Schedule a Instructions 2018

What is the Schedule A Instructions

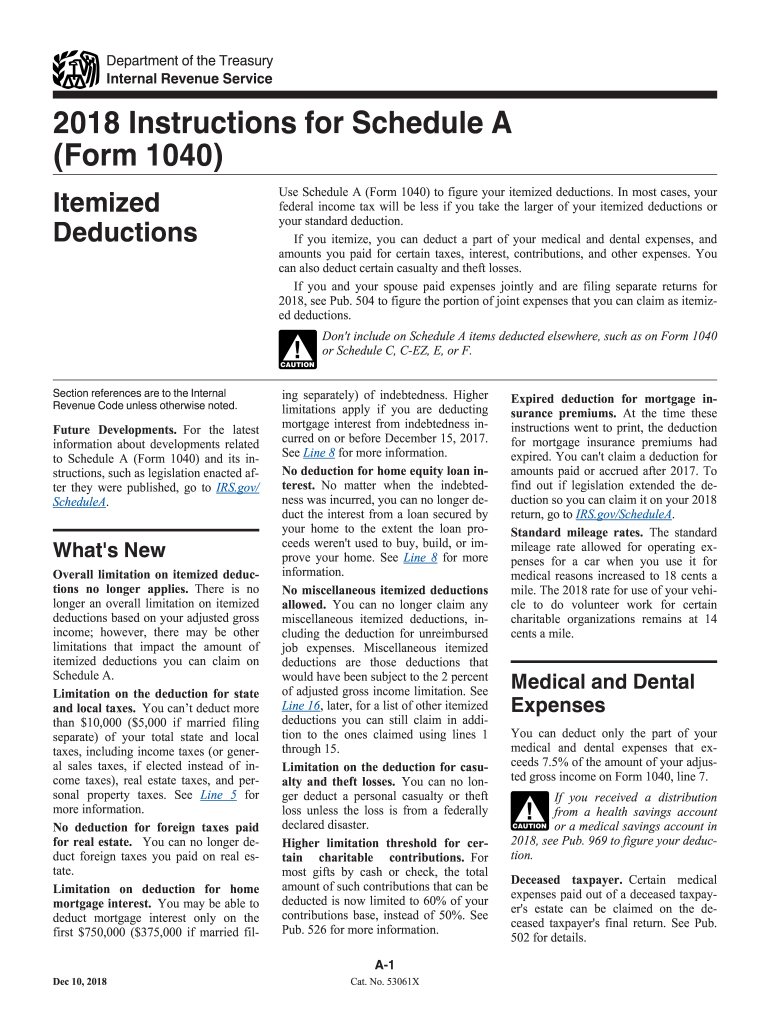

The Schedule A Instructions provide detailed guidance for taxpayers on how to itemize deductions on their federal income tax return. This form is used to report various deductible expenses, which can reduce taxable income and potentially lower the overall tax liability. Common deductions include medical expenses, mortgage interest, state and local taxes, and charitable contributions. Understanding the Schedule A Instructions is crucial for taxpayers who wish to maximize their deductions and ensure compliance with IRS regulations.

Steps to complete the Schedule A Instructions

Completing the Schedule A Instructions involves several key steps:

- Gather Documentation: Collect all necessary documents, including receipts and statements for deductible expenses.

- Review Eligibility: Ensure that the expenses qualify as itemized deductions according to IRS guidelines.

- Fill Out the Form: Accurately enter the amounts for each category of deduction on the Schedule A form.

- Calculate Total Deductions: Add up all itemized deductions to determine the total amount to report on your tax return.

- Attach to Form 1040: Include the completed Schedule A with your Form 1040 when filing your taxes.

Key elements of the Schedule A Instructions

The Schedule A Instructions include several key elements that taxpayers must understand:

- Deduction Categories: The instructions outline specific categories for deductions, such as medical expenses, taxes paid, and gifts to charity.

- Limitations and Thresholds: Certain deductions may have limitations based on adjusted gross income (AGI), which the instructions clarify.

- Recordkeeping Requirements: Taxpayers are advised on how to maintain records to substantiate their deductions in case of an audit.

- Filing Tips: The instructions provide helpful tips for filing, including common mistakes to avoid and how to ensure accuracy.

IRS Guidelines

The IRS Guidelines for Schedule A provide essential information regarding the rules and regulations governing itemized deductions. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. The guidelines specify which expenses are eligible for deduction, how to calculate them, and the documentation required to support each deduction. Familiarity with these guidelines is vital for accurately completing Schedule A and maximizing potential tax benefits.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule A Instructions. Typically, the deadline for submitting federal tax returns, including Form 1040 and Schedule A, is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should consider any state-specific deadlines that may apply. Filing on time is crucial to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Schedule A Instructions accurately, taxpayers need to gather several required documents, including:

- Receipts: For all deductible expenses, including medical bills and charitable contributions.

- Form 1098: Mortgage interest statement for reporting home mortgage interest paid.

- Property Tax Statements: Documentation of state and local property taxes paid.

- Bank Statements: To verify any additional deductible expenses.

Legal use of the Schedule A Instructions

The legal use of the Schedule A Instructions is governed by IRS regulations. Taxpayers must ensure that all deductions claimed are legitimate and supported by appropriate documentation. Misrepresenting deductions can lead to penalties, including fines and interest charges. It is essential to follow the instructions closely to maintain compliance with tax laws and avoid potential legal issues. Consulting a tax professional may also be beneficial for complex situations.

Quick guide on how to complete irs instructions 1040 schedule form 2018 2019

Complete Schedule A Instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly and without delays. Manage Schedule A Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Schedule A Instructions seamlessly

- Find Schedule A Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule A Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs instructions 1040 schedule form 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the irs instructions 1040 schedule form 2018 2019

How to make an eSignature for the Irs Instructions 1040 Schedule Form 2018 2019 in the online mode

How to generate an electronic signature for the Irs Instructions 1040 Schedule Form 2018 2019 in Chrome

How to generate an eSignature for putting it on the Irs Instructions 1040 Schedule Form 2018 2019 in Gmail

How to make an eSignature for the Irs Instructions 1040 Schedule Form 2018 2019 straight from your smart phone

How to create an eSignature for the Irs Instructions 1040 Schedule Form 2018 2019 on iOS devices

How to generate an eSignature for the Irs Instructions 1040 Schedule Form 2018 2019 on Android OS

People also ask

-

What are itemized deductions for 2017?

Itemized deductions for 2017 refer to specific expenses that taxpayers can claim to reduce their taxable income. These deductions, which include expenses like mortgage interest and medical expenses, are documented on IRS Form 1040. Understanding itemized deductions 2017 instructions can help you maximize your tax return.

-

How can I find the itemized deductions 2017 instructions?

The itemized deductions 2017 instructions can be found on the official IRS website. This documentation provides detailed guidance on which expenses qualify as itemized deductions and how to properly report them. A thorough review of these instructions ensures compliance and maximizes your eligible deductions.

-

What features does airSlate SignNow offer for signing tax documents?

airSlate SignNow provides features such as eSignature capabilities, document templates, and secure storage for signing tax documents like the itemized deductions 2017 instructions. The user-friendly interface makes it easy to send documents for review and signature, streamlining the tax preparation process for you and your accountant.

-

Is airSlate SignNow a cost-effective solution for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses looking to manage document eSigning efficiently. With competitive pricing plans and robust features, it allows businesses to effortlessly handle documents like itemized deductions 2017 instructions without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software. This integration allows users to import and send documents such as itemized deductions 2017 instructions directly from their accounting platform, enhancing overall productivity and ensuring better organization of tax documents.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers several benefits, including increased efficiency, reduced paperwork, and secure eSigning. The platform simplifies the process of managing essential documents like the itemized deductions 2017 instructions, making it easier for users to complete their tax returns quickly and accurately.

-

What types of documents can I send with airSlate SignNow?

airSlate SignNow allows you to send a variety of documents, including tax forms, contracts, and agreements. You can easily manage documents related to itemized deductions 2017 instructions alongside other essential paperwork, ensuring that all needed documents are handled in one streamlined platform.

Get more for Schedule A Instructions

Find out other Schedule A Instructions

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement