

What is the Irs Instructions 1040 Schedule Form

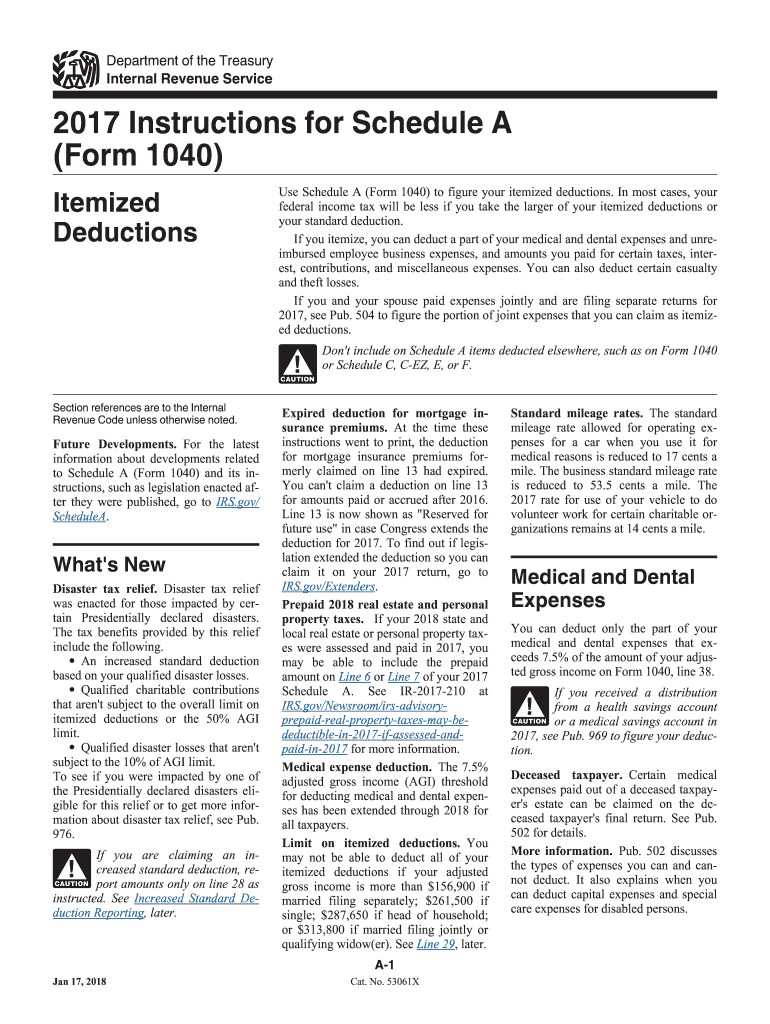

The Irs Instructions 1040 Schedule Form is a crucial document used by taxpayers in the United States to report additional income, claim deductions, and calculate tax liabilities. This form is part of the larger IRS Form 1040, which is the standard individual income tax return form. The schedule provides detailed guidance on various tax situations, helping taxpayers accurately complete their returns and ensure compliance with federal tax laws.

How to use the Irs Instructions 1040 Schedule Form

Using the Irs Instructions 1040 Schedule Form involves several steps. First, determine which schedules apply to your tax situation. Common schedules include Schedule A for itemized deductions and Schedule C for business income. Once you identify the relevant schedules, carefully read the instructions provided for each. These instructions outline how to fill out the form, what information is required, and any calculations needed. It is essential to follow these guidelines closely to avoid errors that could lead to delays or penalties.

Steps to complete the Irs Instructions 1040 Schedule Form

Completing the Irs Instructions 1040 Schedule Form requires a systematic approach. Start by gathering all necessary documents, such as W-2s, 1099s, and receipts for deductions. Next, fill out the form by entering your income, deductions, and credits as instructed. Double-check your entries for accuracy and ensure all calculations are correct. Finally, review the form against the IRS guidelines to confirm that you have met all requirements before submission.

Key elements of the Irs Instructions 1040 Schedule Form

The Irs Instructions 1040 Schedule Form includes several key elements that are vital for accurate tax reporting. These elements typically encompass income sources, allowable deductions, and credits. Each section is designed to capture specific financial information, such as wages, self-employment income, and investment earnings. Additionally, the form may require details on expenses related to business operations or itemized deductions, such as mortgage interest and charitable contributions. Understanding these elements is essential for effectively completing your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Instructions 1040 Schedule Form align with the overall tax filing schedule set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if you require additional time, you can file for an extension, which generally extends the deadline to October fifteenth. It is crucial to be aware of these dates to avoid penalties and ensure timely submission of your tax documents.

Legal use of the Irs Instructions 1040 Schedule Form

The Irs Instructions 1040 Schedule Form serves as a legally binding document when completed accurately and submitted to the IRS. Compliance with the instructions provided is essential to ensure that the form is accepted without issues. E-signatures are increasingly recognized as valid, provided they meet specific legal standards, such as those outlined in the ESIGN Act and UETA. Using a reliable digital solution can help ensure that your e-signature and submission are secure and compliant with legal requirements.

Quick guide on how to complete irs instructions 1040 schedule form 2017

Complete Irs Instructions 1040 Schedule Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Handle Irs Instructions 1040 Schedule Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centered processes today.

The easiest way to modify and electronically sign Irs Instructions 1040 Schedule Form with ease

- Find Irs Instructions 1040 Schedule Form and click Obtain Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Finished button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Instructions 1040 Schedule Form and ensure seamless communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs instructions 1040 schedule form 2017

Create this form in 5 minutes!

How to create an eSignature for the irs instructions 1040 schedule form 2017

How to create an eSignature for the Irs Instructions 1040 Schedule Form 2017 online

How to create an eSignature for the Irs Instructions 1040 Schedule Form 2017 in Chrome

How to generate an eSignature for putting it on the Irs Instructions 1040 Schedule Form 2017 in Gmail

How to generate an electronic signature for the Irs Instructions 1040 Schedule Form 2017 right from your mobile device

How to make an eSignature for the Irs Instructions 1040 Schedule Form 2017 on iOS

How to generate an eSignature for the Irs Instructions 1040 Schedule Form 2017 on Android OS

People also ask

-

What are the IRS Instructions for completing Form 1040 Schedule?

The IRS Instructions for completing Form 1040 Schedule provide detailed guidance on how to fill out the form accurately. This includes information on what income to report, deductions available, and how to calculate your taxes owed. Familiarizing yourself with these instructions ensures compliance and maximizes your potential refunds.

-

How can airSlate SignNow help with filling out the IRS Instructions 1040 Schedule Form?

airSlate SignNow offers templates that can assist users in filling out the IRS Instructions 1040 Schedule Form with ease. Our platform allows you to input data directly into pre-formatted fields, ensuring accuracy and reducing the chances of errors. Additionally, you can securely eSign and send the completed forms promptly.

-

What features does airSlate SignNow provide for IRS forms like the 1040 Schedule?

AirSlate SignNow provides robust features such as customizable templates, real-time collaboration, and secure cloud storage for IRS forms like the 1040 Schedule. You can automate document workflows and set reminders for filing deadlines, simplifying the entire process and ensuring you never miss an important date.

-

Is there a cost associated with using airSlate SignNow for IRS Instructions 1040 Schedule Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans provide features suitable for individual users as well as teams. Our cost-effective solutions ensure you can efficiently manage necessary documentation like the IRS Instructions 1040 Schedule Form without overspending.

-

Can airSlate SignNow integrate with other software for financial management?

Absolutely! airSlate SignNow integrates seamlessly with popular financial management software, making it easier to share and utilize data across platforms. This ensures that when you are completing the IRS Instructions 1040 Schedule Form, all necessary information is readily accessible without redundant data entry.

-

What are the benefits of using airSlate SignNow to manage IRS documents?

Using airSlate SignNow to manage IRS documents, including the 1040 Schedule Form, offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures your documents are signed and stored securely while providing easy access and quick turnaround times, thus simplifying the filing process.

-

How secure is my information when using airSlate SignNow for the IRS Instructions 1040 Schedule Form?

AirSlate SignNow places a high priority on data security, utilizing encryption and secure server protocols to protect your information. When submitting the IRS Instructions 1040 Schedule Form, you can have peace of mind knowing that your sensitive data is safeguarded against unauthorized access.

Get more for Irs Instructions 1040 Schedule Form

Find out other Irs Instructions 1040 Schedule Form

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast